Minnesota: 2030 | 2023 edition - Tracking progress: Strategies for growth

Tracking progress:

Strategies for growth

The basic formula for economic growth is simple. An economy can grow in two ways. First, by adding more people, increasing the number of workers who produce goods and services. Or, growth can occur through productivity gains, increasing the total value of goods and services produced per hour worked in the workforce. Periods of robust economic expansion, such as the 1990s, typically involve both.

As the forecast data show, Minnesota is likely to experience a decades-long period of low population and labor force growth, constraining growth in the state’s economy.

This is not a guarantee, of course. New developments could change the underlying forces driving population change. The federal government could reform immigration policy to allow a greater flow of international migrants to the U.S., providing an opportunity for states like Minnesota to attract global talent. Or, Minnesota could become a net attractor of people from other states, reversing a longer-term trend of negative or flat domestic migration. More unlikely yet, birth rates could increase and create a future wave of population growth. As outlined below, it will be essential for Minnesota to compete for talent wherever and however it can. But change is likely to occur on the margins rather than as a long-term trend reversal altogether.

As such, Minnesota must reorient its economic objectives toward the productivity side of the equation.

Fueling productivity growth would involve increasing human capital, spurring innovation and encouraging business investment in the state. Achieving this is no simple matter, but neither is it impossible. Minnesota experienced periods of such transformation before, as educational gains converged with a wave of innovations to create new industries and boost prosperity for Minnesotans.

In short, a framework for long-term growth will require Minnesota to grow its population and workforce in whatever ways it can while fostering greater productivity growth through innovation and investment in a highly skilled workforce.

Minnesota: 2030, published in early 2021, outlined three strategic priorities that seek to support this framework for growth. By building on Minnesota’s existing strengths, leveraging the state’s workforce and strengthening communities, Minnesota can increase the productive capacity of its economy while making room for new residents and workers.

The following section evaluates Minnesota’s progress or setbacks in these three areas over the first three years of the decade and identifies actionable items that could move Minnesota closer to its long-term objectives.

Build on strengths

The first strategic priority of Minnesota: 2030 is to build on Minnesota’s existing industry strengths to foster a diversified and growing economy. Building on our strengths means looking first at existing industries and businesses and enabling their continued expansion over time. It also means capitalizing on new opportunities that may arise through changing market conditions.

Minnesota has demonstrated both strengths and weaknesses in this regard since the start of the decade.

Opportunities:

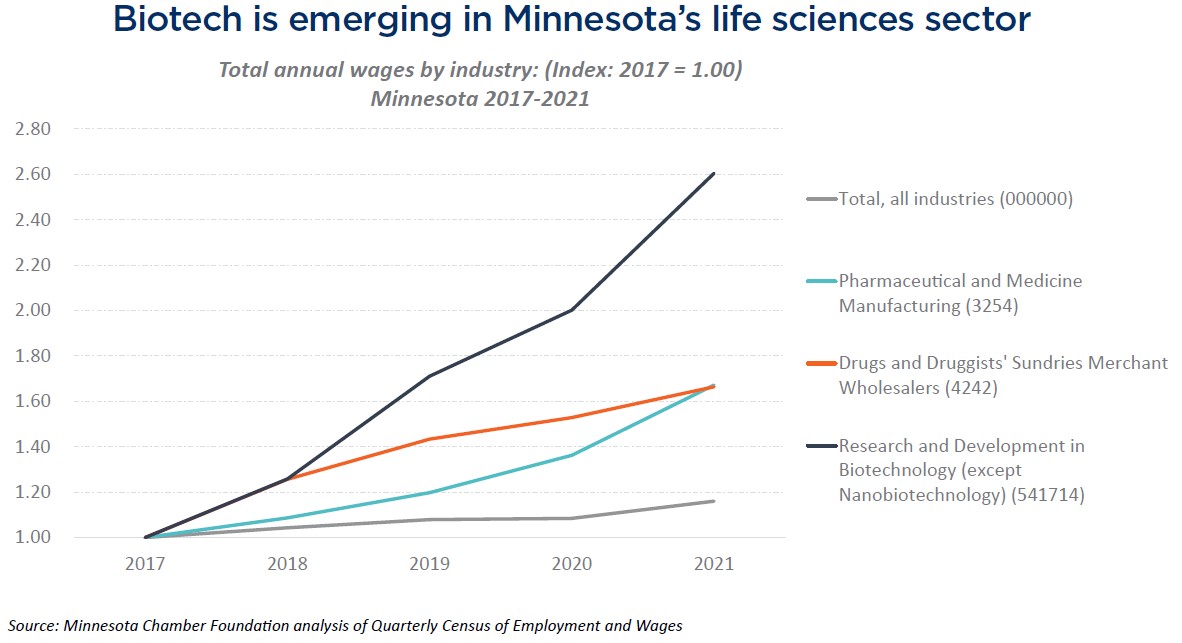

Minnesota’s life sciences sector remains a top strength in Minnesota’s economy, with biopharma continuing to gain prominence. Minnesota entered the 2020s with one of the nation’s largest and most innovative medical sectors. Minnesota: 2030 suggested that the state can build on this strength by continuing to support innovation and growth in its mature verticals within the sector (i.e., health care delivery, insurance and medical device manufacturing) while accelerating growth in biotech/ pharma and digital health.

As of early 2023, this strategic direction appears to be bearing fruit. Minnesota’s three largest verticals of delivery, insurance and med-tech recovered from pandemic-induced job losses and grew faster than their industry peers in the U.S.

Further, while Boston and the Bay Area continue to dominate the U.S. biotech industry, Minnesota has gained traction in recent years. Minnesota’s biotech-related industries were the fastest growing vertical within its health and medical sector since 2018 and experienced a surge in total payroll growth. Recent expansions from companies such as Bio-Techne, Upsher-Smith, Kindeva, Cambrex, Nu-Tek and others reflect a potential for Minnesota’s still-modest-sized biotech industry to cross a threshold of scale. Industry growth has also spurred investments from higher ed institutions, like the University of Minnesota’s 2020 expansion of its Biotechnology Resource Center, and economic development initiatives like the Greater MSP-led attempt to secure $100 million in federal funding for a “BioInnovation” cluster development.

