Grow Minnesota! summer quarterly 2023

Quick Menu

-

Grow Minnesota! introduction

-

Quarterly economic snapshot – Minnesota’s economic performance through the middle of 2023

-

Minnesota business retention and expansion trends

-

Grow Minnesota! – Tools and resources for Minnesota businesses

Grow Minnesota! introduction

The Grow Minnesota! team at the Minnesota Chamber of Commerce helps businesses connect to resources to grow and expand in the state. How can we help?

Direct business assistance:

- Grow Minnesota! staff can help your business navigate the multitude of resources and tools available to Minnesota businesses. Our team visits with businesses to learn about their operations, key challenges and growth plans. We then follow up with a customized report to identify available resources and provide further guidance on how to utilize these resources. To get started, fill out our Grow Minnesota! in-take form or contact us directly at growminnesota@mnchamber.com.

Economic insights:

- Check out some of our economic insights in the sections below and look for more articles and special reports in the future.

- Grow Minnesota! can provide customized economic data and reports upon request. Contact us at soneil@mnchamber.com for more information.

Local economic development support:

- Grow Minnesota! partners receive the tools and support they need to lead business retention and expansion strategies in their local communities. Contact Vicki Stute, Vice President of Programs and Business Services at vstute@mnchamber.com to learn more.

Quarterly economic snapshot – Minnesota’s economic performance through the middle of 2023

Minnesota’s economy remained stable and continued to grow in the first half of 2023 despite earlier predictions that the U.S. would fall into a mild recession sometime this year. Minnesota – like the U.S. economy – experienced falling inflation levels alongside GDP gains and continued low unemployment rates into the middle of 2023.

However, the state faces notable headwinds, including recent declines in total employment and low economic growth rates compared to other states. Read more here as we break down Minnesota’s economic performance through the middle of 2023.

Key Findings:

- Minnesota’s real GDP grew by 2.2% in the first quarter of 2023 but continues to lag growth in the U.S. economy. Minnesota and other upper Midwest states continue to grow slower than the national average, with Minnesota ranking 35th in real GDP growth from Q4 2019 to Q1 2023.

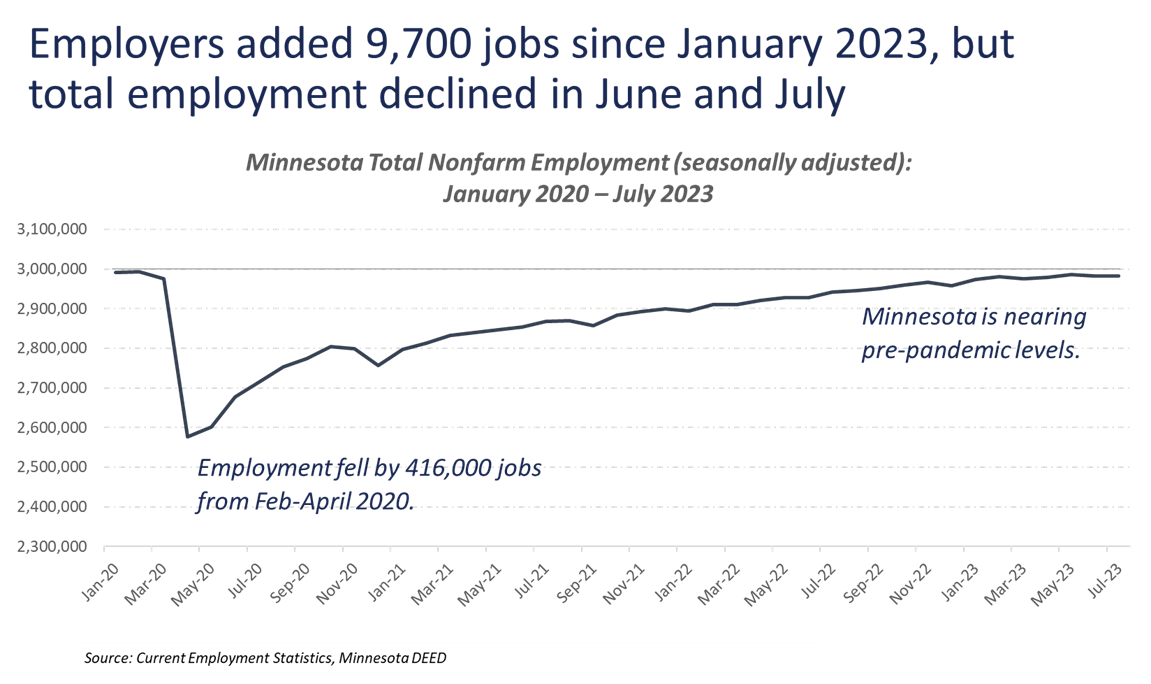

- Job growth cooled at the midyear point, with total employment falling by 2,900 jobs in June and another 400 jobs in July. Minnesota employers added a total of 9,700 jobs in the first six months of the year, increasing at less than half the rate of the U.S. economy. Minnesota is one of 14 states that have yet to recover the jobs lost in the 2020 downturn.

