Tracking growth in Minnesota’s manufacturing sector this decade

By Sean O'Neil

Senior Director of Economic Development and Research

Minnesota’s manufacturing sector plays an outsized role in the state’s economy. It is the state’s second largest sector and has a disproportionate impact on other industries. When manufacturing grows, it spurs activity in construction, real estate, professional services, utilities and other industries that supply the needs of local manufacturers.

Given this ripple effect, it is worth asking: How is Minnesota’s manufacturing sector performing? Is it growing, holding steady or in decline? How does it compare to other states and to the U.S. manufacturing sector overall? The answers to these questions shed light on the broader economy and can help pinpoint areas where targeted action might strengthen future growth.

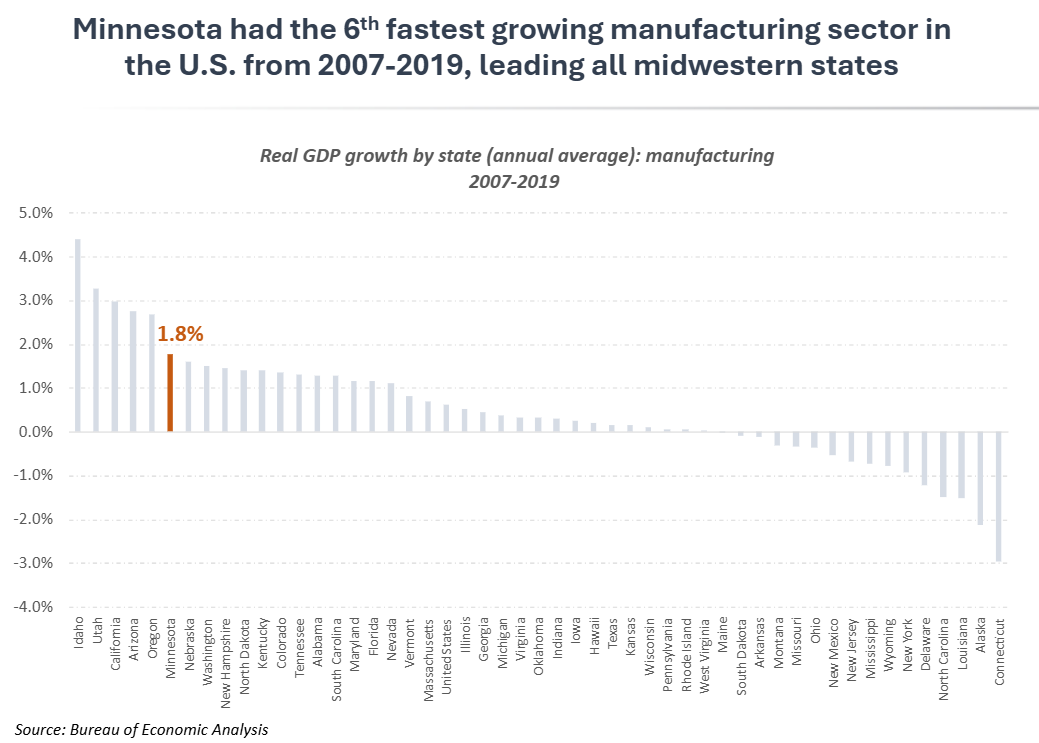

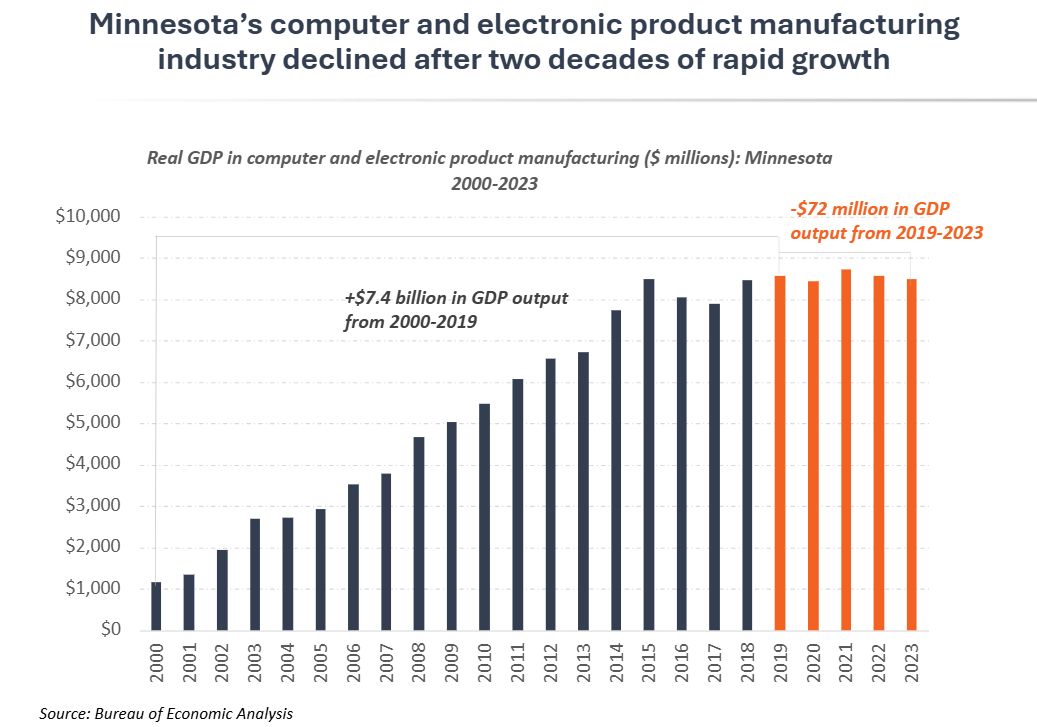

