Share your story in the 2025 business retention and expansion report

Last spring, the Minnesota Chamber Foundation’s Grow Minnesota! program surveyed businesses across the state to better understand the factors driving expansion and investment activities. The 2024 State of business retention and expansion report found that Minnesota faces economic headwinds shared by the entire country such as interest rates and inflation, but the state also faces unique difficulties like an exceptionally tight labor market and a challenging business climate. Over time these factors will slow growth, but the report points out that we can capitalize on our opportunities and leverage our strengths to improve productivity and spur innovation.

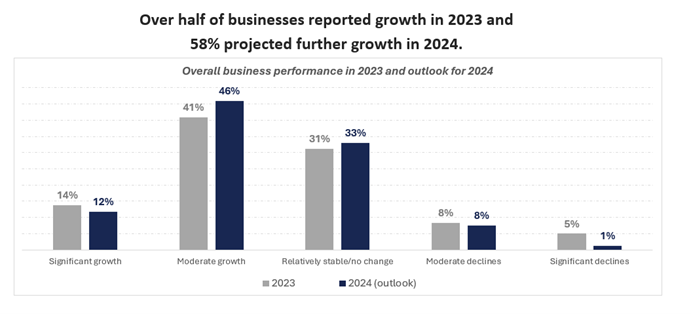

Over half of businesses surveyed reported overall growth in business performance during 2023, and 58% predicted growth in 2024. As we look back on the year, we want to hear what you think. Click here to participate in the 2025 business retention and expansion survey.

Here are four notable trends from the 2024 report:

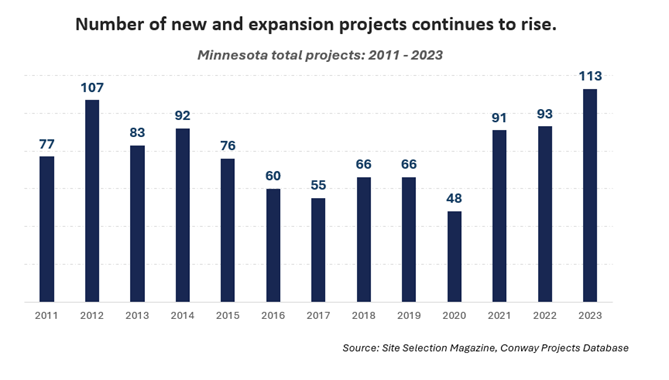

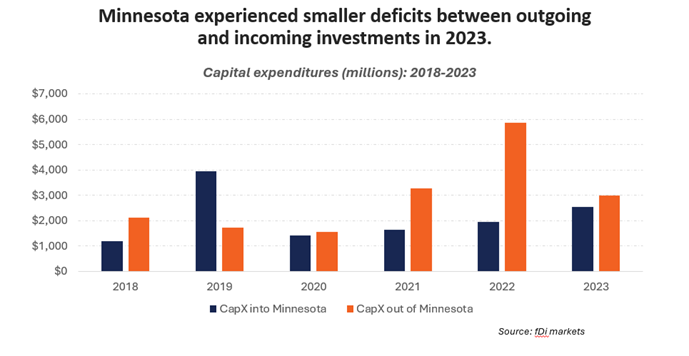

- Interest rates and inflation placed a burden on investments, causing some companies to delay expansion until the cost of borrowing decreases. Larger economic conditions are stifling growth; however, expansion data reveals an underlying demand for growth. In 2023, Minnesota had at least 113 expansion projects, up from 93 in 2022. Furthermore, investments into Minnesota from out-of-state companies increased to $2.5 billion in capital expenditures and 4,353 jobs created. Minnesota secured large investments across a range of industries including healthcare and medical technology, food and agriculture, data centers and advanced manufacturing.

- General workforce availability was cited as the top barrier to expansion by businesses and economic developers. 69% percent of businesses surveyed in the 2024 BRE report claimed they had difficulty in finding employees. The state’s historically low unemployment rate emphasizes how tight the current labor market is. However, workforce also emerged as one of the state’s strengths. Minnesotans are particularly well-educated and hard-working; the state has a highly skilled workforce and a high labor force participation rate (68.2% in 2024).

- Federal and state policies loomed large in responses from businesses and economic developers. Economic developers commonly cited sweeping federal policies such as the Inflation Reduction Act and CHIPS Act as primary drivers of the recent surge in the number and size of new projects leads. However, businesses and some economic developers raised concerns about a variety of state policies, such as taxes, environmental permitting, and new labor mandates, as potential barriers to growth.

- Shortages of available properties and shovel-ready sites emerged as a common issue in interviews and surveys of economic development organizations. Simply put, if a business can’t find a property that meets their size, infrastructure, and utility needs, they can’t expand there. For communities with available land, it’s an advantage as they’re able to retain existing companies and compete for new expansions. Although Minnesota is one of many states that have a shovel-ready certified site program to encourage the attraction of megaprojects, Minnesota lags in the number of total acres certified and is significantly lower in this metric than neighboring states such as Iowa and Illinois.

We are asking for your help by completing this survey that will provide critical insights on this topic and help drive actions to better support businesses in Minnesota.

The deadline to submit your responses is April 15th. The survey will take approximately 5-10 minutes to complete.

The survey is anonymous, and results will only be reported at an aggregate level. Again, the purpose is to use these findings to inform stakeholders about important issues for small businesses and enable actions to better support investment and growth in the state.

Recommended Articles

The Minnesota Chamber of Commerce released this letter on behalf of more than 60 CEOs of Minnesota-based companies today.

The...