Costs Matter: Manufacturing in Minnesota

By Sean O'Neil

Senior Director of Economic Development and Research

Manufacturing plays a vital role in Minnesota’s economy, yet the sector faces a combination of factors that make it among the most expensive and complex industries in which to operate.

First, manufacturers carry significantly higher operating costs than in many other industries. While a professional services company may function with relatively little overhead, manufacturers must invest heavily in facilities, equipment, supply inputs, transportation, logistics and energy. Annual capital expenses can reach tens of millions of dollars, even for smaller firms. For instance, a multi-axis CNC machine used by a local metal parts supplier may cost more than $1.5 million. A digital inkjet press for commercial printing can approach $4 million. Annual electric bills can exceed $1 million for a midsized facility. And these purchases represent only one line item among the wide range of costs manufacturers face in their normal operating budgets.

Second, the industry is disproportionately exposed to regulatory costs. According to the National Association of Manufacturers, manufacturers spend an average of $29,100 per employee to comply with federal regulations—nearly double the $12,800 per employee spent by firms overall. Compliance often requires complex environmental permits, restrictions on materials and more extensive labor regulations, all of which add to the baseline cost structure.

Finally, U.S. manufacturers compete directly with firms in lower-cost regions and countries, which puts additional downward pressure on prices. This dynamic is especially acute in low-margin industries where producers have little room to raise prices while managing high operating expenses.

The combination of high operational and regulatory costs alongside global competition with lower cost peers is a hallmark feature of the manufacturing sector that must be better understood as Minnesota seeks to grow its industrial base.

This article examines recent survey findings on manufacturing costs in Minnesota and highlights several areas where the state has experienced an erosion of affordability in recent years.

Recent surveys cite rising costs as a challenge for manufacturers in Minnesota.

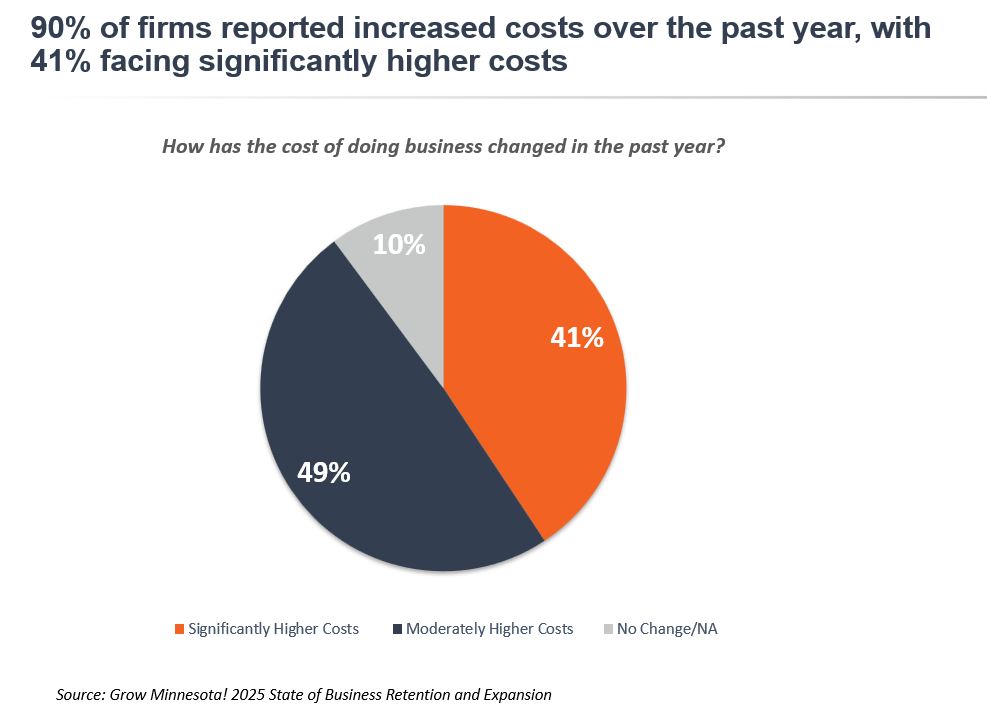

A 2025 survey of Minnesota businesses conducted by the Grow Minnesota! program showed that a high share of firms experienced moderate or significant cost increases over the past year. Ninety percent of manufacturing businesses surveyed reported rising costs over the past year, with 41% facing significant impacts. Examples of impacts noted by manufacturers included:

- "Seems like costs in every area are going up. Our break-even costs have increased by 50% in the last 5 years. Not sustainable."

- “This may hit home particularly to manufacturers as it is generally a very tight-margin business (especially for smaller ones).”