Analysis of GDP and employment trends shows that manufacturing has been a competitive strength for Minnesota over the past several decades. Output increased steadily – even as employment declined – and the state outperformed U.S. manufacturing for the first two decades of the 21st century. Much of this growth came from advanced manufacturing subsectors that drove value-added output. For example, Minnesota’s computer and electronic products subsector – which includes medical devices, industrial controls, semiconductors, computers and other related activities – expanded at a rapid 11% annual rate from 2000 to 2019. This performance made Minnesota the sixth-fastest-growing manufacturing state during the 2007–2019 business cycle and positioned it well for continued growth entering the 2020s.

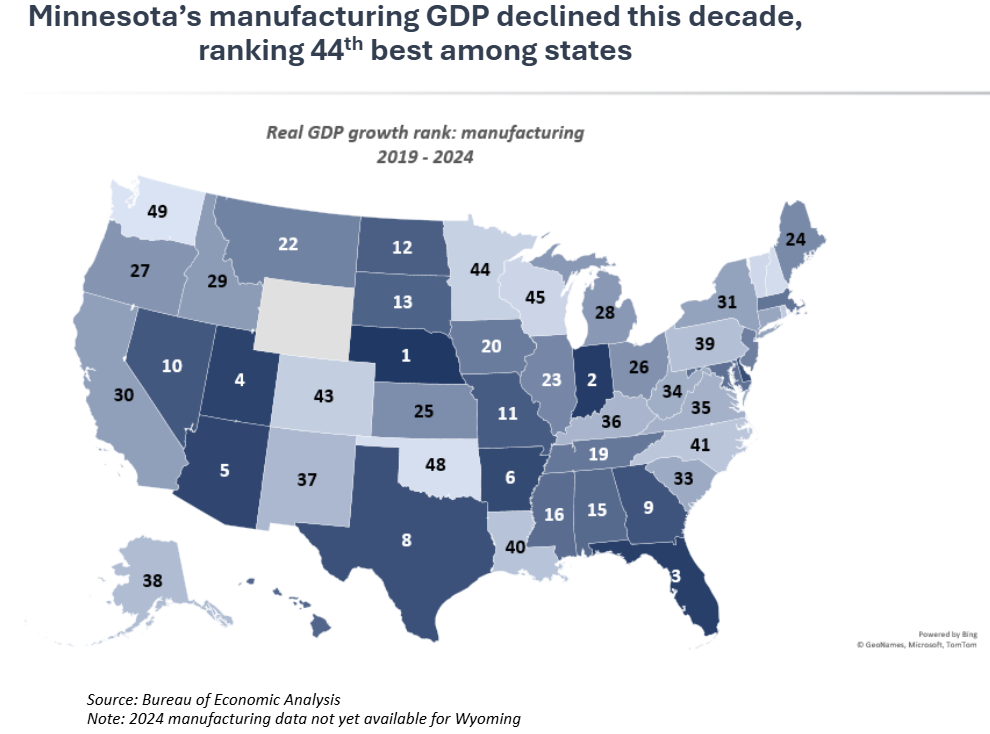

However, momentum has faltered in the first half of the current decade. Both manufacturing GDP and jobs have declined, and Minnesota now ranks 44th among states in manufacturing growth. This downturn has been a key factor in the state’s recent economic underperformance, with Minnesota falling into the lower third of states on several major growth indicators.