- Minnesota’s labor market remains strong, with unemployment hovering at 3% and 24,965 more Minnesotans joining the workforce in the first half of the year. The recent uptick in labor force participation alongside cooling demand has slightly lessened the intensity of Minnesota’s workforce shortage. However, Minnesota still only had 54 available workers for every 100 open jobs in June, underlying the continued challenge for the state’s workforce availability.

- Minnesota exports rose to $6.6 billion in Q1 2023. Exports gains continue to be driven by Canada which now receives nearly a third of the state’s total exports, compared to just 18.5% in 2019.

- Entrepreneurship showed mixed signals in the first half of the year. New business applications rose to their second-highest levels on record. However, startup funding tightened considerably, with total venture capital investment dropping by 63% compared to last year.

- U.S. inflation increased at the slowest rate in over two years this June and ticked up only slightly in July, making a so-called “soft landing” appear within reach. Inflation in the Minneapolis-St. Paul MSA fell even lower to 1.0% in July 2023, the lowest across all U.S. metro regions.

Minnesota business expansion and investment trends in 2023

2023 State of Business Retention and Expansion

In 2003, the Minnesota Chamber of Commerce formed a partnership with over two dozen local chambers and economic development organizations to conduct ongoing outreach to Minnesota companies. The focus of this outreach was to thank businesses for their investment in Minnesota’s economy, ask them about their current challenges and future expansion plans and connect them to resources to stay and grow in Minnesota. Over the next twenty years, the Grow Minnesota!® program advanced this mission, working with over 90 local partners to conduct more than 13,500 one-on-one business retention and expansion visits with Minnesota business leaders and assist more than 3,200 businesses.

Now in its 20th year, Grow Minnesota!® has embarked on an effort to assess the current state of business expansion activity in Minnesota. The Grow Minnesota! 2023 State of Business Retention and Expansion report collects data and insights on expansion trends through independent third-party databases and through surveys and interviews with Minnesota businesses, site selectors and economic developers. Below are some key findings from our research.

Read the full report here.

Strengths

- Business expansion projects increased in Minnesota and throughout the U.S. in 2021 and 2022. Nationally, the rise of so-called “mega-projects” worth billions in capital investments shook up the economic development landscape.

- In 2022, Minnesota generated expansions from companies in a wide range of industries spread broadly throughout the state. Minnesota’s largest expansion announcements included two proposed $1 billion data center projects, expected to take place in Chaska and Becker. The top 25 largest expansion announcements in 2022 plan to add an expected 2,527 jobs and invest $3.48 billion in capital expenditures.

- Businesses and site selectors cited Minnesota’s strong workforce, local communities, and existing industry clusters in areas like life sciences, skilled manufacturing and natural resource-based industries as competitive advantages to expand in Minnesota.

Mixed

- Fifty-seven percent (57%) of survey respondents expect automation to increase moderately or significantly in the next 1—3 years, and a plurality (32%) indicated that they would look to increase automation if they continue to face workforce shortages over time.

- Fifty percent (50%) of survey respondents expanded or made major investments in Minnesota in recent years. Comments from respondents suggested that many businesses expand locally as a default, as the owners and existing employees live here and have embedded operations in the community or have fundamental business considerations that drive their location decisions, such as proximity to markets or supply chains.

- A majority of businesses (56%) plan to prioritize their current location for future expansion activities, while 25% plan to prioritize locations in other states over time. 29% of respondents have current plans to expand outside of Minnesota.

Challenges

- While overall activity ticked up in Minnesota since 2021, the state consistently ranks near the bottom of Midwest states for new and expansion projects. Minnesota ranked 10th out of 12 states in the region in total projects from 2018 to 2022 and ranked 10th in projects per capita in 2022.

- Minnesota lost three notable expansions due to regulatory barriers, totaling a combined loss of 350 potential new jobs and $1.2 billion in lost capital investment.

- Survey respondents ranked Minnesota’s high state tax rates and lack of available workers as the top two barriers that prevented businesses from expanding in Minnesota. Businesses and site selectors described that overall business climate and hiring issues have led some companies to expand outside of Minnesota in recent years.

- Data from fDi Markets shows that Minnesota-based companies are expanding in other states at a higher rate than out-of-state companies are expanding in Minnesota. Since 2020, Minnesota had a net investment deficit of 54 projects, 2,500 jobs and $6.6 billion in capital expenditures.

- Minnesota companies are investing most heavily in Florida, Indiana, Colorado and Texas, with those states receiving $4.6 billion in capital investments from Minnesota companies from 2020—2022. Additionally, Minnesota had a net investment deficit with each of its neighboring states so far this decade, with Minnesota-based companies investing $562 million more in neighboring states than companies from those states invested in Minnesota projects.