- "Tough to be profitable and invest in your business when there is upward cost pressure and lower demand levels.“

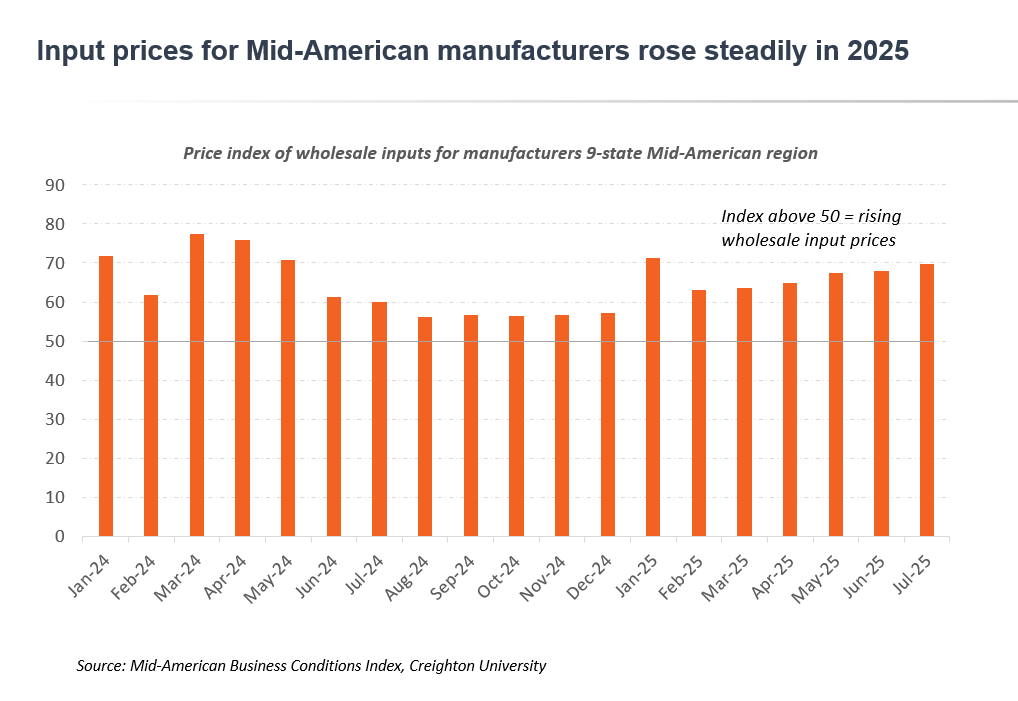

While not a random sample survey, overall findings align with other scientific polls. For example, Creighton University’s Mid-America Business Conditions Index, which surveys manufacturing supply managers each month in a nine-state region (including Minnesota), showed increasing wholesale input prices in each month over the past year, with prices accelerating in the first half of 2025.

Manufacturers raise concerns about impacts of new mandates and business climate issues in Minnesota.

