What is a level-funded health plan? 4 ways it may help contain costs | from UnitedHealthcare

ChamberHealth by UnitedHealthcare showcases the benefits of a level-funded plan

The Minnesota Chamber of Commerce and UnitedHealthcare announced a partnership to offer health plans designed to save small businesses on medical premiums while gaining more flexibility, freedom and stability. ChamberHealth by UnitedHealthcare are level-funded health plans that offer small businesses the same range of access as large corporations at competitive prices.

Historically, the choice in health care funding for a smaller business has been between the higher-cost predictability of a fully insured plan and the potential savings, albeit with risks, of self-funding.

Now there’s an alternative called the level-funded health plan.

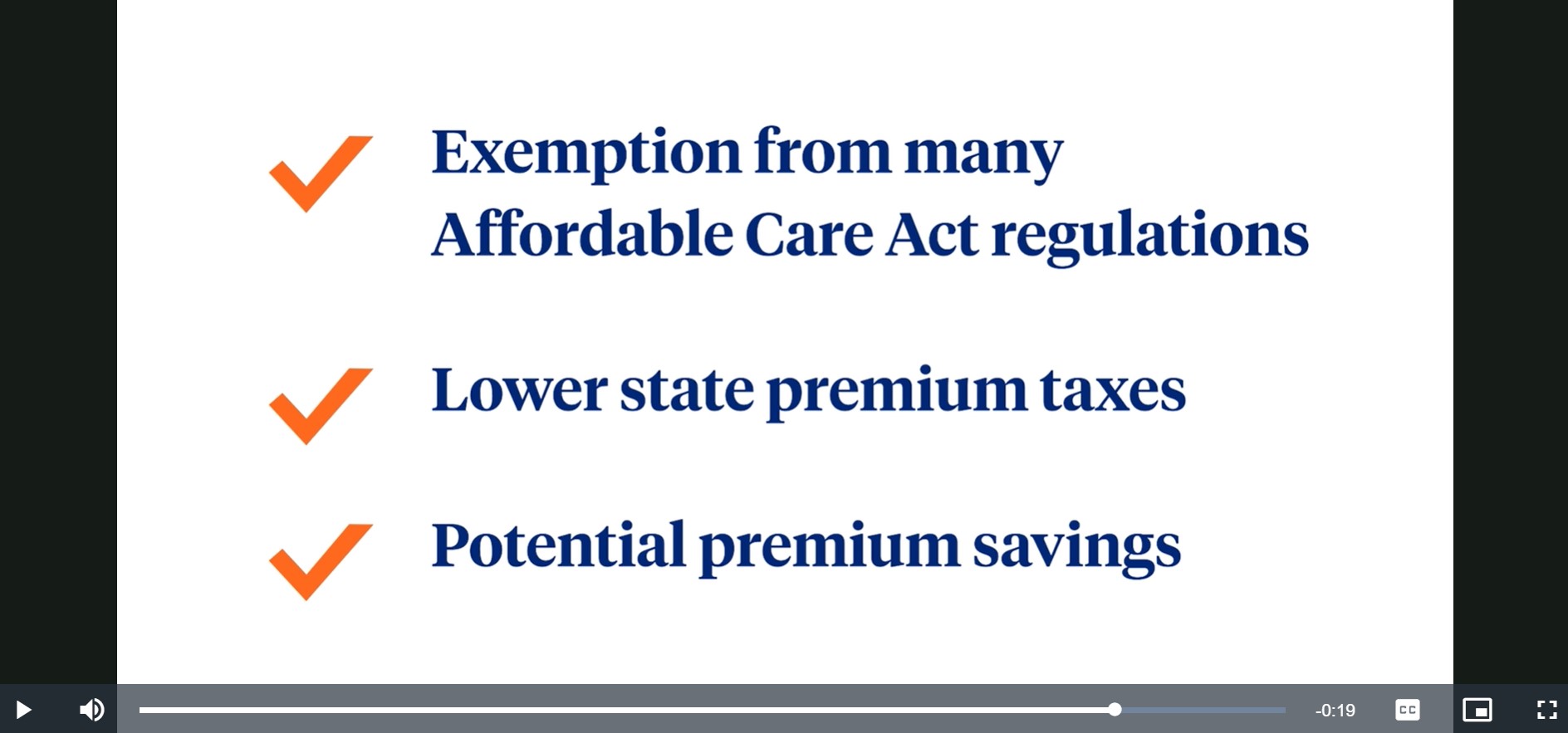

A level-funded plan is an option for employers that want to move away from fully insured health care but are not yet ready to completely self-insure. Health insurers have designed level-funded plans to offer two main upsides: predictability and potential savings, including through a possible surplus refund.

Use of these plans is on the rise. According to a recent survey, 42% of small firms report that they have a level-funded plan, a steep increase from previous years.

Here are four key points of level-funded plans

1. A level-funded plan offers predictability and mitigated risks

Employers with a level-funded plan pay a fixed monthly fee, which covers the maximum claims liability, administrative fees and stop-loss insurance to protect against unexpectedly large claims and high utilization. With a level-funded plan, if the costs of individual or aggregate medical claims exceed the plan’s maximum, the plan covers the difference.

2. A level-funded plan may have a surplus refund

In a traditional fully insured plan, the insurance company assumes the financial risk for providing health services. At the end of the plan year, if actual health care claims are higher than expected, the insurer covers the costs. If they’re lower, the insurer keeps the difference. By contrast, an employer with a level-funded plan is insured against higher-than-expected claims and may get a surplus refund in the end, if annual medical claims are lower than expected.

3. Level-funded plans offer greater insights on costs

Unlike most fully insured plans, employers with level funding can get complete monthly data reports to help them better understand employee utilization of health services. These reports offer a look at things like emergency room visits, virtual care usage and prescription drug utilization. This data may lead to a faster understanding of issues that are driving costs.

4. Member experience can be key within the level-funded model

Level-funded plans also typically include resources and programs that may increase member engagement and reduce costs. For example, level-funded plans from UnitedHealthcare include wellness programs and 24/7 virtual care options, which may make it easier for employees and their families to play a more active role in their health care and, as a result, save on out-of-pocket costs.

For small business owners seeking a health plan designed with affordability in mind, an alternative like level-funding may be a solution.

For more information on level-funded health plans, download this article (pdf).