This article explores Minnesota’s recent manufacturing trajectory and examines which subsectors within its diverse base may be facing particular headwinds. Understanding both the strengths and the vulnerabilities of the sector can help identify more targeted strategies to support manufacturers in the years ahead.

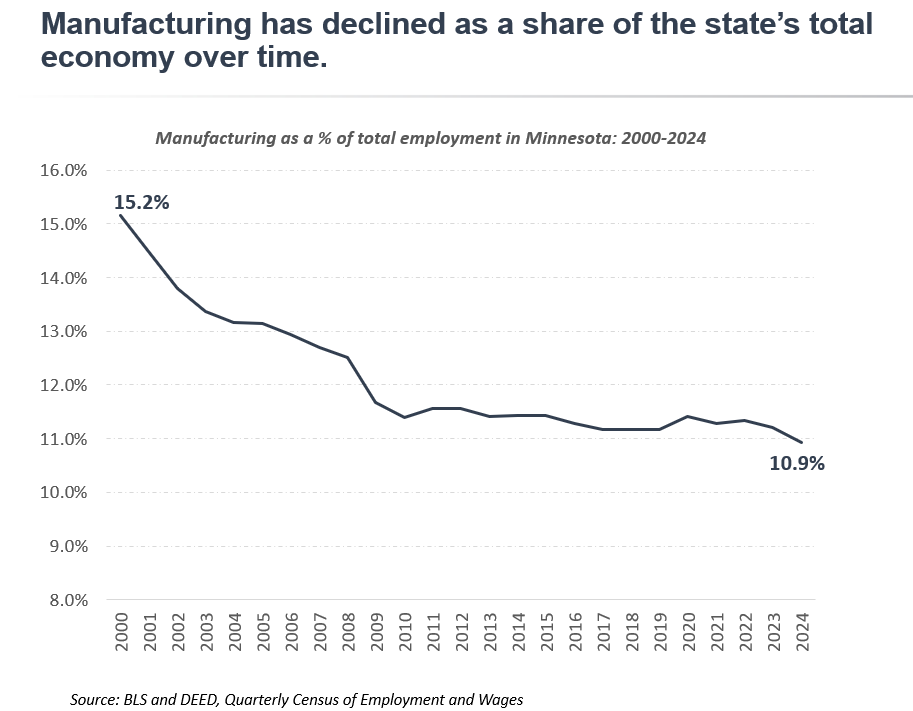

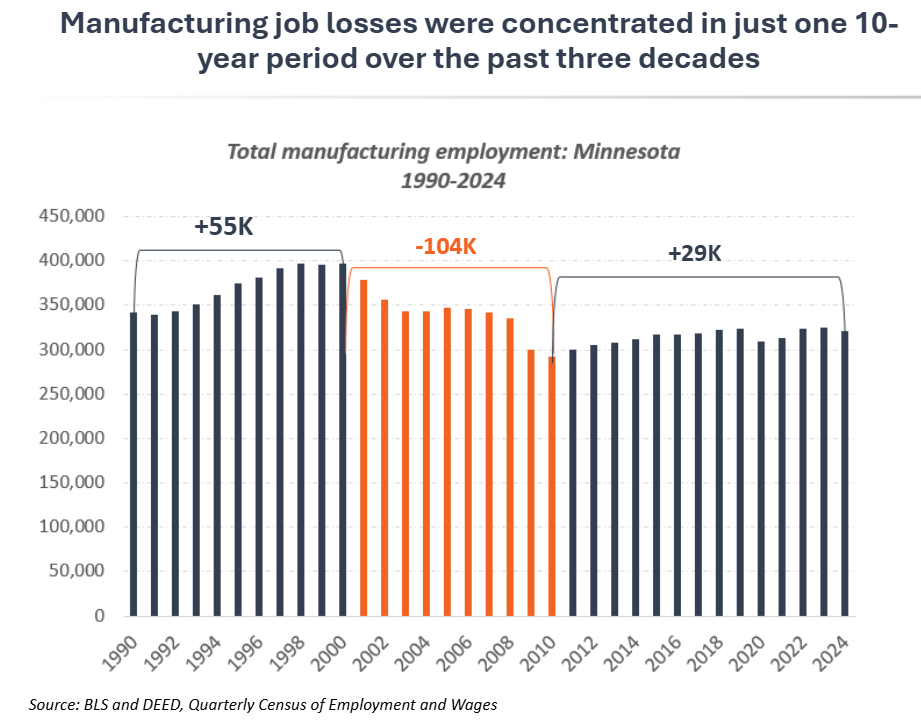

Minnesota’s manufacturing employment has declined over time. However, these losses were concentrated in a 10-year period between 2000-2010, with the state adding manufacturing jobs in two of the past three decades. The narrative of “manufacturing decline” – which dominates much of the public discourse on manufacturing – suggests that the sector has been in a state of steady losses over a period of decades. At first glance, this can look to be the case. Manufacturing jobs as a share of total employment in Minnesota fell from 15% in 2000 to 11% in 2024, without any significant period of market share gains in that time. However, this masks the extent to which job losses were concentrated in the decade between 2000 and 2010. This decade was marked by two recessions with severe impacts on manufacturing, alongside China’s accession to the World Trade Organization (WTO), which intensified global competition and offshoring pressures in what became known as the “China shock.”