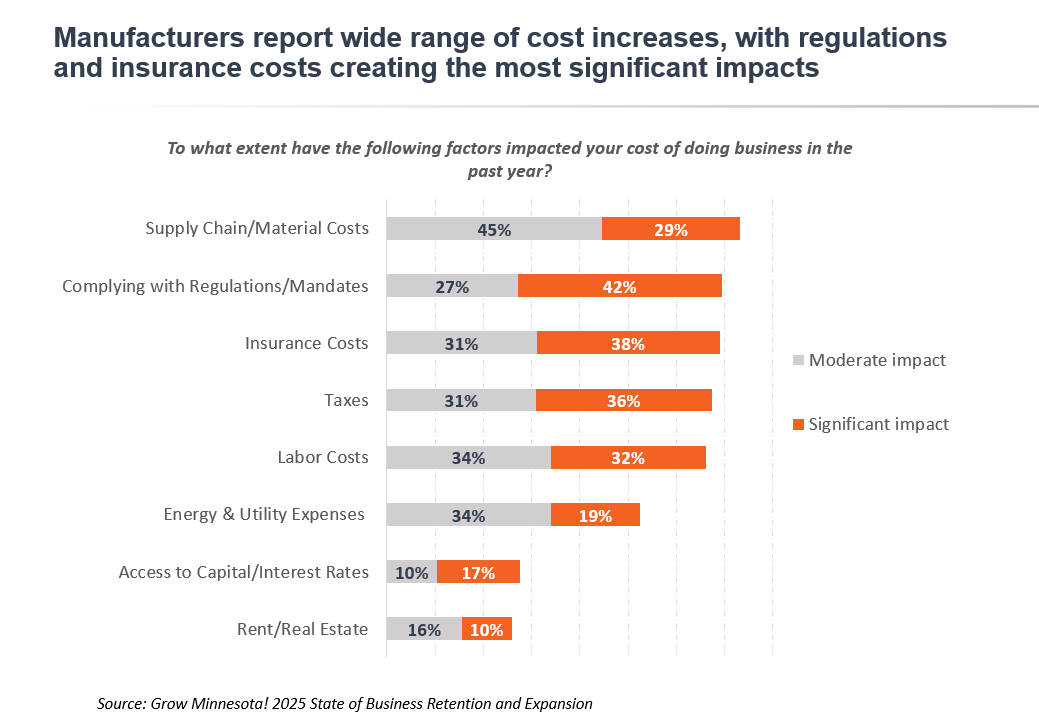

Cost pressures on manufacturers are not unique to Minnesota. However, surveys from the Minnesota Chamber Foundation, Enterprise Minnesota and others reveal concerns about state-imposed costs related to new labor mandates and other business climate issues. The 2025 Grow Minnesota! survey indicated that 42% of manufacturers faced significant cost impacts from compliance with state regulations and mandates, highest among all categories. Open-ended responses provided more detail:

- “State regulations are killing us as they contribute to employee issues and efforts to comply.“

- “Complying with new mandates issued by the state of Minnesota have been costly in terms of time, resources, and energy. Insurance premiums have also increased significantly.“

- "Labor costs and regulations are significantly impacting our business. Causing our company to not be competitive globally."

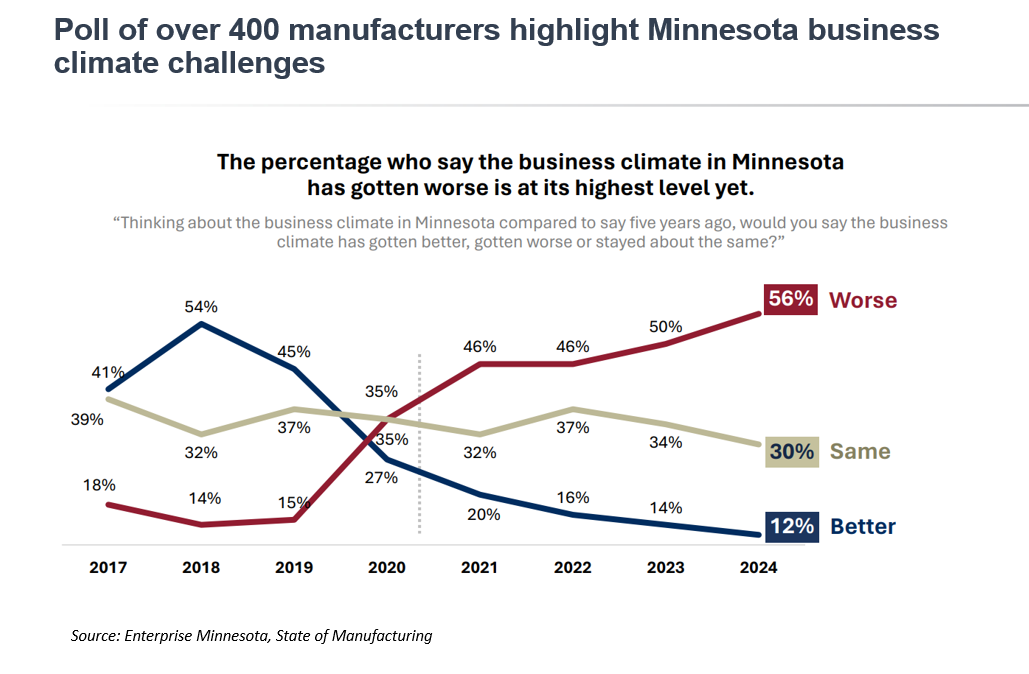

Likewise, Enterprise Minnesota’s 2024 State of Manufacturing report, which polls over 400 manufacturers around the state, found notable concerns about worsening conditions in Minnesota business climate. Their report states: “An alarming trend line in the past four years has been a growing percentage of manufacturers who believe that the Minnesota business climate is worse than before. In this year’s State of Manufacturing® (SOM) survey, a record-high 56% of respondents note that it’s worse, up from 50% last year and 15% five years ago.” Of particular concern were new labor mandates passed in the 2023 legislative session, including the Earned Sick and Safe Time and Paid Family and Medical Leave programs. Over two-thirds expected some impact from these new mandates, with around a third expected major effects on their business.

Recent interviews with manufacturing leaders through the Grow Minnesota! program have echoed similar themes. One midsized manufacturer in the Twin Cities suburbs explained that the total cost incurred through the Earned Sick and Safe Time (ESST) program last year exceeded $750,000. Another visit to a plastic parts supplier for the med-tech industry described that while investing in their workforce is a number one priority, managing these new mandates has been “an administrative nightmare.” The ESST program impacted production operations and forced them to overhaul their prior bereavement policy, which had been a valued employee benefit. While both businesses remain committed to staying in Minnesota, such mandates create another layer of complexity to manage as they compete with businesses in lower cost states.

