Building workforce capacity is key to unlocking manufacturing growth in Minnesota

By Sean O'Neil

Senior Director of Economic Development and Research

Overview:

Minnesota’s manufacturing workforce remains one of the state’s most important competitive advantages. When manufacturers choose to locate or expand in Minnesota, they frequently cite access to a skilled workforce as a key driver of that decision. At the same time, however, workforce availability has emerged as one of the sector’s most significant constraints. Job vacancy data and employer feedback consistently show that difficulty filling open positions are among the most commonly reported barriers to growth across the state.

This dual reality—strong workforce quality paired with limited workforce availability—now sits at the center of Minnesota’s manufacturing competitiveness and will shape the sector’s outlook in the years ahead.

The manufacturing workforce is also changing in fundamental ways. Demographic shifts are generating substantial replacement demand as experienced workers retire, leaving a large number of positions to be backfilled. At the same time, advances in equipment, digital systems and automation are altering the skillsets required within manufacturing environments. These changes are reflected in rising educational attainment among production workers and sustained growth in non-production roles, including management, business operations and engineering, over the past two decades.

Together, these trends point to the need for action on two fronts. First, communities and employers must expand how they promote manufacturing careers and access new and emerging talent pools. Second, training and upskilling systems must evolve to better align with changing technologies and be easier for employers to navigate and use.

This report examines the key workforce trends shaping Minnesota’s manufacturing sector and outlines practical tools and resources that businesses can leverage to attract, train and retain the talent needed to remain competitive.