The other decades since 1990 have looked better. Minnesota manufacturing experienced net employment gains throughout the 1990’s and the 2010’s. Though the gains didn’t compensate for the 104,000 jobs lost in the early 2000’s, it complicates the view that the sector has been in steady decline. This is important because it impacts how workers and businesses experience industry changes. For example, an individual entering the manufacturing workforce in 2011 would have experienced nearly a decade of uninterrupted growth in their sector. They would be positioned in an industry with increasing, not decreasing opportunities. The large losses experienced in one decade do not necessitate continued declines in the future.

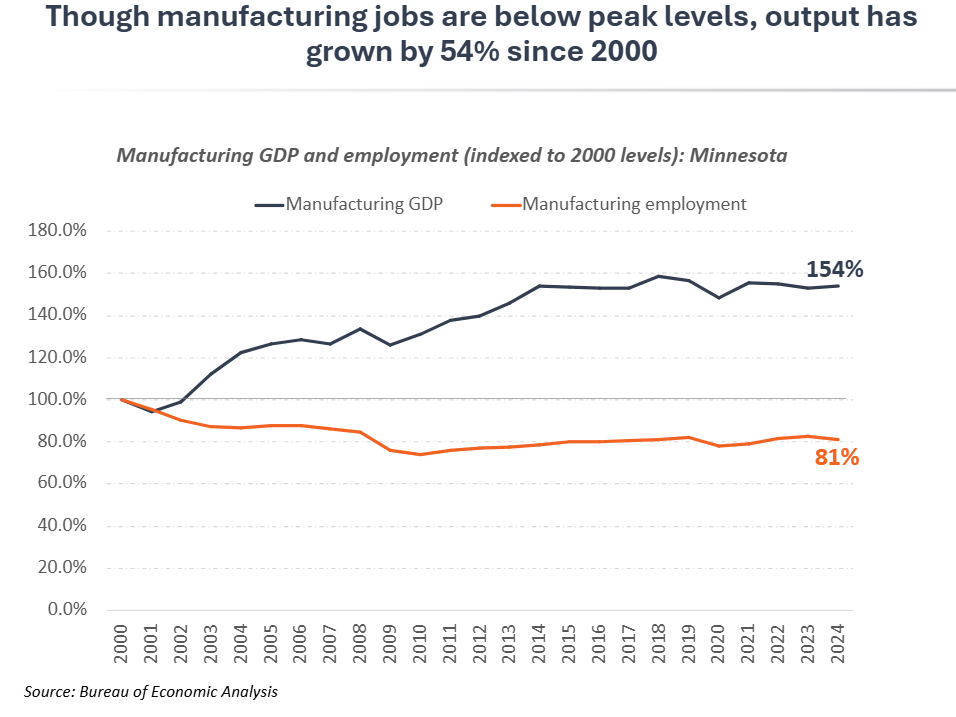

Manufacturing output (real GDP) in Minnesota increased by 54% since 2000, indicating continued growth through productivity and movement into higher value-added activities. Perhaps the largest misperception about manufacturing is that job losses equate to overall decline in the sector. This is simply not the case. A combination of automation technologies, process improvements and shifts to higher value activities have allowed manufacturers to become more efficient and expand their output, even as job counts have not recovered to peak levels. Real GDP in Minnesota’s manufacturing sector grew by over 50% since 2000, including during the period of large job losses after the Great Recession. Minnesota specializes in several high-value manufacturing subsectors, such medical devices and industrial controls, that have continued to grow and shift the whole sector toward activities up the value chain.