Minnesota remains a strong manufacturing state, but high operating costs impact its relative competitiveness with other states.

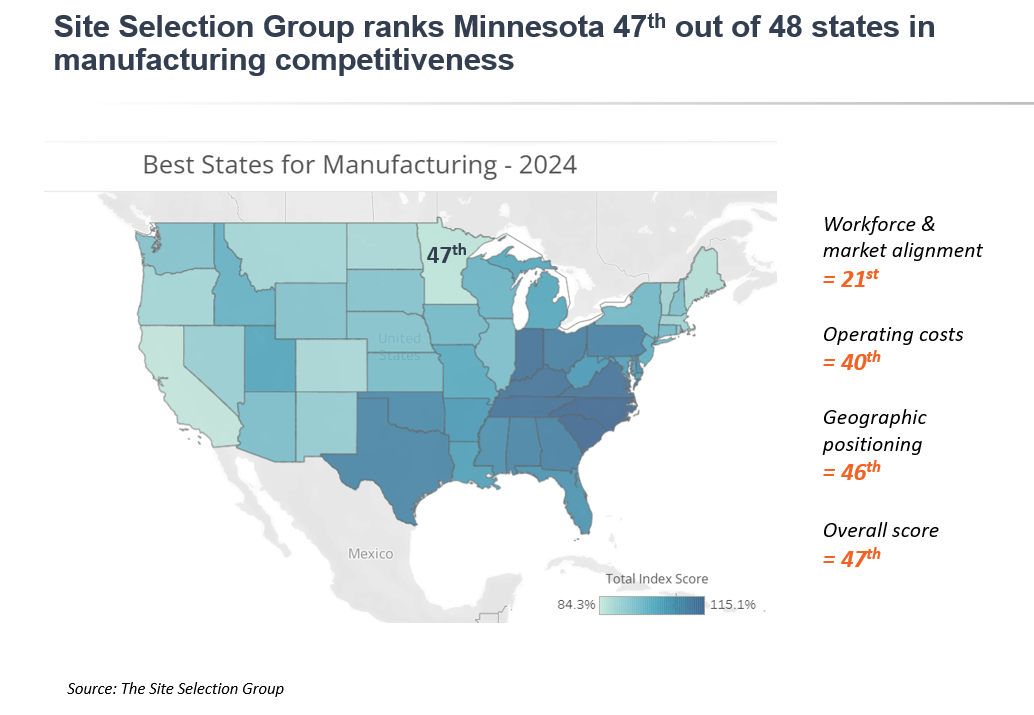

Many factors influence the overall economic competitiveness of a region or state. The fact that Minnesota has a high concentration of manufacturing activity with leading industry clusters is evidence of underlying comparative advantages for local manufacturing producers. However, competitiveness is a moving target, with strengths and challenges evolving over time. Among its challenges, the state faces higher costs of doing business than many peers, impacting its ability to compete for manufacturing investments. Each year, the Site Selection Group ranks states in various indicators of manufacturing competitiveness, examining how geographic proximity, workforce and operating costs would be evaluated in a site selection process. Their baseline analysis puts Minnesota near the bottom of states in overall manufacturing competitiveness, with its operating costs ranked 40th among states. Of course, actual operating costs will vary substantially based on the unique factors of the business – what they produce, the equipment and inputs used, amount and type of labor needed, distribution costs to ends markets and so forth. But exercises like this provide insights into the relative costs across states for expenses that will be common among firms, such as taxes, energy and labor.