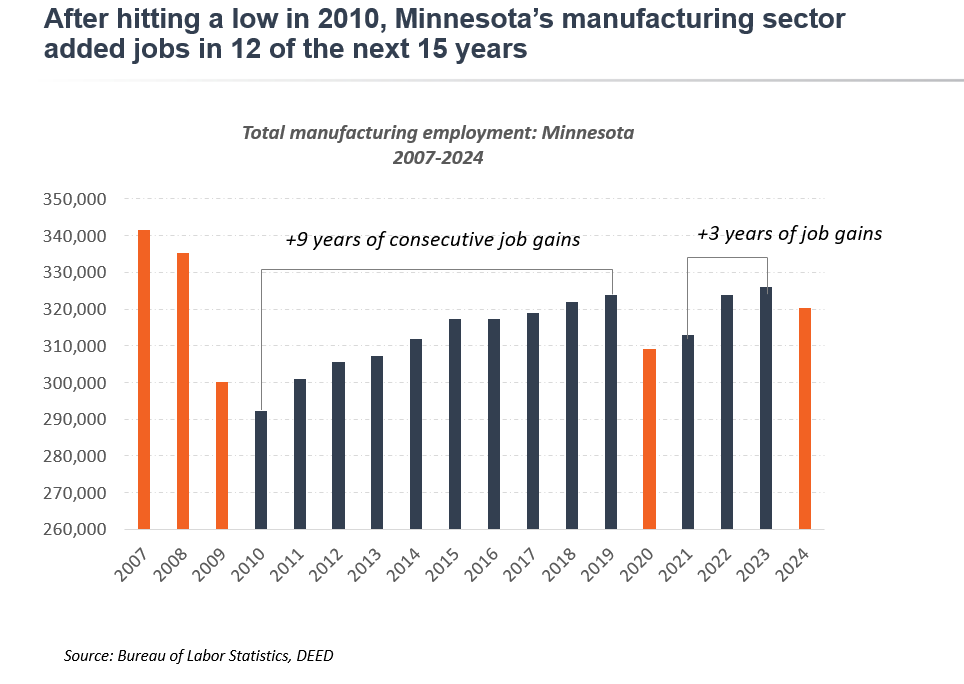

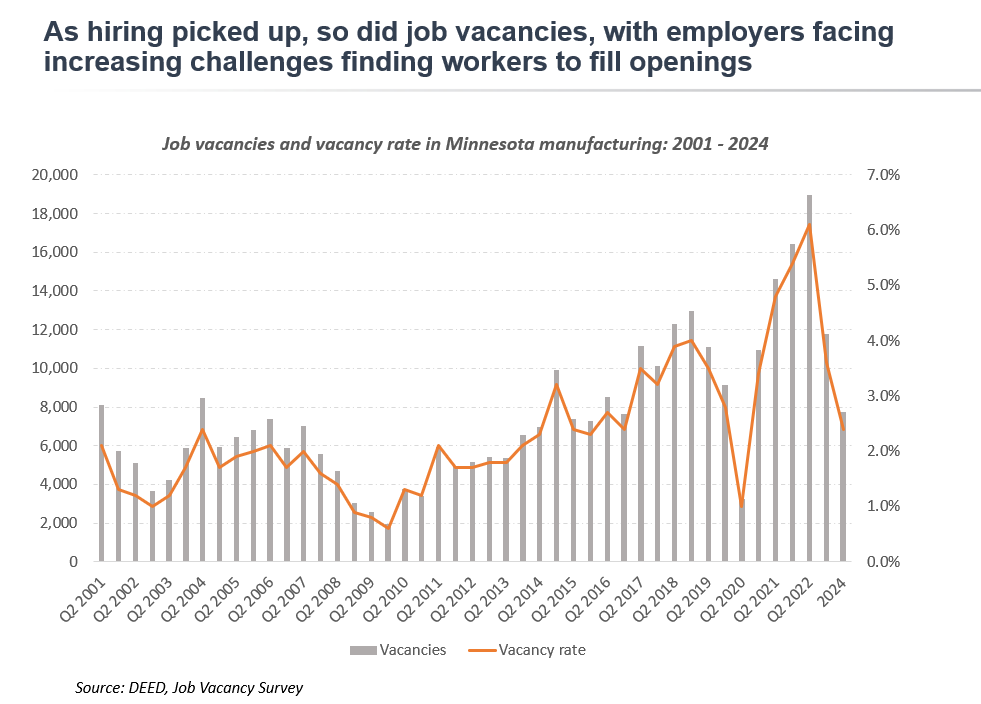

The number of unfilled manufacturing jobs grew steadily since 2010, as demand outpaced the supply of workers. Minnesota manufacturers added jobs in twelve of the fifteen years from 2010-2024, following the substantial losses experienced in the 2007-2009 recession. As hiring picked up, however, so too did the number of unfilled manufacturing jobs, with employers facing increased challenges finding available workers. This is evident in the rising number of job vacancies in Minnesota’s manufacturing sector. The Department of Employment and Economic Development calculates that there were around 2,000 unfilled manufacturing jobs at the trough of the Great Recession in 2009. By late 2018, that had increased to roughly 13,000 job vacancies. The turbulent impacts of the COVID-19 pandemic further disrupted labor markets, leading unfilled manufacturing jobs to spike to nearly 19,000 in the fourth quarter of 2022. While vacancies have since subsided, this appears to be driven more by short-term declines in labor demand than an improvement in supply of available workers.