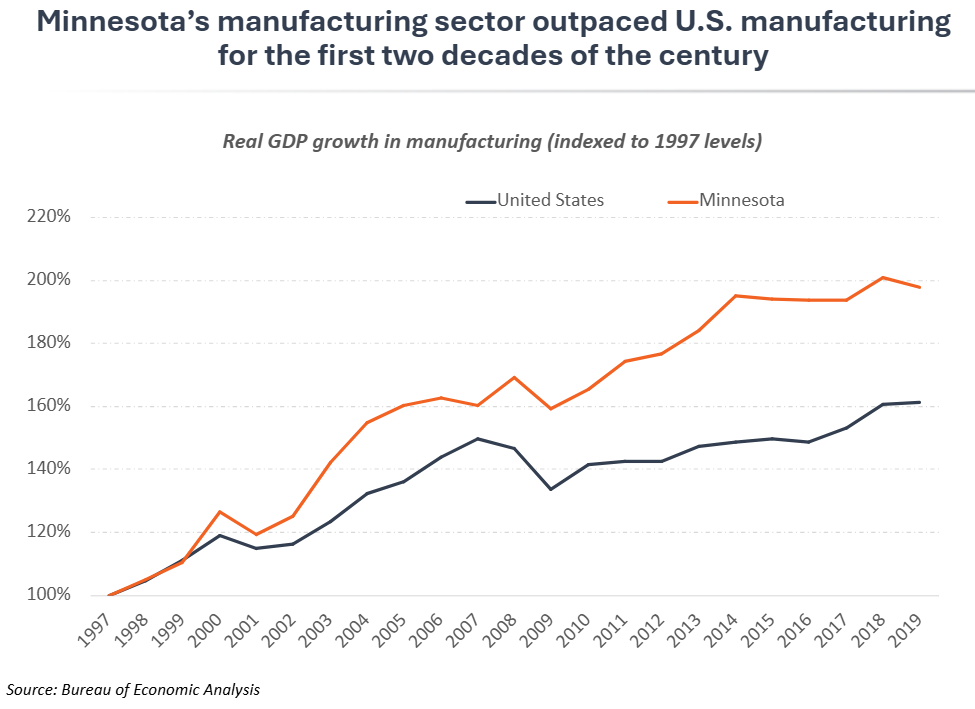

Manufacturing was a competitive bright spot for Minnesota in the first two decades of the century, with Minnesota outpacing the U.S. manufacturing sector and ranking 6th in GDP growth nationally from 2007-2019. While Minnesota’s overall economic growth consistently lagged the U.S. economy for much of this century, the opposite has been true for Minnesota’s manufacturing sector. From 2000-2019, Minnesota’s manufacturing GDP grew 2.4% annually, compared to just 1.6% in the U.S manufacturing sector. During the 2007-2019 business cycle, Minnesota ranked 6th among states in manufacturing GDP growth and ranked 1st among all states in the Midwest region.

Further, the outlook for Minnesota’s manufacturing sector looked bright heading into the 2020 decade. The Minnesota Chamber Foundation’s Minnesota: 2030 report showed that the sector was projected to grow by 2% annually over the decade, leading to the conclusion that manufacturing was a key opportunity and strength for Minnesota to build on as the state looked for ways to accelerate performance in its overall economy. The report stated:

“Minnesota’s strength in this sector positions the state to compete this decade

and leverage technological changes related to Industry 4.0, automation and additive manufacturing…

IHS Markit forecasts that value in manufacturing output will grow at a healthy rate even as

employment declines this decade, signaling continued productivity gains in the sector.”