Resurgence of federal industrial policy presents new opportunities for Minnesota industries. The U.S. government has taken a more assertive role in recent years to boost the nation’s domestic supply chain capacity in critical areas such as semiconductors, medicine and biomaterials, energy and clean technologies. This wave of industrial policy efforts has created new opportunities for Minnesota’s economy.

Below are some examples:

- Semiconductors: Passage of the federal CHIPS and Science Act – which authorized nearly $53 billion to incentivize semiconductor production and R&D in the U.S. – spurred substantial efforts from Minnesota’s semiconductor industry, universities and economic development entities to secure support for new expansions and partnerships in this area. Minnesota is home to three semiconductor fabs – SkyWater Technology, Polar Semiconductor and Honeywell – and dozens of companies that provide equipment, supplies and services to the industry.

- Hydrogen energy: The federal Inflation Reduction Act of 2022 included a $7 billion program from the U.S. Department of Energy to create regional clean hydrogen hubs across the country. Minnesota responded by signing on to two multi-state initiatives – the Heartland Hydrogen Hub and the Midwest Hydrogen Coalition – that will identify potential hydrogen-related projects in the region. This occurred in conjunction with an announcement from Cummins in October 2022 that the company will dedicate nearly 90,000 square feet to produce electrolyzers in its Fridley facility. Additionally, CenterPoint Energy conducted a $2.5 million pilot project to blend clean hydrogen into its natural gas pipeline system in 2022. While still in its nascent stages, these efforts present an opportunity for Minnesota to position itself for further development in the coming years.

- EV and clean-tech supply chains: Minnesota can also capitalize on massive investments in cleantech supply chains. Most notably, high-profile mining proposals in Northeastern Minnesota would provide critical minerals needed for producing electric vehicles, wind turbines and other products. These projects are coupled with a 2022 announcement from U.S. Steel that it will invest $150 million in Minnesota to produce higher-grade taconite pellets that serve electric arc steel furnaces. The combination of these potential investments would make Minnesota an increasingly important part of the U.S. domestic supply chain for electrification efforts.

Economic development programs are opening the door to investments in automation and innovation. Encouraging productivity through automation and technological advancements is essential to growing our economy. Yet, economic development programs have historically emphasized job creation as a preeminent factor in determining local and state support. Recent developments may be changing this. The Minnesota Department of Employment and Economic Development (DEED) launched two automation incentives since 2021 that provide grants and loans for automation equipment and training. Further, Minnesota has experienced a proliferation of resources in recent years that provide financial and technical assistance to innovative startups with high-growth potential. While many of these programs are new, they should be studied carefully in coming years to measure outcomes and double down on programs that work.

Threats:

Minnesota’s digital tech sector continues to lag national peers, threatening future growth in the state. Minnesota was an early leader in computing and internet technologies. However, the state’s digital tech sector never bounced back to full prominence after the dot com bubble burst in 2001. Since then, the U.S. tech sector shifted increasingly toward places like California, Washington, Texas, Colorado, Utah and North Carolina. From 2007-2021, the GDP in Minnesota’s computer systems design industry grew 43rd fastest among all states. GDP in the tech-heavy information sector grew 33rd fastest. Broader measures of the tech sector, which include tech jobs in any industry (rather than just pure digital tech industries) don’t improve Minnesota’s position, with tech jobs growing 38th fastest in the U.S. and projected to grow 46th fastest over the next decade.

Minnesota still has a sizable and skilled tech workforce. It simply is growing slower than most states, leaving employers to lure workers from other Minnesota companies or hire outside the state. This matters because, despite recent shakiness in the U.S. tech sector, future economic growth is likely to be heavily influenced by tech-related activities. The key to reviving growth is to foster a stronger network of collaboration and promotion within the industry and, most importantly, to increase the availability of tech talent in the state (see “Leverage Minnesotans” for more on this).

Companies are investing billions in new projects around the U.S., but Minnesota has failed to attract large expansions. As mentioned earlier, federal policy efforts to boost domestic supply chains unleashed a wave of so-called “mega projects” around the U.S. Minnesota should be competitive for some of these expansions. But so far, the state has been unable to secure such historic investments. A review of publicly announced business expansions in Minnesota shows that 130 companies announced expansion plans in 2022 that would generate $3.8 billion in capital expenditures and retain or create over 5,700 jobs in Minnesota. Outside of two separate $1 billion data center projects (which are still in planning stages), the largest expansions range around $150 million and would create about 300-350 jobs. These are sizable projects, to be sure. But compare this to a peer state like North Carolina that reported in 2022 to have secured 28,690 new jobs from companies investing an expected $19.3 billion in the state. Similarly, Indiana announced 218 new projects in 2022 that will invest $22.2 billion and create 24,059 new jobs. Minnesota has not experienced similar levels of new investments this decade.

One component of this underperformance may relate to permitting delays for new expansions. In 2022, three companies announced they were pulling out of sizable economic development projects due to lengthy and uncertain permitting timelines. These three projects represent a combined loss of 350 potential new jobs and $1.2 billion in capital investment.

Convergence of factors poses questions over the future of Minnesota’s headquarters economy. Minnesota’s cluster of global company headquarters is among the state’s greatest economic assets. Minnesota is home to 16 Fortune 500 companies and an additional 11 companies in the Fortune 1000. By some measures, Minnesota’s headquarters economy has strengthened in recent years, with GDP and employment in the state’s management of companies and enterprises industry increasing steadily over the past decade.

However, a convergence of issues over the past several years invites questions about the future. Most notably, the combination of remote work, public safety concerns in urban downtowns and inflationary pressures have led some company headquarters to significantly downsize their real estate footprint in Minnesota. Since 2021, a growing number of company headquarters announced they are leaving behind a collective 4.2 million square feet of local real estate as they consolidate offices or look for smaller spaces.

This does not mean those businesses’ operations are leaving the state. Company statements indicate that operations will remain in Minnesota and that their downsizing moves reflect changing real estate needs due to hybrid work models.

But it does signal a longer-term phase where headquarters campuses are less likely to be filled day-to-day with Minnesota workers. This untethering of jobs to office locations leaves open the possibility that some employees may move out of the state and continue to work for the company. It also leaves open the case that, over time, out-of-state employees fill an increasing share of headquarters jobs with no ties to Minnesota or jobs may be scattered around the world in smaller offices. What’s more certain is that these moves will create continued challenges for downtown business districts and suburban retail hubs that rely on office workforces to sustain economic activity and provide a sense of vibrancy.