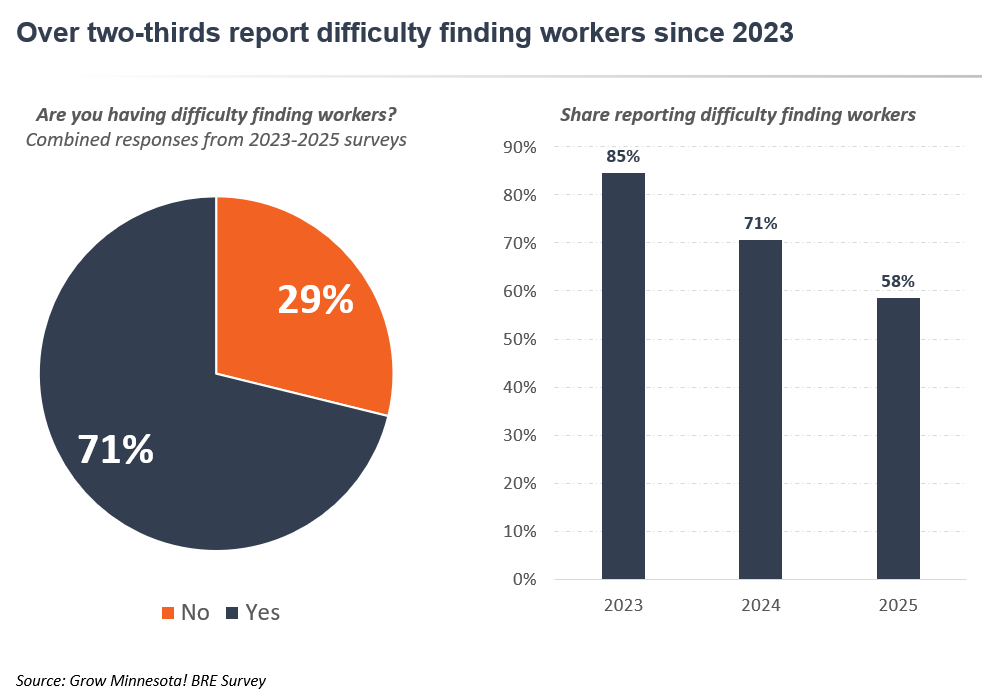

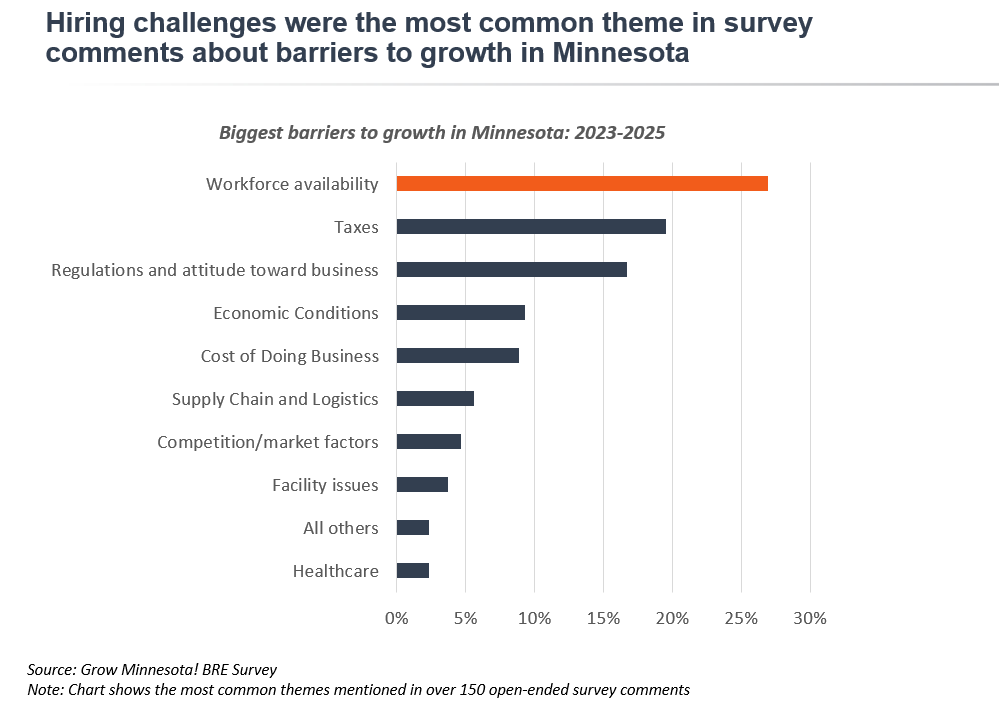

Manufacturers report workforce availability and skills gaps as a top barrier to their growth in the state. In addition to job vacancy data, other surveys and interviews with manufacturing leaders show that workforce availability has become a primary challenge for employers’ ability to grow and expand in the state. Since 2023, the Grow Minnesota! program surveyed over 150 manufacturers through its annual State of Business Retention and Expansion report. Over seventy percent of manufacturers surveyed since 2023 reported difficulty finding workers. Similarly, Enterprise Minnesota’s 2025 poll of over 400 manufacturers found that 80% of firms say it is somewhat or very difficult to attract qualified talent.