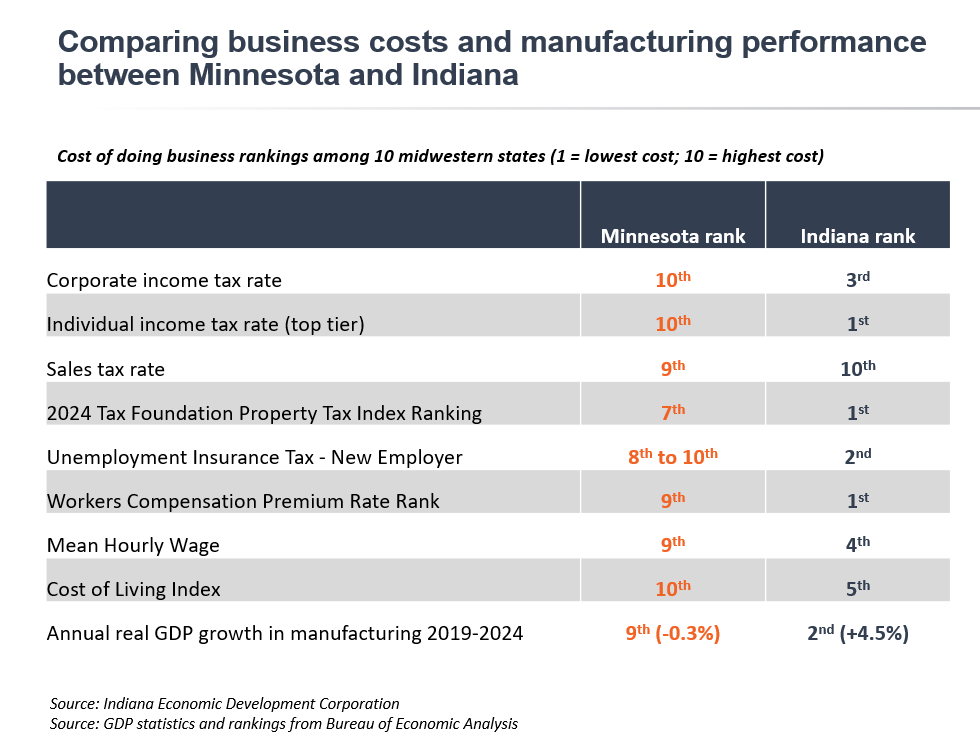

For example, the Tax Foundation ranked Minnesota 44th in tax competitiveness among states in 2025, with the state falling in the bottom ten states in four of six categories. A side-by-side comparison with a Midwest manufacturing peer state like Indiana illustrates the structural differences in some of these costs. Indiana has positioned itself over time to attract manufacturing investments through lowering its business costs and pursuing targeted economic development strategies. A scorecard from a local economic development organization in Indiana shows that Indiana ranks in the top 5 lowest-cost states (among 10 Midwest peers) in seven different categories, while Minnesota ranked among the highest cost in each category.

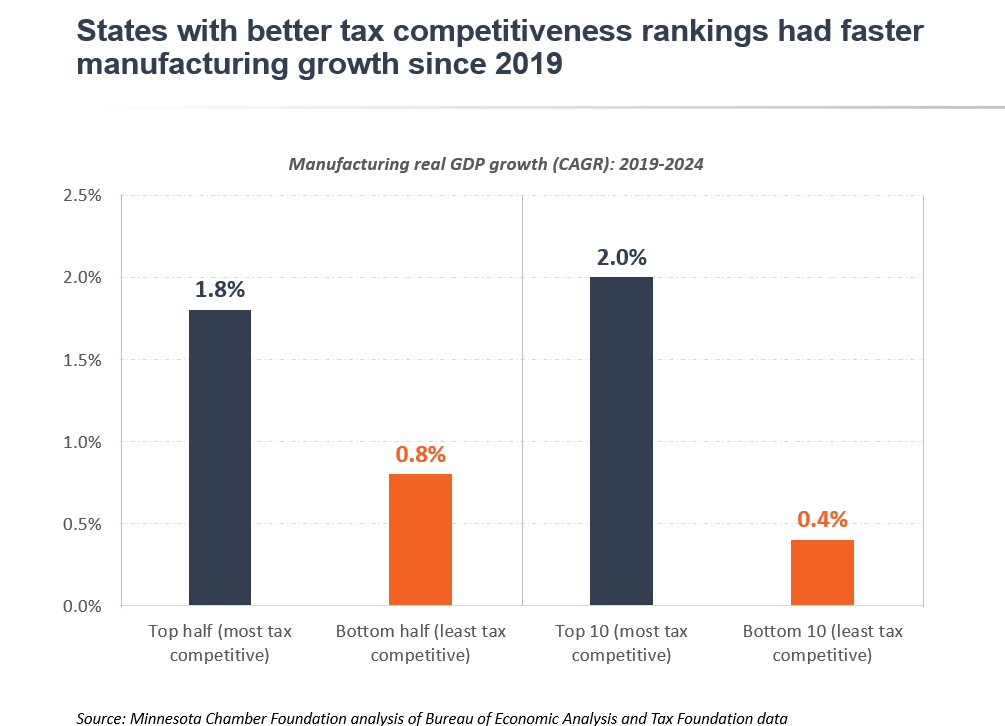

How do these differences in tax costs impact manufacturing performance? More research is needed to examine causal relationships, but the data at least show a general correlation between manufacturing performance and tax competitiveness in recent years. Manufacturing GDP in the top ten most tax-competitive states – as ranked by the Tax Foundation – grew by 2.0% annually so far this decade, compared to just 0.4% among the ten least competitive states (including Minnesota). Minnesota’s manufacturing sector contracted by -0.3% annually since 2019. Indiana, by contrast, grew its manufacturing sector by 4.5% annually in that same time frame.