Leverage Minnesotans

This Minnesota: 2030 strategy deals with the dual objectives of improving the state’s workforce. First, Minnesota must find creative ways to grow the number of available workers in the state, even as aging demographics pose a challenge. Second, Minnesota must invest in the human capital of its citizens, enabling productivity growth through a highly skilled workforce.

Opportunities:

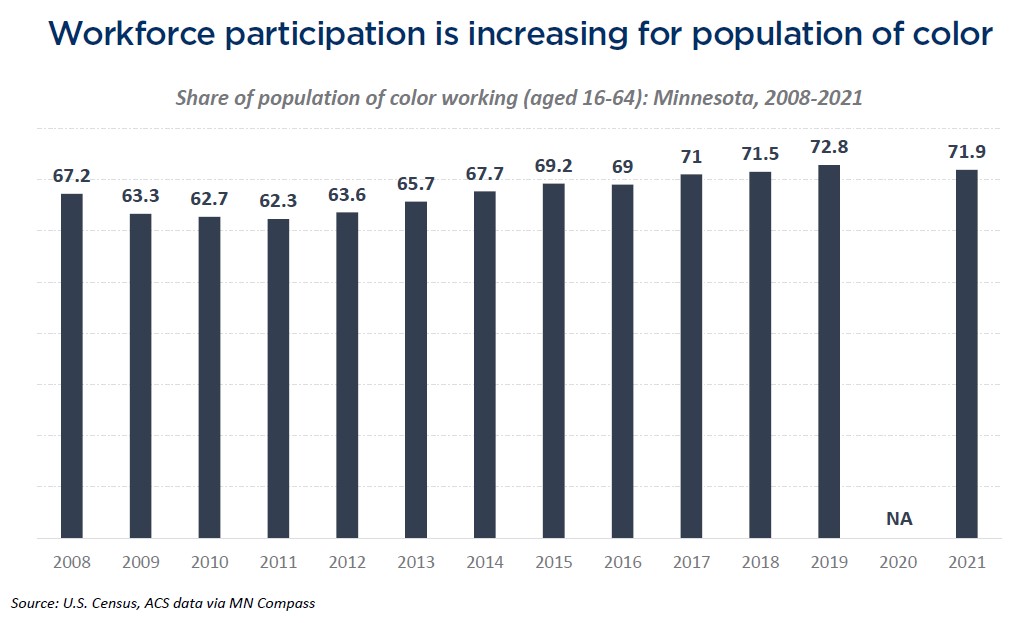

Workforce participation is increasing for Minnesotans of color. To sustain a healthy workforce, Minnesota must ensure that no one is left on the economic sidelines. Doing so can help stabilize workforce participation rates as older workers exit the labor force. There is some evidence that Minnesota is succeeding on this front. A report from the Department of Employment and Economic Development shows that Minnesota’s Black labor force participation rate increased by 2.5 percentage points since 2010 – in contrast to falling participation rates for white Minnesotans and by 2021 ranked 3rd highest in the U.S. Minnesota’s Latino labor force participation rate was 77.5% in 2021, highest among all demographic groups. Further, workforce participation rates among core working-age adults (age 16-64) for Minnesota’s population of color increased steadily over the past decade, reaching a peak of 72.8 in 2019 before decreasing slightly in 2021. Continuing these gains over the next decade can help grow Minnesota’s workforce and improve economic outcomes for BIPOC communities (see “Strengthen communities” for more analysis on this topic).

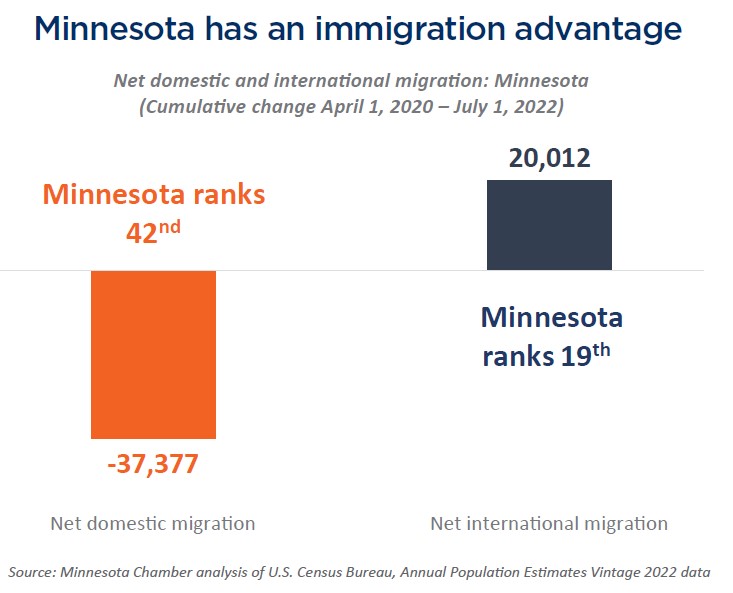

Minnesota continues to rank high in international migration despite the recent immigration slowdown in the U.S. The case for immigration is simple. Population growth has slowed to record lows in the U.S. due to declining birth rates over time. The U.S. economy had nearly 10.8 million unfilled jobs at the end of 2022, and job vacancies are expected to be a continued challenge going forward. Barring a reversal of fertility rates, immigration remains the primary mechanism to grow the nation’s population and ensure a stable workforce. This is especially important for states like Minnesota, where immigration has long been a competitive advantage. International migration helped offset domestic migration losses since 2000 and supported the economic activity by boosting the state’s workforce and entrepreneurship. While restrictive federal policies and the global COVID-19 pandemic led to a slowdown in immigration in recent years, Minnesota still ranked 19th among states in net international migration from 2020-2022.

Minnesota can seek to leverage this strength by further building out its support structures to welcome and settle new Americans here while advocating for federal immigration reforms to meet the needs of a modern economy.

Education levels continue to rise in Minnesota. Increasing education levels in the population is a fundamental component of developing the state’s economy over time. At a high level, Minnesota has succeeded to continue raising the share of adults with a high school or college degree. The share of adults 25 and over with a Bachelor’s degree or higher increased by 8.5 percentage points from 2006-2021, reaching a peak of 38.9% in 2021. Similarly, the share of adults with at least a high school degree increased from 90.7% in 2006 to 94.1% in 2021.