These hiring difficulties are more than a minor hurdle. Indeed, workforce availability topped the list of barriers to growth reported by Minnesota manufacturers in recent years. Interestingly, workforce challenges continued to rank among manufacturers top concerns in 2024 and 2025, even as hiring demand cooled in the face of sectoral headwinds. This demonstrates that the availability of qualified talent is perceived as a longer-term structural concern for manufacturing businesses in Minnesota.

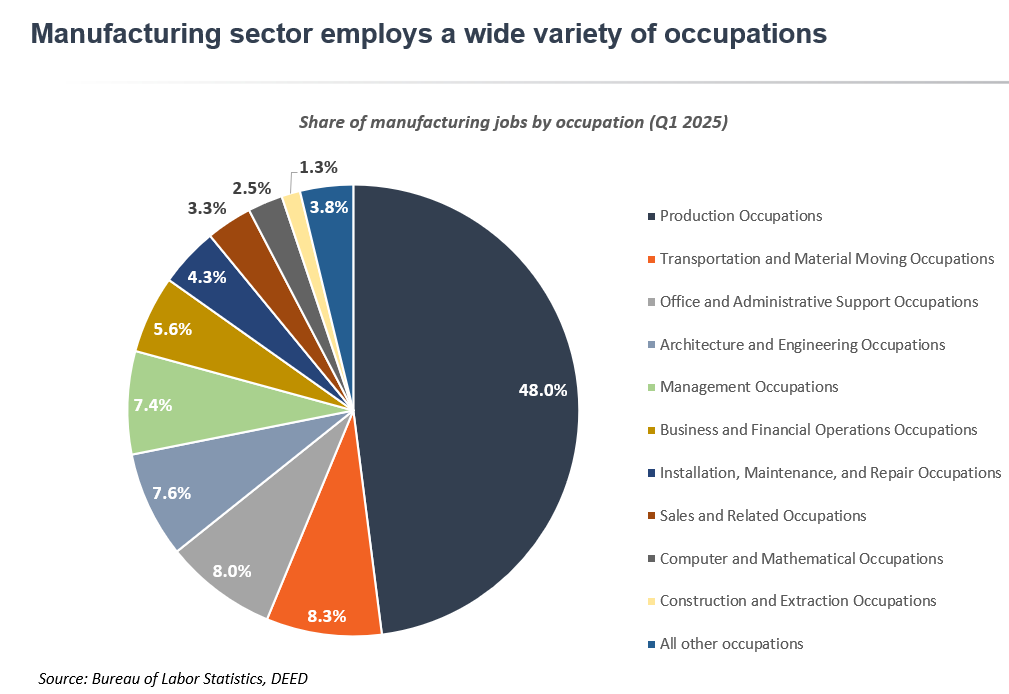

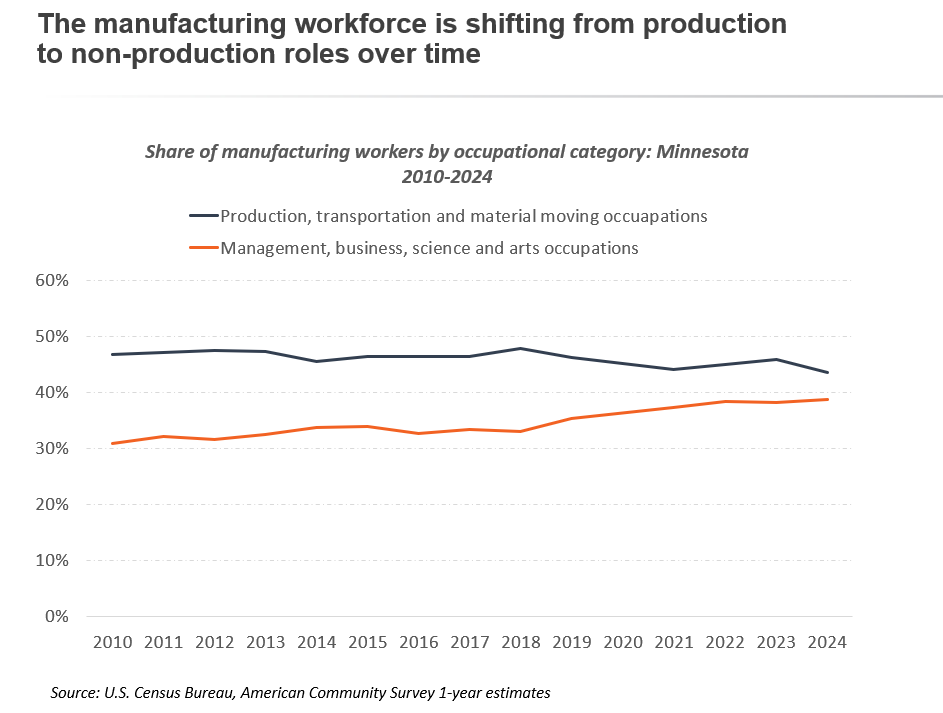

Manufacturers employ a wide range of occupations, with non-production roles growing over time. Minnesota’s manufacturing sector has the highest occupational mix of any industry in the state, with over 400 distinct occupations in the workforce. Less than half of all manufacturing jobs are in production, with 52% of roles involved in other aspects of the business, whether transportation and material handling, business operations, management, engineering and so forth. Further, the share of jobs by role has shifted, increasing toward non-production occupations over the past fifteen years. For example, the share of manufacturing jobs in management and business operations rose from 31% in 2010 to 39% in 2024, while production occupations declined from 47% to 42% over that same time. This dynamic is reflected throughout the U.S. manufacturing sector as well. However, Minnesota has an above-average share of non-production manufacturing jobs relative to other states and has the highest share among Midwestern states. Despite these changes, production jobs remain by far the single largest occupational category within manufacturing and are the jobs employers often describe as being most difficult to fill.