These snapshots will not settle long standing debates about tax policy. But they should prompt further investigation into how states can create the optimal balance of factors that yield manufacturing growth.

Costs of doing business in Minnesota are outpacing the national average in key areas.

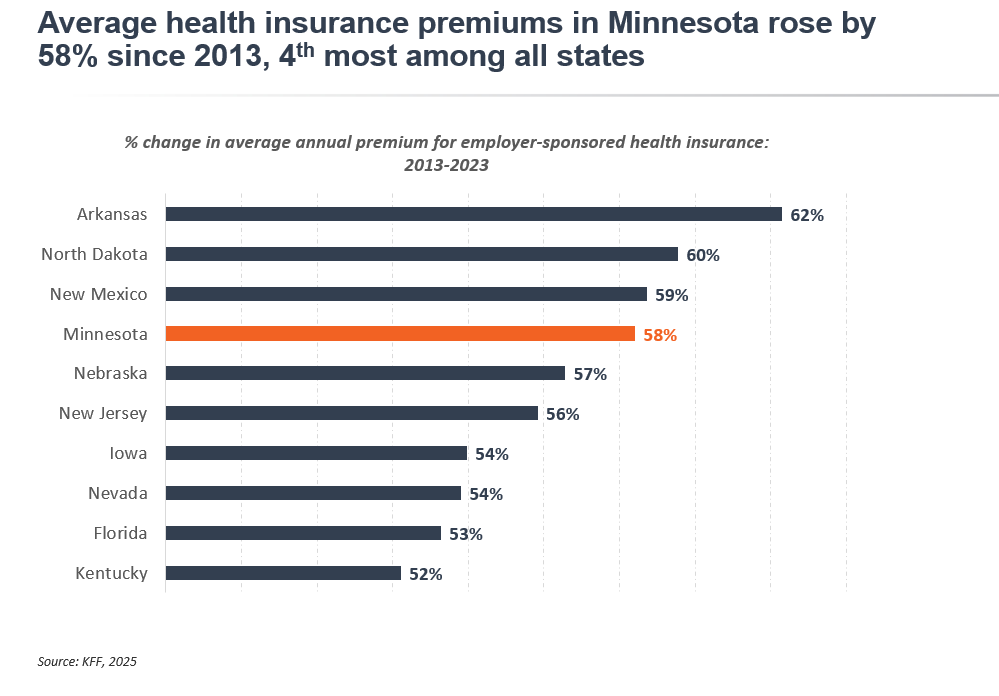

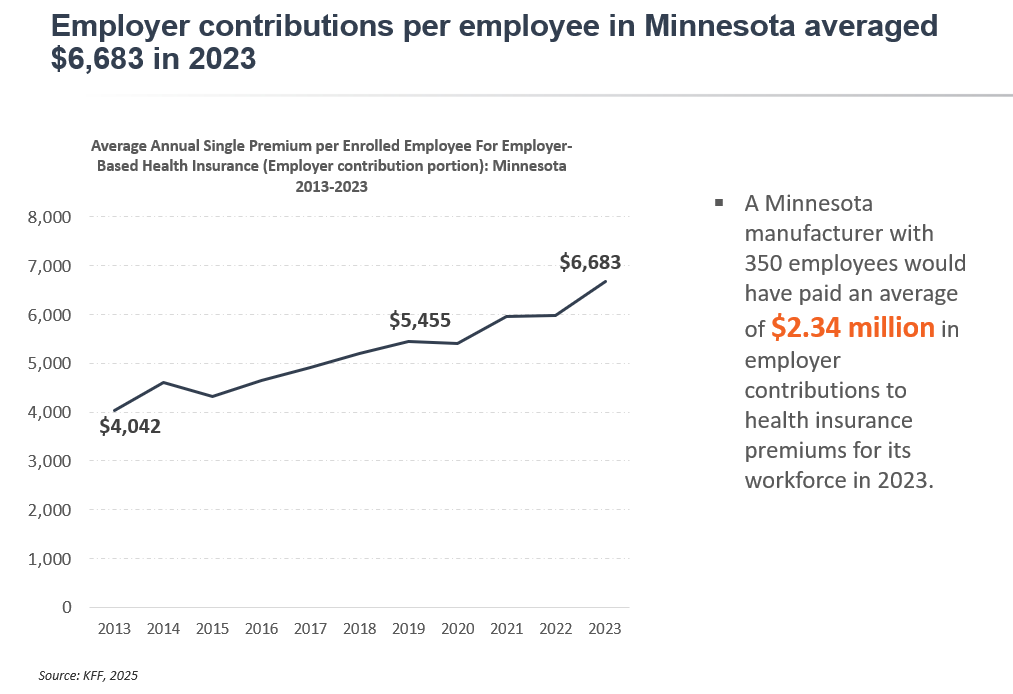

A brief analysis of two expenses common to manufacturers – health insurance and energy costs – demonstrate the dynamic changes of affordability over time. For example, data from KFF – a national health care think-tank – shows that Minnesota’s average health insurance premiums per individual in employer-sponsored plans have risen faster than the national average over the past decade, leading the state to slip from the 38th most expensive in 2013 to the 13th most expensive in 2023, with average annual premiums costing $8,355 per enrollee. Health insurance premiums in Minnesota rose 4th fastest among states since 2013, increasing by 58%.

Rising health care costs impact both employers and employees. Average employer contributions per enrollee in Minnesota increased from $4,042 in 2013 to $6,683 in 2023. Extrapolated out to a midsized manufacturer with 350 insured employees, the company would have spent $2.34 million on employer health insurance contributions in 2023.

Manufacturers surveyed by the Minnesota Chamber Foundation noted the significant impact of rising insurance costs, with 38% saying they faced significant cost impacts last year. A small metal fabricator business in the Twin Cities explained that their health care costs increased by $400,000 this year alone, as several employees experienced health issues that led to large claims activities. Survey comments from other manufacturers reflected similar concerns:

- “Medical costs are significantly over budget. Workers have less money left after bills and new hires are expecting wages at our current management level wages.” – Manufacturer with fewer than 100 employees in Freeborn County

- “Health insurance continually costs more for less coverage.” – Manufacturer with fewer than 25 employees in Stevens County

- “Minnesota's high tax corporate rates and exponentially rising health care insurance costs slow our ability to reinvest in new capabilities and additional associates.” – Manufacturer with fewer than 100 employees in Carver County

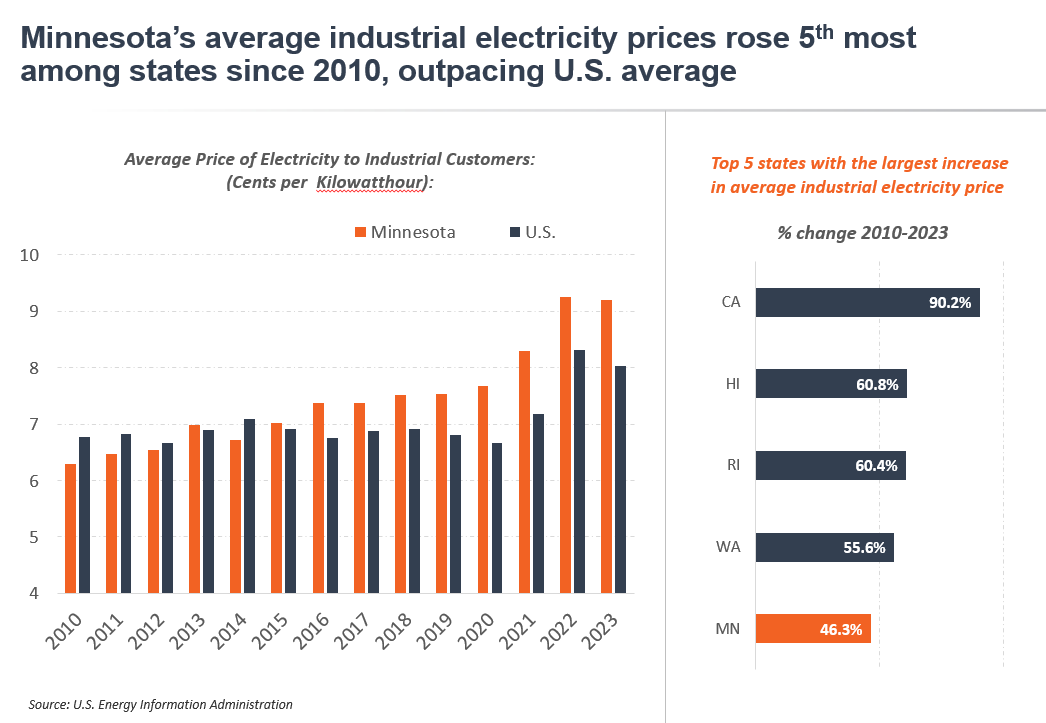

Energy costs are another area where manufacturers face higher expenses, given the sector’s greater energy intensity relative to other industries. The National Association of Manufacturers notes that industrial users consume over one-third of the nation’s total energy. The average price per unit of electricity can vary substantially from state-to-state, impacting the underlying cost competitiveness for manufacturing investments by location. According to data from the U.S. Energy Information Administration (EIA), Minnesota ranked 15th highest in average industrial electricity costs nationwide—measured in cents per kilowatt hour—and 2nd highest among Midwest states between June 2024 and May 2025. Further, industrial electricity rates increased faster in Minnesota than in the U.S. in recent years, rising 5th fastest among states from 2010-2023.