Threats:

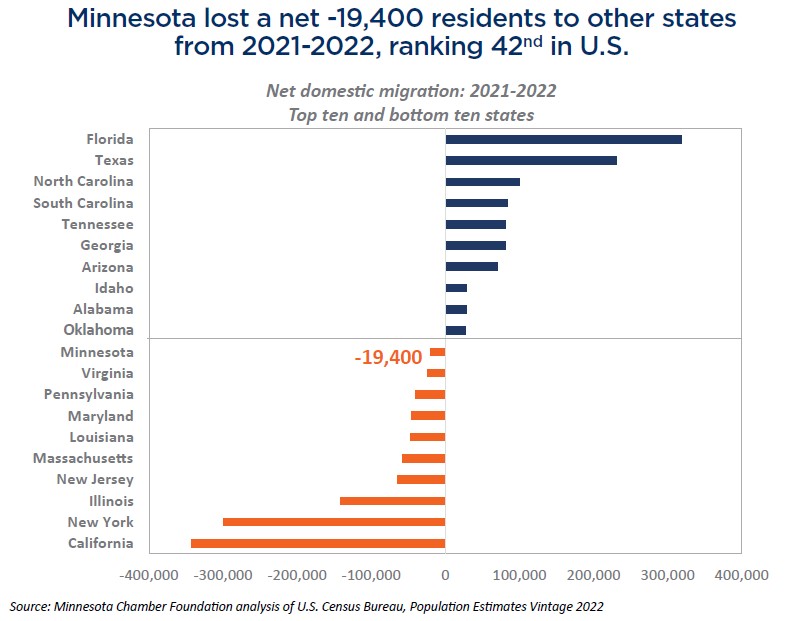

Minnesota’s net domestic migration outcomes worsened since 2020, ranking 42nd among states from 2020-2022. Minnesota: 2030 argued that the state can stabilize its workforce growth by improving domestic migration outcomes while accelerating immigration. Both sides of this equation have been challenged so far this decade. Minnesota became a net exporter of people, as domestic migration worsened substantially since 2020 and immigration levels slowed, leaving the state with overall net migration losses. Current data from the U.S. Census Population Estimates show that Minnesota lost -16,312 people from 2020-2021 and another -19,400 from 2021-2022 net to other states, ranking 42nd best among states in both years.

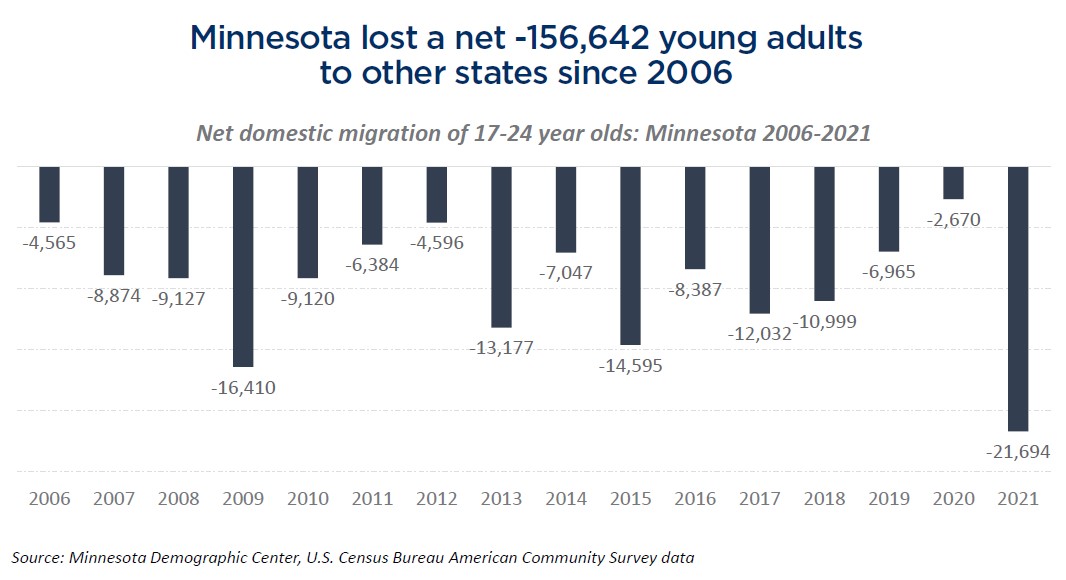

Unlike immigration, which is heavily dependent on federal policies, the state has more control over the factors that influence state-to-state migration patterns. A breakdown of migration data shows that much of Minnesota’s net migration losses occur among people between 17-24 years old. If Minnesota is to retain and attract more talent to the state, it must start with improving outcomes among young adults as they graduate high school and transition into postsecondary education or the workforce.

Further, Minnesota must improve its regional competitiveness within the Midwest. Since 2020, only three Midwestern states – South Dakota, Indiana and Missouri – had positive net domestic migration, as migration flowed heavily to states in the sunbelt and mountain west. Many of these states benefit from a combination of favorable climates and competitive tax rates for individuals and businesses. Minnesota can’t change its location on the map, but it can control the levers that influence its quality of life and affordability. States like Utah, Washington, North Carolina, South Dakota, New Hampshire and Colorado have shown that these two objectives are not mutually exclusive. Leveraging Minnesota’s quality of life advantages while lowering cost burdens can help revive Minnesota’s status as a regional magnet within the Midwest. This is particularly important as the prevalence of remote work makes it easier for top talent to move to locations of choice around the U.S.

The COVID-19 pandemic led to a sharp drop in Minnesota’s labor force participation rates. Stabilizing future workforce participation will be critical. Minnesota’s labor force participation rates have steadily declined since 2001 and are projected to decline further this decade as the population ages. The COVID-19 pandemic accelerated this trend, with over 97,000 Minnesotans dropping out of the labor force in the first year of the pandemic. Participation rates recovered slightly in late 2021 and the first half of 2022 before plateauing again. By February 2023, Minnesota’s labor force participation rate remained two percentage points below pre-pandemic levels. As mentioned earlier, Minnesota can help mitigate this long-term trend by reducing barriers to employment for underrepresented groups, as well as encouraging work among youth and older adults who may want to explore part-time or seasonal jobs.