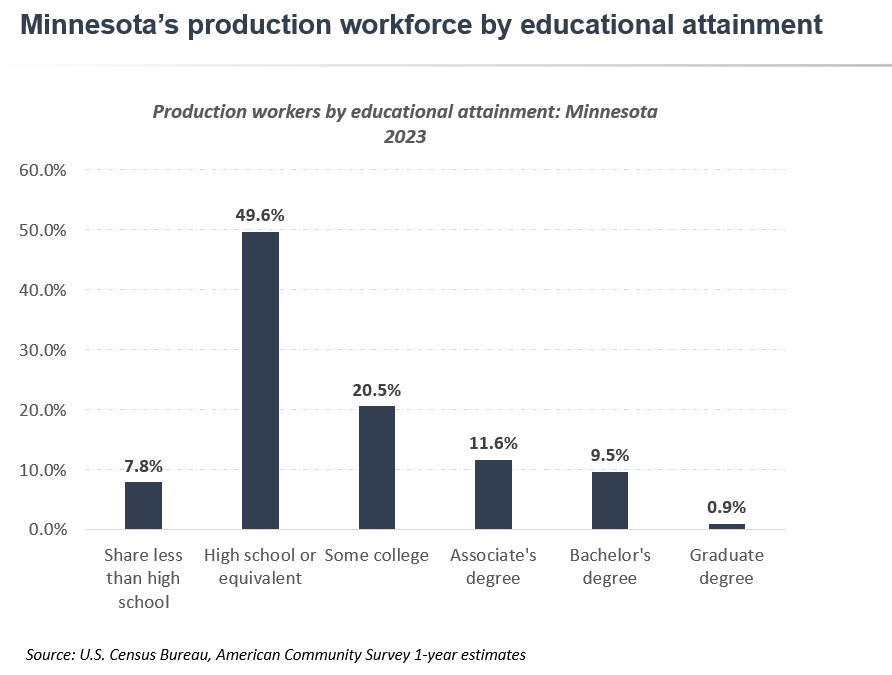

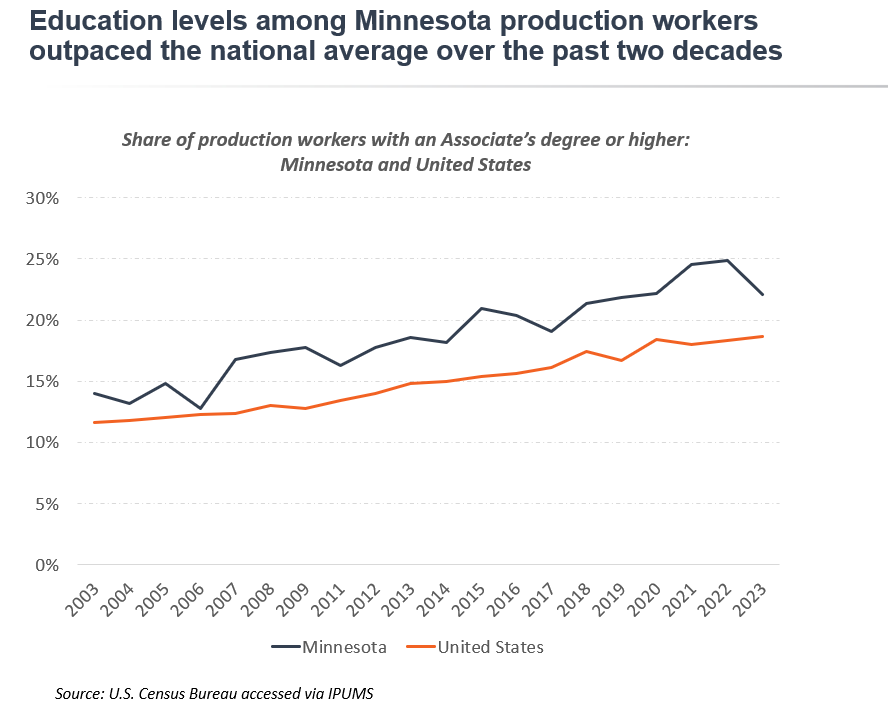

Education levels among Minnesota’s production workers rose over past two decades, outpacing the U.S. average. Data from the U.S. Census American Community Survey show that Minnesotans in production occupations possess a wide range of education levels. (Note: Production occupations primarily exist within the manufacturing sector, though a smaller share are in other industries). The largest shares of production workers have either completed high school or some college as their highest level of education. However, this is changing over time. The share of production workers with an associate degree or higher rose from 14% in 2003 to a high of 25% in 2022. Further, education levels in Minnesota’s production workforce outpace their peers nationally, with 25% of Minnesota production workers possessing an associate degree or higher in 2022 compared to 18% in the U.S. production workforce. Despite these gains, over half of workers in production occupations have not received any postsecondary education, which may indicate room for growth in connecting manufacturing employees to career-specific training programs.

