Minnsights Blog

Browse by Topic

-

I'm coming to you this week after the conclusion of this year's Minnesota Chamber-hosted Business Day at the Capitol. This is an annual program where business leaders from across the state – our members, local chambers, and other trade associations – gather at the Capitol to meet with and learn about key issues facing the business community.

-

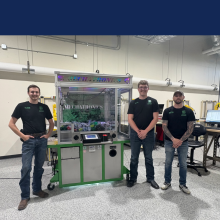

It has been a busy week at the Capitol and a busy week here. This week, I am traveling to western Minnesota to meet up with the Leaders Lab Program. Now in its 10th year, the Leaders Lab program is designed to provide leadership skills to Minnesota business leaders and emerging business leaders. Our time in Willmar has been going well, with visits to the dairy and pork industries and a stop at Minnesota’s MinnWest Technology Campus, an exciting hub of emerging technology critical for future growth.

-

We have some exciting news to share. As noted in previous podcasts, the Chamber was engaged in litigation against the state, and we now have a permanent injunction with no appeal in our case. The deadline for the state's appeal, which was set by federal Judge Tostrud, has passed. This marks the conclusion of a two-year journey by the Chamber and our allies to protect the fundamental rights of businesses here in Minnesota.

-

Canada and Mexico have long been key markets for Minnesota businesses, and their importance to the state's economy has only grown in recent years. Since 2016, Minnesota trade has pivoted away from China and increasingly toward its North American partners, deepening supply chain integration across the continent, particularly in the state's manufacturing and natural resource sectors.

-

While our focus here at the Chamber remains on legislative matters at the state capitol, I want to take time this week to lay out tariffs and trade and their impact on Minnesota’s economy.

Latest Articles (blog page)

Learn more about this year's class of Leadership Minnesota participants.

The Minnesota Chamber of Commerce is excited to announce that we are partnering with the College Board and the U.S...

Minnesota Climate-Smart Food Systems Equipment and Vehicle Replacement Grant

Minnesota Pollution Control Agency (MPCA) will offer $5 million in grant...

Happy New Year to each of you. I hope 2026 is off to a great start for you, your family...