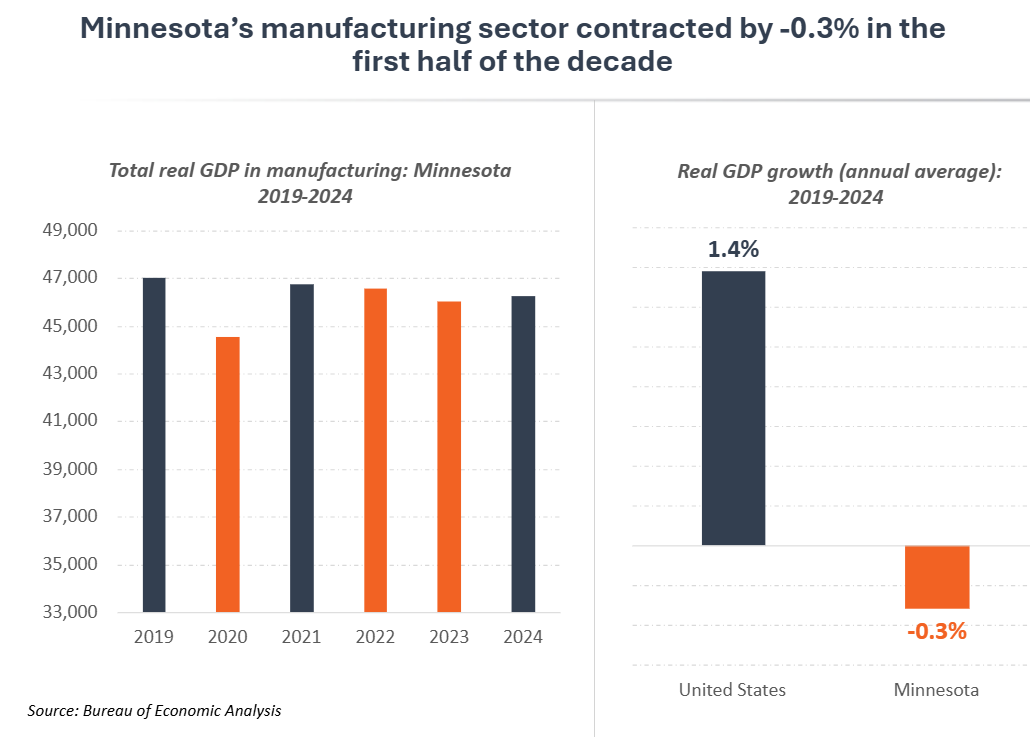

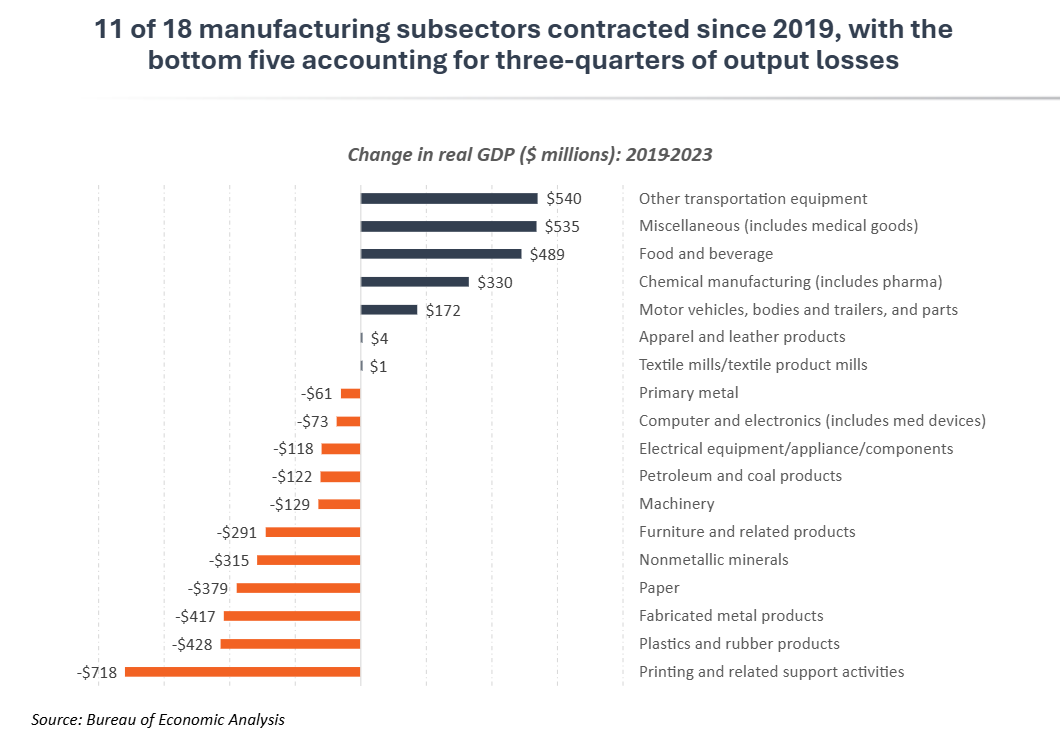

After growing faster than the national average from 2000-2019, Minnesota’s manufacturing performance slipped in the first half of this decade, with total GDP and employment declining and Minnesota ranking 44th nationally in manufacturing GDP growth. In contrast to the healthy manufacturing outlook heading into 2020, Minnesota’s actual performance in the sector faced much steeper headwinds than expected. After recovering quickly from the 2020 downturn, the industry hit a period of ups and downs in the subsequent four years, even as the U.S. manufacturing sector climbed steadily. Minnesota went from 6th in the 2007-2019 period to 44th in 2019-2024 among states in manufacturing GDP growth, ranking 8th among midwestern states. The sector experienced net declines in both jobs and GDP output from 2019 to 2024, declining by -0.3% annually compared to a positive 1.4% growth nationally.