Minnesota experienced a sharp decline in student test scores this decade, posing warning signs for future educational outcomes. Education faced immense challenges in 2020 and 2021 as the pandemic and social distancing policies disrupted classroom activity. The full impact of these disruptions is still to be seen. However, Minnesota experienced early warning signs in declining 4th and 8th-grade reading and math test scores. Results from the National Assessment of Educational Performance (NAEP) showed steep declines across the nation in literacy and math in 2022. Minnesota’s decline was more severe than in the U.S. and converged closer to the national average in recent years. This relative decline pre-dates the COVID-19 pandemic. For example, Minnesota’s 8th-grade math test scores in 2015 were 12 points higher than the national average but were only 6 points higher by 2022. Similarly, Minnesota’s 8th-grade reading test scores were five points higher than the U.S. in 2015 but were even with the national average by 2022. This shows both an absolute and relative decline in test scores that must be remedied to better serve Minnesota students now and ensure a highly-skilled workforce in the future.

Minnesota is not producing enough tech talent to meet current or future demand. The availability of tech talent is critical to growing Minnesota’s economy over the next decade. Yet, despite notable efforts to train Minnesotans in high-demand IT fields, the state is not turning the ship fast enough to meet the needs of our changing economy. A report from the Minnesota Tech Association states that just 21% of high schools in Minnesota offer computer science coursework, compared to 53% of high schools in the U.S. This failure to provide Minnesotans with critical IT skills negatively impacts the state’s future economic growth prospects. Tech-related industries project to drive growth in the U.S. economy this decade, and advancements in A.I. and automation are reshaping business models across sectors. Yet, CompTIA projects that Minnesota’s tech workforce will grow 46th fastest among all states over the next ten years. Already, Minnesota’s ranking of total net tech employment has fallen from 12th largest in 2018 to 18th in 2022.

Strengthen communities

Minnesota’s economic success this decade will depend on its ability to adequately supply fundamental community assets such as child care, housing, broadband and making inclusion a strength of Minnesota’s economy. While these are statewide concerns, the solutions often take shape at the local level. Minnesota experienced a range of outcomes in these areas this decade. Below we outline some of the successes as well as remaining challenges in these areas.

Child care

Opportunities:

The urgency of Minnesota’s growing child care shortage has spurred a proliferation of creative efforts to increase availability. The COVID-19 pandemic exacerbated Minnesota’s already-substantial child care availability challenge. The silver lining is that the magnitude of the challenge has sparked greater urgency among communities, businesses and policymakers to address the issue and entertain a wide range of potential solutions. Much of the action to increase child care access has occurred from grassroots efforts at the local level, tailoring solutions to the unique issues and assets of the individual community. Research from the Center for Rural Policy and Development highlights how grassroots strategies have involved everything from financial support to providers to leveraging local schools as providers to public outreach and community collaboration initiatives. In many cases, this has included efforts from employers to provide support and resources for expanded child care in the community, or in some cases, to build on-site child care at their place of business, like the recent announcement of such an effort by Hormel in Austin.

These grassroots strategies have been coupled with state policy changes to address regulatory burdens and increase child care funding. For example, the state authorized the “pods” model in 2021, allowing multiple child care family providers to operate in a shared facility in the community so long as services are not commingled and remain separate within the building. These developments should be carefully assessed going forward.

Threats:

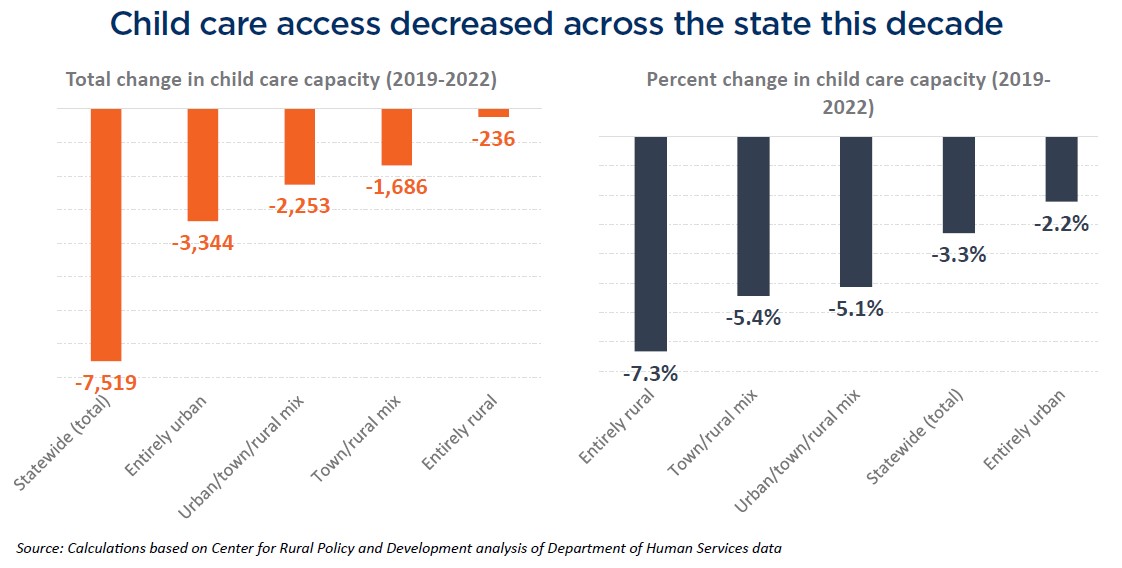

Despite recent efforts, Minnesota continues to face severe challenges related to increasing child care availability throughout the state. Since the early 2000s, the total number of licensed child care providers has declined steadily and substantially throughout the state. This has been driven by a decline in the number of licensed in-home family child care providers, which has disproportionately impacted rural communities that are more reliant on in-home family-based care and typically do not have the population density needed to make center-based care a viable option. Conversely, regions with larger populations have been able to offset some of the declines in family child care providers by increasing the number of licensed child care centers. However, daycare centers have faced challenges of their own, as ongoing staffing issues have strained operations and limited their capacity to meet demand.

Both in-home child care and child care centers were negatively impacted during the pandemic, as the underlying forces pressuring both sides were exacerbated. In total, Minnesota lost over 7,500 seats of child care capacity from 2019-2022, with the relative decline being steepest in more rural areas of the state.