In the News: Notable business expansions in 2023

Each quarter, the Department of Employment and Economic Development (DEED) rounds up information on publicly announced business expansions. Below are some recent examples of new projects, innovations, and initiatives that will shape the economic landscape in our communities in the months and years to come.

After adding significant space in Dayton and Rogers over the past four years, Graco's expansion will nearly double its footprint in Anoka.

COLLIERS

The facility is expected to add more than 50 jobs by the end of 2028. Graco currently has more than 1,500 employees in the Twin Cities. "This expansion will immediately elevate our ability to meet our customers' growing demand, and it prepares us for the next decade of growth," said Peter O'Shea, president of Graco's worldwide lubrication equipment division, in a statement. "We've simply outgrown our current space."

READ MORE

Minnesota Dairy Plant Announces Big Expansion Plans

DAIRY HERD MANAGEMENT

In the small town of Perham, Minn., sits Bongards Creameries, a leading national cheese and whey manufacturer who recently announced a $125 million expansion project. The project is expected to begin in July and will increase the plant’s capacity to take in 5.5 million lbs. of milk per day, an increase of 30%. “With this latest investment, we will be able to continue supporting the growth of our business, allow our current farmer-owners to expand, and allow us to bring on new members,” said Daryl Larson, Bongards CEO, in a press release statement. “In order to increase our milk intake by nearly a third, many aspects of the production process need to be expanded.”

READ MORE

Polar Semiconductor eyes federal subsidies to help double output of Bloomington plant

STAR TRIBUNE

Polar Semiconductor hopes federal subsidies will help fund a technology upgrade that will cost at least $420 million and double the output at the Bloomington plant. Expansion and how to fund it is front of mind as Polar this week hosts semiconductor industry leaders from across the country as they learn more about available new money and talk about how the industry is growing again in the U.S.

READ MORE

Lockheed Martin entity looks to invest $45M in Twin Cities expansion

FINANCE & COMMERCE

Defense contractor Lockheed Martin has a St. Paul location in mind for a new microelectronics subsidiary that would bring more than 100 well-paying jobs to the city. The subsidiary, ForwardEdge ASIC LLC, intends to lease 35,000 to 70,000 square feet of lab and office space in the metro area as part of a $45 million investment, the Minnesota Department of Employment and Economic Development said in a public notice this week.

READ MORE

Spectro Alloys to expand with new building in Rosemount

MINNEAPOLIS/ST. PAUL BUSINESS JOURNAL

Rosemount-based aluminum recycler Spectro Alloys Corp. is planning a $76.8 million expansion with a new 90,000-square-foot building on its campus along Highway 55. The manufacturer is currently asking the state to help fund the project, which it says will bring 70 “highly paid” jobs to Rosemount. Spectro expects to break ground in 2024 on the 42-acre site and have the building operational mid-2025. The new facility will be equipped for melting aluminum and recasting it into sheet and billet alloys, which are often used in structural components for vehicles and buildings.

READ MORE

Search for site underway now that Minnesota Legislature backed a $200 million biomanufacturing campus

STAR TRIBUNE

Now that the state approved funds to help build a $200 million biomanufacturing campus, attention now is on where the complex will land. "We're looking at and evaluating a number of sites," said Douglas Friedman, CEO of Minneapolis-based Bioindustrial Manufacturing and Design Ecosystem (BioMADE), the nonprofit developing the facility. BioMADE is seeking 300 to 1,000 acres of land, ideally within 90 minutes of the Twin Cities, Friedman said. Access to utilities, water, rail and feedstocks will be important.

READ MORE

Yanmar CE NA Announces Expansion Plans, Hundreds of Job Openings in Coming Years

YANMAR

Yanmar Compact Equipment North America (Yanmar CE NA), encompassing the Yanmar Compact Equipment and ASV brands, announces plans for a 32,000-square-foot expansion to its Grand Rapids, Minnesota facility. The new expansion and a subsequent paint system will increase paint capacity by up to three times with maximum automation and allow a parts manufacturing capacity increase of up to two times in the previously occupied space. This project sets the stage for future capacity increases with company officials projecting the addition of hundreds of full-time positions over the next five years.

READ MORE

Grow Minnesota! – Tools and resources for Minnesota businesses

Below is a round-up of articles and reports to understand economic trends and access key resources to grow and expand in Minnesota.

Looking for ways to grow your business? We can help.

Contact Grow Minnesota! staff at growminnesota@mnchamber.com today to get answers to your questions and/or to schedule your Grow Minnesota! visit.

Interested in sponsoring a 2023 quarterly or annual report?

Contact the Chamber's Elizabeth Sherry to learn about exclusive sponsorship opportunities for the Grow Minnesota! 2023 quarterly and annual reports, or other Grow Minnesota! digital publications. Get your brand in front of businesses from around the state.

Recommended Articles

The Minnesota Chamber of Commerce released this letter on behalf of more than 60 CEOs of Minnesota-based companies today.

The...