This begs the question, what happened to make Minnesota go from 6th to 44th this business cycle? Why has the state’s manufacturing underperformed relative to other states and what might this mean for its future outlook? While more in-depth research is needed to fully answer this question, a breakdown of the state’s subsectors provides some clues.

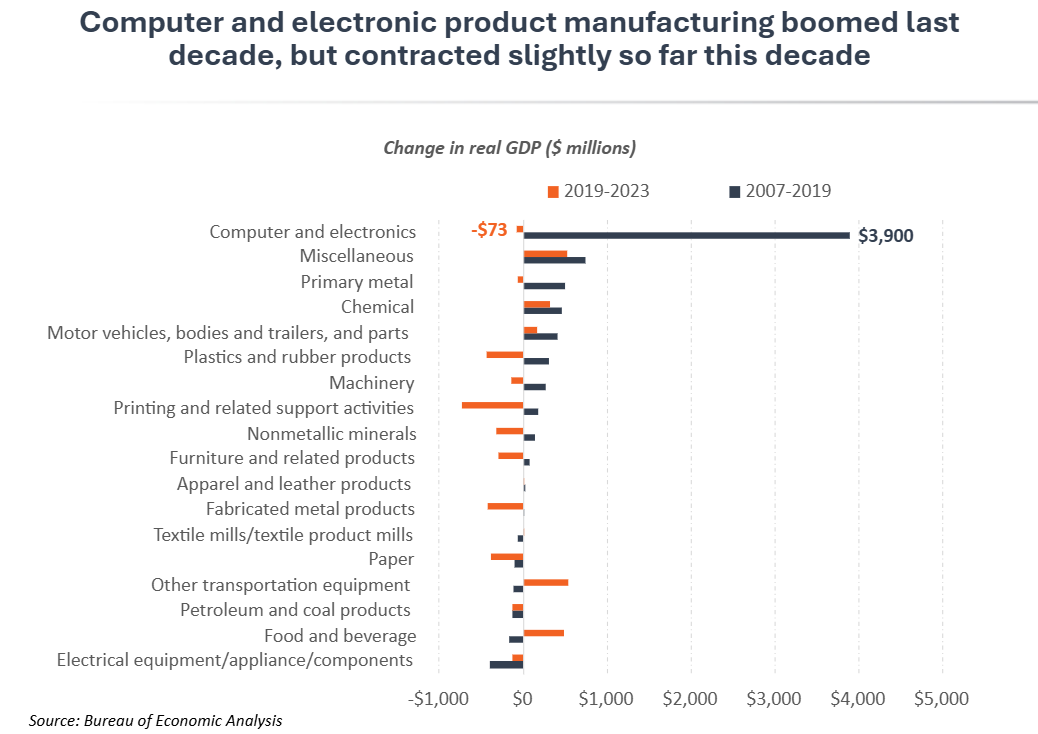

Minnesota’s manufacturing slowdown this decade was due in part to a decline in its computer and electronic products subsector, which had been an engine for manufacturing growth in recent decades. Minnesota’s computer and electronic products industry represents some of the state’s most advanced manufacturing activities. This subsector includes manufacturing of electromedical devices, semiconductors, circuit boards, computers, storage devices, industrial controls and more. From 2000-2019, it accounted for nearly 60% of Minnesota’s overall manufacturing growth, expanding at a rapid 11% annual rate in that time. Since 2019, however, total output in computer and electronic products manufacturing contracted modestly by -0.3%. This change from rapid double-digit annual growth to a slight decline impacted performance across the entire sector. State GDP data from the Bureau of Economic Analysis does not allow for a more detailed analysis within the computer and electronic products subsector. However, employment data from the Bureau of Labor Statistics, which drills down to a more detailed level, shows substantial variance across this industry. For example, the subsector added jobs in electromedical devices, semiconductors, bare printed circuit boards and capacitors in the five-year period from 2019-2024. But employment declined substantially in other areas like electronic computers and environmental controls for buildings. This helps explain why overall activity has declined in this critical part of Minnesota’s manufacturing, even as the state’s med-tech and semiconductor businesses have continued to expand.