Housing

Opportunities:

After a decade of limited home building in Minnesota, permits for new housing units surged in 2021 and early 2022. Minnesota home building began slowing in 2004 before coming to a near halt between 2007-2011. New housing starts recovered only gradually in the ensuing years, leaving Minnesota with a substantial shortfall of new housing. In 2018, the state’s Housing Task Force put forth a goal of adding 300,000 new units by 2030 to meet demand. Progress was slow over the next two years but surged in 2021 and early 2022, as permits for new housing units hit a 16-year high. This was matched by rising home sales, which hit a 20-year high in the Twin Cities in 2021. Unfortunately, momentum was cut short by rising inflation and interest rates in the second half of 2022, leaving Minnesota with an uncertain near-term housing outlook. The experience of 2021, however, showed Minnesota’s potential to increase the rate of homebuilding activity and its capacity to reduce housing shortages this decade.

Further, similar to the state’s child care challenge, the issue of housing availability has also spurred initiatives and collaboration across all regions of the state, laying the groundwork for future solutions to take hold. Many employers are leading the way in investing in workforce housing ranging from Marvin on the northern border to Mayo in Rochester.

Threats:

Rising inflation and interest rates led to a sharp drop in new housing activity since early 2022. Further, the low churn of the existing housing stock left Minnesota with declining housing inventories and higher prices this decade. After booming in 2021, Minnesota home building slowed in 2022 and early 2023 amidst headwinds of rising inflation and interest rates. In 2022, home sales also sank to their lowest level since 2014, and permits for new housing units plummeted in the second half of 2022 and early 2023. Moreover, housing inventories fell in 2020 and remained low through 2022, driving up prices and creating further pressures on housing affordability in the state.

Taken together, while Minnesota made momentary progress in 2021, the state continues to face housing shortfalls and will need to address underlying barriers to ensure greater future housing availability.

Connectivity/Broadband:

Opportunities:

Minnesota continued to expand broadband access in recent years. A 2022 annual report from the state’s Broadband Taskforce shows that broadband access increased across all three classes of service speeds since 2015. The fastest growth has occurred from broadband with download speeds of at least 100 Mbps and upload speeds of 20 Mbps (the middle of the three tiers), which increased by 49% from 2015-2022 and reached 1.22 million more Minnesota households. Access to very high-speed broadband also increased, with 479,000 more Minnesotans having access to broadband with download and upload speeds of 1 gigabit per second. And access to lower-speed internet service of 25/3 Mbps (the FCC’s current threshold to be considered broadband) continued to reach more unserved households in that time as well, with 154,000 more households having access in 2022 than in 2015. These developments helped close the connectivity gap in the state. In 2017, there were 186 cities still lacking access to wired broadband with 25/3 Mbps speeds. But by 2022, that number shrunk to just 16 cities.

Minnesota continued to expand broadband access in recent years. A 2022 annual report from the state’s Broadband Taskforce shows that broadband access increased across all three classes of service speeds since 2015. The fastest growth has occurred from broadband with download speeds of at least 100 Mbps and upload speeds of 20 Mbps (the middle of the three tiers), which increased by 49% from 2015-2022 and reached 1.22 million more Minnesota households. Access to very high-speed broadband also increased, with 479,000 more Minnesotans having access to broadband with download and upload speeds of 1 gigabit per second. And access to lower-speed internet service of 25/3 Mbps (the FCC’s current threshold to be considered broadband) continued to reach more unserved households in that time as well, with 154,000 more households having access in 2022 than in 2015. These developments helped close the connectivity gap in the state. In 2017, there were 186 cities still lacking access to wired broadband with 25/3 Mbps speeds. But by 2022, that number shrunk to just 16 cities.

Threats:

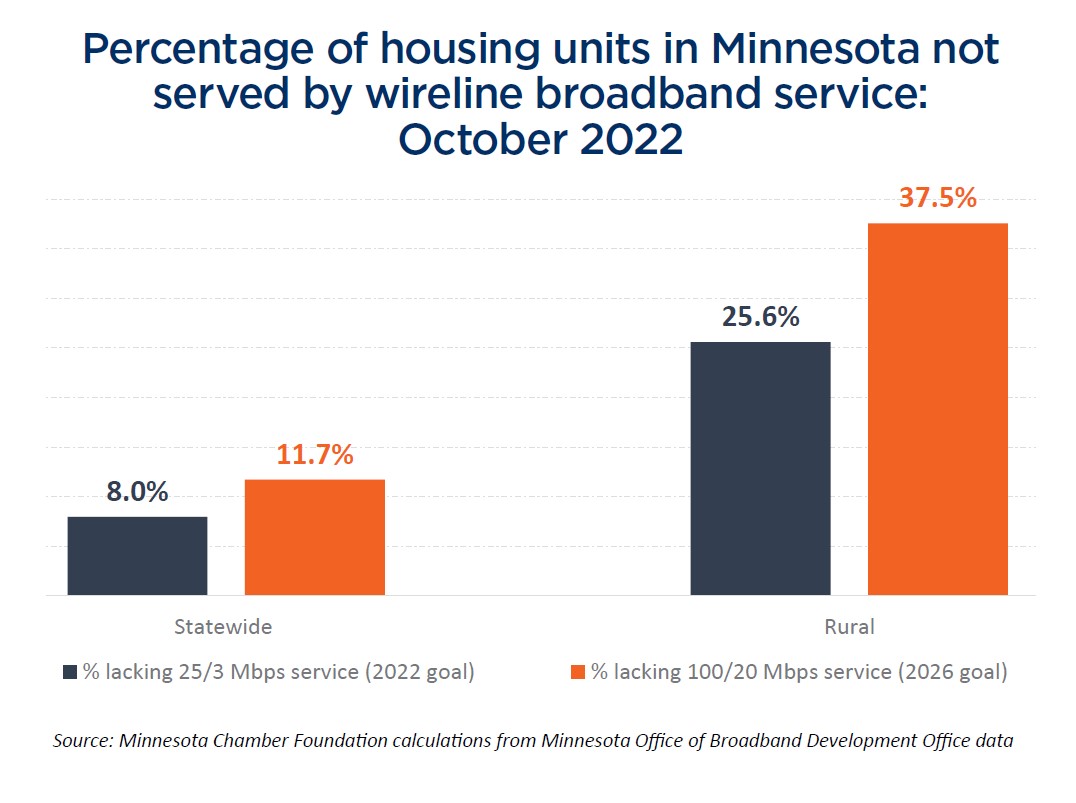

Despite recent progress, Minnesota remains behind its statutory goals of ensuring universal access to 25/3 Mbps broadband service by 2022 and 100/20 Mbps service by 2026. As of late 2022, nearly 8% of Minnesota households still lacked access to 25/3 Mbps broadband, with that share jumping to 25% in rural Minnesota. Progress on the state’s 2026 goal remains further off, with nearly 13% of households statewide and nearly 38% of rural households lacking access to internet speeds of 100/20 Mbps. The state’s Broadband Taskforce cites several notable challenges to deploying service to remaining areas, including rising construction and material costs, labor shortages, permitting-related costs and delays, weather constraints and the high costs of last-mile connections in remote areas.