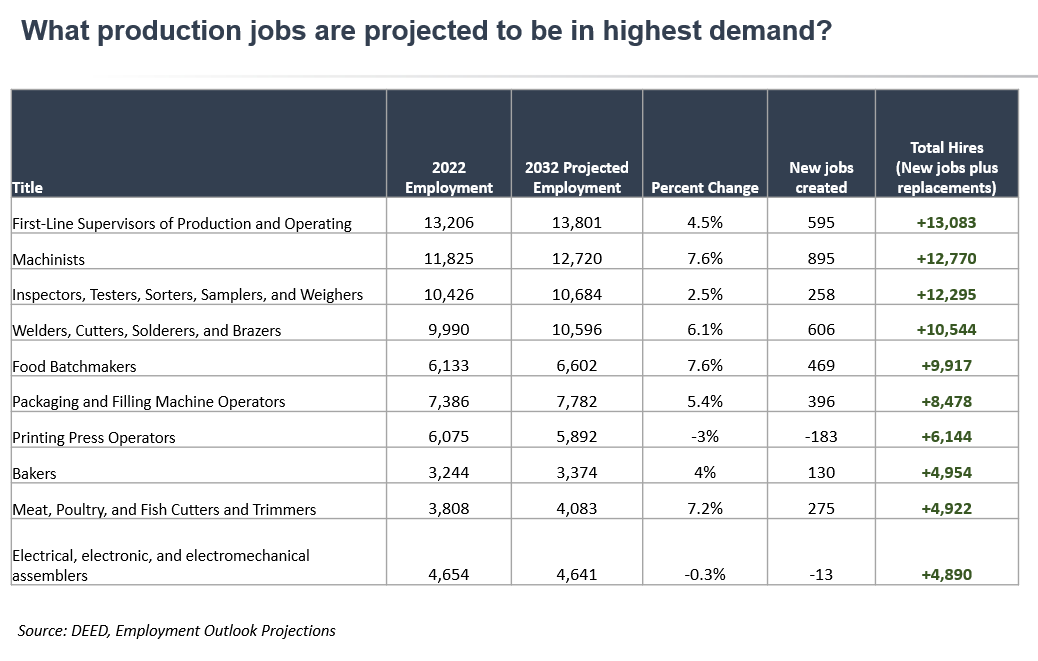

Minnesota is projected to have over 200,000 job openings in production occupations from 2022-2032, driven largely by retirements. Two structural forces will shape the state’s manufacturing workforce over the next decade. First, automation and technology adoption are reshaping production work. Advances in equipment, robotics, and digital systems are expected to moderate growth in headcount while increasing the productivity and skills of remaining workers. As one manufacturing leader noted during a Fall 2025 focus group, recent automation investments have been paired with more intensive training strategies—improving job quality and wages even as staffing levels hold steady.

Second, demographic changes will generate significant replacement demand. Minnesota’s aging workforce means that many experienced production workers will retire over the coming years. The Department of Employment and Economic Development projects nearly 226,000 openings in production roles over the 2022–2032 period. The largest volumes are expected for production supervisors, machinists, inspectors and welders. Even occupations with declining overall employment—such as printing press operators—will still need substantial levels of backfilling to maintain operations.

These dynamics mean that demand for new workers will remain strong, even if total employment in some production roles contracts. They also signal a continued shift in the competencies required of new and incumbent workers as technologies evolve.

Meeting this demand requires clear strategies for strengthening the manufacturing talent pipeline. New workers must come from a combination of four sources: graduates of high schools and post-secondary programs; adults currently outside the labor force; workers transitioning from other industries; and people moving to Minnesota from other states or countries. Targeted efforts across each of these channels will be essential to meeting long-term workforce needs.At the same time, increasing the supply of workers is only one part of the challenge. Manufacturers also need effective tools to train and upskill their current and incoming workforce. Minnesota offers several programs designed to support these needs, yet many employers report that available resources are not widely known or can be difficult to access. Evaluating, refining and—where necessary—expanding these programs will be critical to ensuring that workers can develop the advanced skillsets required to fuel growth in Minnesota’s manufacturing sector.

What can Minnesota manufacturers do to find and develop talent?

4 resources and strategies for manufacturers:

Minnesota has dozens of programs and initiatives aimed at strengthening the manufacturing workforce. The resources below highlight practical steps manufacturers can take to expand their talent pipeline and upskill new and existing employees.

Contact the Grow Minnesota! team to learn more information or help connect to any of these options.

1. Partner with your local technical college. Minnesota’s network of two-year career and technical colleges is an underutilized asset for many manufacturers. These institutions can connect you with internship candidates, job-ready graduates and customized training services. Some also have access to state grant funding that can offset the cost of on-site training.

How to get started:

- Call your local chamber of commerce or the Minnesota Chamber Foundation’s Grow Minnesota! team. Chambers often have direct relationships with college leaders and can quickly connect you to the appropriate dean, faculty member or career services contact.

- Reach out to the Dean of Manufacturing (or equivalent). Deans can provide a comprehensive overview of available programs, partnership opportunities and training options. Minnesota State lists contact information for each dean on its website.