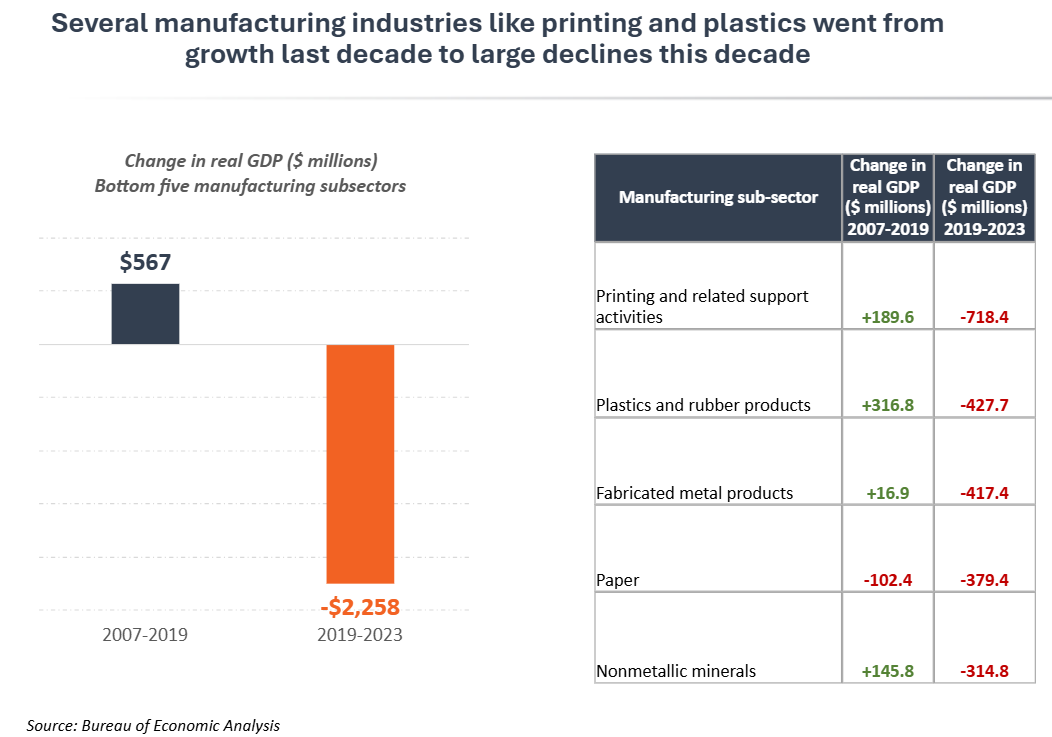

Several manufacturing subsectors, such as printing, plastics and fabricated metal products faced substantial declines this decade, after posting positive net gains in the last business cycle. Within Minnesota’s broad manufacturing sector, five subsectors account for nearly three-quarters of total losses in output since 2019. These subsectors – printing, plastic and rubber products, fabricated metal products, paper and nonmetallic mineral products – make up important parts of Minnesota’s manufacturing sector and are often essential links in the supply chains for other manufacturing and industrial businesses. For example, Minnesota businesses that produce machinery, transportation equipment and medical devices all rely on local machine shops, plastic fabrication, sheet metal and stamping businesses to supply parts for finished products. Creating conditions for growth across Minnesota’s diverse manufacturing base, which includes companies who make finished goods and suppliers to those businesses, will be important to ensure success for the whole sector in coming years.

Minnesota Chamber resources for manufacturers:

The Minnesota Chamber of Commerce and Chamber Foundation are committed to supporting manufacturers around the state. Below are some of the resources available to manufacturing businesses.

- Manufacturers Council – the Minnesota Chamber of Commerce also serves as the state manufacturing association. The Manufacturers Council provides an exclusive opportunity for manufacturing members to share best practices, advocate on behalf of key policy issues and join together to advance pro-growth strategies for manufacturers in Minnesota.

- ChamberHealth – through Minnesota Chamber Business Services, an association health plan specifically for manufacturers is available through ChamberHealth.

- Free one-on-one assistance from Grow Minnesota! – Grow Minnesota! is the state’s leading business retention program, providing free, customized assistance to manufacturers and businesses statewide on strategies to grow their companies, as well as problem solving to remove barriers.

- Online certificate of origin processing through essCert – the Chamber offers a streamlined certificate of origin processing system for quick and efficient approvals.

- Sustainability solutions and savings through Energy Smart and Waste Wise – the Minnesota Chamber Sustainability program provides cost saving consulting and recommendations for on both energy and solid waste. This innovative program has saved businesses millions of dollars throughout its history.

- Free resource guides on business funding, exporting and workforce – Grow Minnesota! has easy-to-navigate guides to help businesses access capital, find new markets and identify workforce partnerships in their communities.

Need more assistance?

The Grow Minnesota! team at the Minnesota Chamber of Commerce can provide additional assistance to help your business access the above resources.

Contact growminnesota@mnchamber.com for more assistance.