The number of Minnesota households connected to internet service continues to grow, but the state must wisely navigate the barriers that prevent faster deployment as new state and federal funding provides a window of opportunity to accelerate statewide broadband service.

Make inclusion a strength

Opportunities:

Minnesotans of color have made notable gains across a range of economic and educational indicators over the past decade. Minnesota has a moral and economic imperative to make inclusion a strength in the state’s economy this decade. While many racial disparities remain, several key economic indicators have shown considerable improvement in recent years.

For example:

- Labor force participation rates increased steadily for Minnesotans of color over the past decade. The state’s workforce participation among 16-64-year-olds of color increased from 62.3% to 71.9% between 2011 and 2021. As a report from the Department of Employment and Economic Development (DEED) shows, Minnesota’s Black labor force participation increased 11th fastest in the U.S. from 2010-2020, and by 2021 Minnesota had the 3rd highest Black labor force participation rate of any state. • Unemployment rates fell for Minnesotans of color in recent years, despite large swings during the pandemic. In 2021, Minnesota had the 5th lowest Black unemployment rate among the 35 states for whom data was available. By January of 2023, Minnesota’s unemployment rate for Black and Hispanic or Latino populations had fallen to 3.6% and 3.3%, respectively, both of which were higher than the state’s white unemployment rate of 2.2% but lower than their group’s pre-pandemic levels.

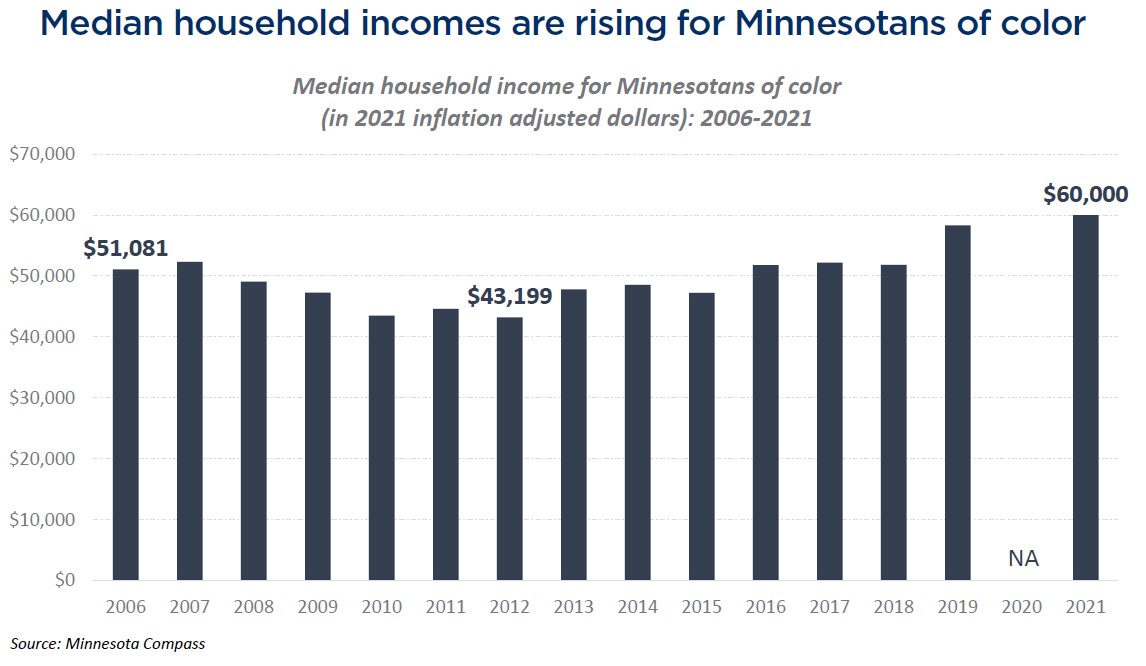

- Income levels are rising for populations of color in Minnesota. Median household incomes rose by 17.5% for people of color from 2006-2021, compared to 7.4% growth for the state’s white population. This helped reduce the racial gap in median household income by roughly $10,000 in that time. Incomes rose particularly fast for Black Minnesotans, though they continue to face among the steepest disparities in income among demographic groups. As a report from DEED states, “Like job prospects, median incomes have been rising rapidly for Black or African American households in Minnesota over the past decade, jumping 63.1% from 2011 to 2021. That was the 7th fastest growth rate in the U.S., where the median Black or African American household income increased 40.8%. Minnesota climbed from the 33rd highest income level for Black people in 2011 to 22nd highest in 2021.”

- Entrepreneurship and business ownership are rising considerably faster for populations of color than for the state’s white population and faster than for populations of color in the U.S. as-a-whole. Minority-owned employer and nonemployer firms increased by 25% and 34%, respectively, from 2012-2018, outpacing the growth of white-owned firms. Black-owned employer firms grew particularly fast, increasing by nearly 37% from 2012-2019, compared to just 23.3% in the U.S.

- Educational attainment is increasing for Minnesotans of color. The share of Minnesota’s population of color graduating on time from high school increased from 58% to 73% between 2012 and 2021, helping close the achievement gap by 11.2 percentage points. The share of Minnesotans of color 25 or older with at least a Bachelor’s degree increased from 24% to 31% since 2010.

Attention to economic inclusion has accelerated this decade and mobilized a growing number of stakeholders toward meaningful action. Minnesotans around the state are making workplaces and communities more equitable and inclusive. For example, the Minnesota Chamber Foundation launched a statewide workforce inclusion effort in 2021, the only such initiative led by a state chamber of commerce in the country. Our work is aimed at assisting employers across the state, regardless of size or location, in building inclusive workforces.