- Contact relevant faculty directly. For example, if you want to partner with a welding program, reaching out to a welding instructor can be the fastest way to explore specific opportunities.

- Look for customized training contacts. Many colleges have dedicated workforce training offices with staff who facilitate contract training and grant-supported programs.

2. Expand your talent pool through inclusion strategies. Manufacturers across the state are broadening their hiring pipelines by creating workplaces that accommodate a wider range of workers. Examples include:

- Partnering with community organizations for English language training. For example:

- MORE Empowerment offers on-site English classes for employees.

- The International Institute of Minnesota provides classes at its facility and can connect employers to additional workforce resources.

- Contact Grow Minnesota! for connections to similar organizations in your area.

- Adapting work environments to support employees with varying physical abilities. One manufacturer described that they installed visual displays at workstations to support workers with hearing impairments. Another manufacturer shared in a Grow Minnesota! visit that they added mechanical lifting devices, reducing the strength requirements needed for machine operation and opening jobs to a broader pool of candidates. Some manufacturers partner with community organizations that serve individuals with disabilities to identify qualified workers and ensure workplace success.

- Organizations like MDI and Opportunity Services can partner directly with businesses to provide unique solutions.

- Note: Minnesota’s Employer Reasonable Accommodation Fund can offset costs associated with needed accommodations.

3. Participate in a Business Education Network (BEN) program. The Minnesota Chamber Foundation’s Business Education Network (BEN) connects employers with K–12 and higher education partners through more than twenty local chambers across the state. BEN provides streamlined opportunities to build awareness of manufacturing careers and engage emerging talent. Contact us to find a local BEN partner near you to get started.

Common BEN activities include:

- CEO in the Classroom: Business leaders visit classrooms to discuss career pathways and learn what future workers value.

- Teacher in the Workplace: High school teachers participate in business tours or short-term summer placements to better understand modern manufacturing environments.

- Career Expos: Employers showcase local jobs and career pathways to high school students in a “trade show” format.

- Career Academies: Schools offer specialized coursework, dual-credit options and preparation in employability skills aligned to regional industry needs.

- Business Tours: Students tour manufacturing facilities to see operations firsthand.

- Job Boards: Local BEN partners promote part-time and summer jobs for students.

Read more about how the Brainerd Lakes

and Winona chambers are connecting

businesses with students through BEN programs.

4. Apply for state workforce grants to train new or incumbent employees. Minnesota offers several grant programs designed to reduce employer training costs and support skill development. Businesses can use these funds for customized training delivered on-site or through educational partners. Key programs include:

- Job Skills Partnership — Department of Employment and Economic Development (DEED). Provides grants of up to $400,000 to educational institutions partnering with businesses to deliver job training for new or incumbent workers.

- Dual Training Pipeline — Office of Higher Education & Department of Labor and Industry. Supports “earn-and-learn” models by reimbursing employers for instruction leading to industry-recognized degrees, certificates, or credentials.

- Up to $150,000 per grantee per year

- Up to $6,000 per trainee per year

- Eligible fields include advanced manufacturing, agriculture, health care services, and IT.

- More info: https://www.dli.mn.gov/business/workforce/pipeline-dual-training-grants

- Job Training Incentive Program (JTIP) — DEED. Provides grants of up to $200,000 to new or expanding businesses in Greater Minnesota (outside the seven-county metro). Requirements include:

- At least three new jobs

- Wages at or above 120% of federal poverty guidelines for a family of four

- Jobs must average 32+ hours/week for at least nine months per year

- More info: https://mn.gov/deed/business/financing-business/training-grant/jtip/

- Automation Training Incentive Program (ATIP) — DEED. Provides grants of up to $35,000 to small businesses (fewer than 150 employees company-wide) in Greater Minnesota implementing new automation technology.

Need more assistance?

The Grow Minnesota! team at the Minnesota Chamber of Commerce can provide additional assistance to help your business access the above resources.

Contact growminnesota@mnchamber.com for more assistance.