How might these energy cost differences impact a small-to-midsized manufacturer? To be sure, actual energy bills for a business will vary based on a variety of factors, including the timing of their energy use, consistency of demand, mix of power sources (electricity or gas), the pricing of the individual utility provider and so forth. However, a simple calculation using the average price for industrial users shows that a 150,000 sq ft manufacturing facility in Minnesota would pay $820,800 annually in electric costs (assuming an average consumption of 60 kwH per sq ft). In comparison, the average cost for the same business in Tennessee would cost $580,000, nearly a quarter million dollars less annually than for the same energy use in Minnesota. These examples illustrate how just one expense item can add significantly to the overall cost of doing business and create structural differences in costs across locations. (See resources section at the end of the article for ways to improve energy efficiency and reduce costs)

Bright spots for Minnesota’s manufacturing competitiveness remain, despite cost challenges.

While the challenges around business costs in Minnesota may seem daunting, there are also upsides to Minnesota’s competitiveness. First, as noted in previous articles, Minnesota has a high share of manufacturing activity relative to other states and ranks first or second across sixteen different manufacturing subsectors. This is itself evidence of comparative advantages that Minnesota possesses over other locations. Firms cluster over time in areas where they can maximize profitable operations. Minnesota’s existing base of manufacturing businesses points to underlying strengths in the sector. For example, one food manufacturing business interviewed by Grow Minnesota! explained that they have plants in Minnesota and Tennessee – and while Tennessee offers some advantages in having lower costs and less regulatory burden, their Minnesota facilities experience less employee attrition, fewer missed days of work and better productivity levels. This may not be easily captured in aggregated datasets across the industry, but it is an example of how Minnesota’s strong workforce may counterbalance some higher costs in other areas.

Further, in site selection processes evaluating Minnesota against higher cost states like California or Massachusetts, a firm may choose Minnesota as a more affordable state than other alternatives. In other words, Minnesota manufacturers compete with lower cost regions, but other higher-cost states must also compete with Minnesota. Such examples have been uncovered in past interviews with real estate and site selection firms who have helped clients expand in Minnesota.

Conclusions

How should Minnesota’s costs of doing business for manufacturers be weighed against its location advantages? Should cost concerns be disregarded given Minnesota’s manufacturing strengths? Here the overall economic data is instructive. The bottom line is that despite Minnesota’s notable strengths, its manufacturing sector has shrunk in the first half of the decade and ranks near the bottom in manufacturing GDP and job growth. Survey insights and external data sources suggest that rising costs are limiting manufacturers’ ability to expand and grow. And costs in key areas like health care, taxes and energy are outpacing other states that Minnesota competes with for manufacturing investments. All of this points to an imperative to alleviate costs for businesses wherever possible, while also building on the advantages Minnesota possesses to support thriving, growing manufacturing businesses. Such an approach would enable the state to maximize its opportunities to accelerate growth in one of its most essential sectors.

Minnesota Chamber resources for manufacturers:

The Minnesota Chamber of Commerce and Chamber Foundation are committed to supporting manufacturers around the state. Below are some of the resources available to manufacturing businesses.

- Manufacturers Council – the Minnesota Chamber of Commerce also serves as the state manufacturing association. The Manufacturers Council provides an exclusive opportunity for manufacturing members to share best practices, advocate on behalf of key policy issues and join together to advance pro-growth strategies for manufacturers in Minnesota.

- ChamberHealth – through Minnesota Chamber Business Services, an association health plan specifically for manufacturers is available through ChamberHealth.

- Free one-on-one assistance from Grow Minnesota! – Grow Minnesota! is the state’s leading business retention program, providing free, customized assistance to manufacturers and businesses statewide on strategies to grow their companies, as well as problem solving to remove barriers.

- Online certificate of origin processing through essCert – the Chamber offers a streamlined certificate of origin processing system for quick and efficient approvals.

- Sustainability solutions and savings through Energy Smart and Waste Wise – the Minnesota Chamber Sustainability program provides cost saving consulting and recommendations for on both energy and solid waste. This innovative program has saved businesses millions of dollars throughout its history.

- Free resource guides on business funding, exporting and workforce – Grow Minnesota! has easy-to-navigate guides to help businesses access capital, find new markets and identify workforce partnerships in their communities.

Need more assistance?

The Grow Minnesota! team at the Minnesota Chamber of Commerce can provide additional assistance to help your business access the above resources.

Contact growminnesota@mnchamber.com for more assistance.