Threats:

Significant gaps remain across a range of economic indicators and broader economic conditions increase risks. While Minnesota has made meaningful gains in recent years, there is still much work to do to truly make inclusion a strength in Minnesota’s economy. Minnesota still possesses among the largest racial disparities in the U.S. in areas such as education, income, housing and more. Further, Minnesotans of color may be disproportionately at risk amidst rising inflation, interest rates and cooling labor market activity. Populations of color historically suffer worse impacts from economic downturns and are slower to make up losses in recovery periods. Minnesota must celebrate recent progress while continuing to fortify those gains in the months and years to come. Moreover, the state can improve its economic performance by accelerating the pace at which Minnesotans of color thrive as students, workers, entrepreneurs and community members.

Priorities going forward

Minnesota: 2030 put forward over 50 individual strategies and recommendations to grow the state’s economy this decade. Several priorities are worth re-highlighting or adding to the list, given changes to economic conditions.

Minnesota must make productivity a top priority to enable a more prosperous future.

The future workforce will be diverse and tech-enabled. Minnesota needs to accelerate efforts to prepare for both. Minnesota can build a stronger economy this decade by investing in a highly skilled and diverse workforce. As mentioned above, notable efforts are underway to address these priorities. However, Minnesota must move the needle faster in both areas. Doing so will involve both private and public sector initiatives.

For example, state leaders should put forward an actionable plan to rapidly increase computer science and related tech offerings to students across Minnesota. Minnesota currently ranks dead last in the U.S. in the share of high schools offering computer science coursework. Providing these critical skills to students is necessary to prepare them for a world increasingly shaped by digital technologies.

Additionally, private sector leaders can invest in training and upskilling efforts and leverage workforce inclusion resources to help them equip a more diverse workforce. The Minnesota Chamber Foundation’s workforce inclusion initiative is poised to partner with employers and workforce development leaders toward that goal.

Double down on efforts to spur entrepreneurship and retain high-growth firms. Minnesota’s future economic success will largely depend on its ability to foster new innovative companies and help them scale and stay in Minnesota over time. Minnesota made significant gains in building its startup ecosystem over the past decade. These developments yield fruit by contributing to record-level investments in new companies and enabling growth in innovative young firms. Academic literature on the topic makes it clear that new firms drive net job creation and make similar contributions to growth in output and productivity. With Minnesota facing a dizzying array of new programs and spending across a wide range of issues, the state should not lose sight of this long-term priority. Further, state leaders should consider how policies may impact the formation and success of new companies in addition to more mature firms. For example, laws that increase regulatory complexity or add administrative burdens may disproportionately disadvantage younger companies that face greater risks and have fewer internal resources to navigate complex layers of local, state and federal rules.

Assess workforce and economic development programs and identify opportunities to increase access, evaluate outcomes and modernize program goals to align with long-term economic objectives. Minnesota offers an extensive list of workforce and economic development programs covering a wide range of topics and targeted populations. Yet, many of these programs were created under economic circumstances vastly different from the ones experienced now. Some programs also establish overly narrow eligibility requirements and create stringent administrative reporting requirements, limiting the take-up rate and potential impact of these programs. With Minnesota entering a period of low labor force growth, the state’s workforce and economic development policies should aim to maximize innovation, productivity and skill attainment. Further, as competition with other states increases, programs must offer greater flexibility to users, clarity of rules, ease of reporting and participant feedback loops. Such improvements could be coupled with reasonable legislative oversight to ensure accountability and effectiveness.

Streamline permitting processes to help Minnesota build on existing industry strengths. Minnesota benefits from a diverse industry base with strengths in sectors such as food and agriculture, health care and med-tech, mining, corporate headquarters and a wide range of manufacturing industries. These existing industries position Minnesota to retain and attract business investment in coming years as federal industrial policy and reshoring of manufacturing activities spur large-scale expansion projects.

However, Minnesota must streamline its regulatory processes to compete for investments in these areas. Speed and certainty are prerequisites for many expansion projects – particularly in an environment of high inflation and interest rates – and Minnesota has too often failed to secure new investments because of preventable bottlenecks in its permitting process. Minnesota should make a long-term investment in its competitiveness by pursuing regulatory reforms that could increase efficiency while maintaining high standards to protect public health, safety and Minnesota’s natural environment.

The cost of doing business is also an element driving business investment decisions that we cannot ignore. The 2020s’ economy has seen three concurrent developments that increase the urgency of addressing long-term operating costs for Minnesota businesses. First, business costs have increased considerably since 2020. Supply chain and labor shortages sparked a 40-year high surge in inflation in 2021 and 2022, squeezing cash flow for businesses and households throughout the state. Second, the pressure for businesses to invest in productivity is increasing. Businesses face a growing imperative to invest in new technologies and equipment to remain competitive and meet demand. A 2021 survey from McKinsey Global Institute shows that 70% of businesses reported to be at least piloting automation strategies in one or more parts of their business, up from just 57% in 2018. Recent developments in A.I. could further increase the competitive pressure for productivity investments. Third, other states are reducing their cost burdens to retain and attract businesses and talent. Minnesota ranks 45th in the Tax Foundation’s State Business Tax Climate Index and continues to move in the opposite direction of top-performing states. Minnesota should look to successful models in the U.S., where states have been able to reduce costs and spur investment.

Minnesota must regain its position as a regional magnet for talent in the upper Midwest.

Advance a strategy to retain and attract more young adults as they transition from high school to college and the workforce. People between the ages of 17 and 24 largely drive Minnesota’s net domestic migration outcomes. Young adults are much more likely to move across state borders than older adults of any age cohort. Minnesota lost a net of nearly 157,000 young adults in this age group from 2006- 2021. Despite the significant impact on Minnesota’s population, however, too little is known about where these young adults go when they leave Minnesota and what underlying factors influence their migration patterns. Minnesota’s research community, regional and state leaders, and higher education leaders should collaborate to better understand this issue and develop actionable steps to address it.

Minnesota can increase its regional competitiveness by making the state more affordable while maintaining its high quality of life. While many factors influence state-to-state migration patterns, Minnesota should take meaningful steps to better balance its quality of life advantages and cost disadvantages relative to other Midwest states. Across the U.S., migration flows to states that combine a high quality of life and reasonable costs to households and businesses. Further, over two dozen states enacted tax reforms this decade to improve competitiveness and adjust for record budget surpluses. Minnesota should look to states who are leading in attracting talent and tread carefully in modeling laws after states with poor migration performance. There’s no magic formula for retaining and attracting residents – but Minnesota should be realistic about the balance needed to keep quality high while ensuring greater affordability.