Minnsights Blog

Browse by Topic

-

I’m excited to share that the Chamber is launching a major new initiative called economic imperative for growth. This effort is part of our latest strategic plan, where the Chamber’s Board of Directors took a hard look at our state’s economy and challenged us to lead an urgent, statewide effort to spark an economic turnaround for Minnesota. The Chamber is uniquely positioned to bring together business leaders, policymakers and experts from across the state to chart that path forward.

-

Last week marked the 100th episode of the Minnesota Business Podcast — and I’m so grateful to everyone who tunes in each week to stay informed and engaged in what’s happening across Minnesota’s business community. In this episode, I cover two important updates: the state’s new phase-out of fluorescent light bulbs (and how our Energy Smart program can help you make the switch) and a reminder that the Paid Family and Medical Leave program is right around the corner.

-

Last week, we hosted our 2025 Workplace Compliance Conference, designed to help businesses better understand and prepare for the sweeping changes to Minnesota’s workplace regulations that have been rolling out since 2024. We now stand at the doorstep of the largest of those new mandates — the Paid Family and Medical Leave law, which takes effect on January 1, 2026. Now’s the time for businesses and employees alike to prepare for this new reality.

-

Each Allina Green Team started when a few motivated employees came forward with an idea. As the Environmental Sustainability Manager for more than 100 Allina Health locations, Suzanne Hansen is responsible for supporting these motivated employees in creating their Green Teams, assisting them with setting and measuring goals, and communicating their successes to the wider organization and public.

-

Minnesota’s Paid Family and Medical Leave program launches in January 2026 – and employers are already preparing for what’s ahead. I sat down with Greg Norfleet from DEED on the Minnesota Business Podcast to talk about how the program is being built, what’s next for businesses and how the Chamber is helping members navigate compliance.

Latest Articles (blog page)

Learn more about this year's class of Leadership Minnesota participants.

The Minnesota Chamber of Commerce is excited to announce that we are partnering with the College Board and the U.S...

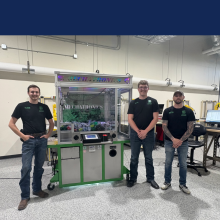

Minnesota Climate-Smart Food Systems Equipment and Vehicle Replacement Grant

Minnesota Pollution Control Agency (MPCA) will offer $5 million in grant...

Happy New Year to each of you. I hope 2026 is off to a great start for you, your family...