2023-24 session outcomes: Earned sick and safe time

Starting January 1, 2024, employers are now mandated to:

- Provide one hour of fully paid sick time for every 30 hours worked, up to 48 hours a year with a carry over up to 80 hours, including temporary and part-time employees.

- Employees must be paid at the same rate they would earn if they were working.

- Employees may take this time off to care for a broad-based definition of “family members.”

- Employers must provide notice to all employees that includes a significant amount of required information. Click here to view a sample notice.

- Employers will be required to include additional information on earnings statements as well as keep record of hours worked and other information.

- The Department of Labor and Industry (DLI) oversees compliance and penalties.

Employers are also mandated to provide one hour of fully paid sick time for every 30 hours worked, up to 48 hours a year, with a carryover up to 80 hours, including temporary and part-time employees. Employees must be paid at the same rate they would earn if they were working. Employees may take this time off to care for a broad-based definition of “family members.” The 2024 legislative session expanded eligible uses and now applies sick and safe time protections to employer-offered more generous sick leave, not just the mandated sick and safe time required, including retaliation protections, eligible uses, documentation, and notice requirements. The Department of Labor and Industry (DLI) oversees compliance and penalties and sick and safe time can be used in tandem - “stacked” - with Paid Family Medical Leave.

This will take effect January 1, 2024. While the underlying mandate and most of the changes from the 2024 legislative session are already in effect, the provisions applying to more generous PTO policies take effect on Jan 1, 2025.

Other resources:

2024 Update on earned sick and safe time

Attorney Sara Lewenstein of Nilan Johnson Lewis shares about the Sick and Safe Time mandate. Sara specializes in Labor and Employment law and is well experienced in assisting employers on how to best comply ever-changing laws and regulations.

This on-demand webinar is for Minnesota Chamber members only. If you wish to become a member or have questions about membership in the Minnesota Chamber, click here.

WATCH: 2023 Statewide Policy Tour discussion on earned sick and safe time

Earned sick and safe time on-demand webinar

View this on-demand webinar on one of the largest compliance changes in the state’s legislative history, led by Courtney Blanchard from Nilan Johnson Lewis. This session discusses the essential facets of the recently passed mandated sick and safe time requirements. Don't miss this opportunity to understand the latest regulations and strategies for implementing and managing these brand-new policies in your organization.

This on-demand webinar is for Minnesota Chamber members only. If you wish to become a member or have questions about membership in the Minnesota Chamber, click here.

New sick and safe leave earnings statement requirements

Employers in Minnesota must provide earnings statements with certain required information to all employees at the end of each pay period.

Earnings statements are important payroll records for employers and employees that document information about wages paid, hours worked, deductions made and benefits accrued by an employee.

Earnings statements must include at least the following information:

- the name of the employee;

- the total hours worked by the employee in the pay period, unless the worker is considered exempt under the Minnesota Fair Labor Standards Act;

- the rate or rates of pay, including whether the employee is paid by the hour, shift, day, week, salary, piece, commission or other method;

- any allowances claimed for meals or lodging under Minnesota Rules 5200;

- the gross pay earned by the employee in the pay period;

- the net pay after all deductions are made;

- a list of all deductions (taxes, insurance, union dues, other) made from the employee's pay;

- the date the pay period ended;

- the employer's legal and operating name;

- the employer's telephone number; and

- the physical address of the employer's main office or principal place of business and a mailing address, if different.

In addition, under Minnesota's earned sick and safe time law, which goes into effect Jan. 1, 2024, employers will be required to include the following additional information on earnings statements:

- the total number of sick and safe time hours available for use by the employee; and

- the total number of sick and safe time hours used by the employee in the pay period.

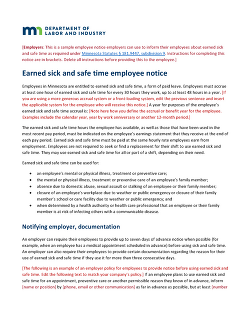

Earned sick and safe time (ESST) employee notice available

The Minnesota Department of Labor and Industry (DLI) has created a sample ESST employee notice employers can use or model their employee notices after.

Employers must provide employees with a notice by Jan. 1, 2024, or at the start of employment, whichever is later. The notice must be provided in English and in an employee’s primary language if that is not English.

The sample notice is available in English and will be translated to Chinese, Hmong, Somali, Spanish, Vietnamese and additional languages. DLI has also created an ESST workplace poster.

Find the ESST employee notice, poster and other resources at dli.mn.gov/sick-leave.

Explore other issues

Interested in the Chamber's policy work?

Our goal remains to ensure that our state remains affordable to raise a family or start a successful business. The voice of business is important at the Capitol, to share real stories of how legislators’ decisions help or hurt Minnesota’s entrepreneurs. If you’re interested in helping us fight for all employers and employees across the state, find an opportunity that fits your interest.