2023 State of business retention and expansion in Minnesota

Quick Menu

-

Overview and key findings

-

Minnesota expansion activity within regional and national context

-

Public announcements of expansions won and lost in 2022

-

Business expansion survey and interview findings

-

Conclusions and recommendations

Grow Minnesota!® background

In 2003, the Minnesota Chamber of Commerce formed a partnership with over two dozen local chambers and economic development organizations to conduct ongoing outreach to Minnesota companies. The focus of this outreach was to thank businesses for their investment in Minnesota’s economy, ask them about their current challenges and future expansion plans and connect them to resources to stay and grow in Minnesota. Over the next twenty years, the Grow Minnesota!® program advanced this mission, working with over 90 local partners to conduct more than 13,500 one-on-one business retention and expansion visits with Minnesota business leaders and assist more than 3,200 businesses.

Now in its 20th year, Grow Minnesota!® has embarked on an effort to assess the current state of business expansion activity in Minnesota. The events of the first three years of the decade created new challenges and opportunities for businesses to expand their operations and altered the competitive landscape for states to compete for business investments. Minnesota, like much of the nation, faces slowing labor force growth and historically tight labor markets. Automation and new technologies are reshaping how businesses operate. Rising inflation and interest rates have put increasing cost pressures on businesses and households and created uncertainty in the economic outlook.

Within this context, it is more important now than ever for Minnesota’s local and state leaders – from chambers of commerce and economic development authorities to city councils and state policymakers – to actively engage Minnesota businesses and better understand what they need to grow and expand in the state.

We hope this report uncovers useful insights that can guide the efforts of the state’s diverse range of economic development stakeholders and enhance our collective ability to grow Minnesota.

Grow Minnesota!® is grateful for its continued partnership with local chambers, economic development entities and business support organizations around the state. We also thank our report investors, Great River Energy and Minnesota Power, for supporting this work.

Back to top

Overview and key findings:

Business expansion projects play a critical role in Minnesota’s economy. Each year, dozens-to-hundreds of businesses look to invest in new equipment, facilities or employees to increase their output and grow their operations. Where these businesses choose to place their investments has a direct impact on those local communities and the broader regional and state economies in which they take place, as those projects generate new jobs, boost local supply chain activities and expand the tax base. Yet too little is known about how many businesses are expanding at any given time, how the number and type of projects are changing over time and what factors drive location decisions for these investments.

This report is an initial attempt to collect data and insights on Minnesota’s business expansion trends, providing a launching point for further investigation and research. Grow Minnesota!® conducted an online survey of 171 Minnesota businesses across the state and interviewed over fifty businesses, economic developers and site selectors to better understand these issues. We further supplemented these findings with analysis of publicly available information on business expansions and private third-party data sources to track expansion activities and assess Minnesota’s performance relative to other states.

Key findings:

- Business expansion projects increased in Minnesota and throughout the U.S. in 2021 and 2022. Nationally, the rise of so-called “mega-projects” worth billions in capital investments shook up the economic development landscape.

- While overall activity ticked up in Minnesota since 2021, the state consistently ranks near the bottom of Midwest states for new and expansion projects. Minnesota ranked 10th out of 12 states in the region in total projects from 2018 to 2022, and ranked 10th in projects per capita in 2022.

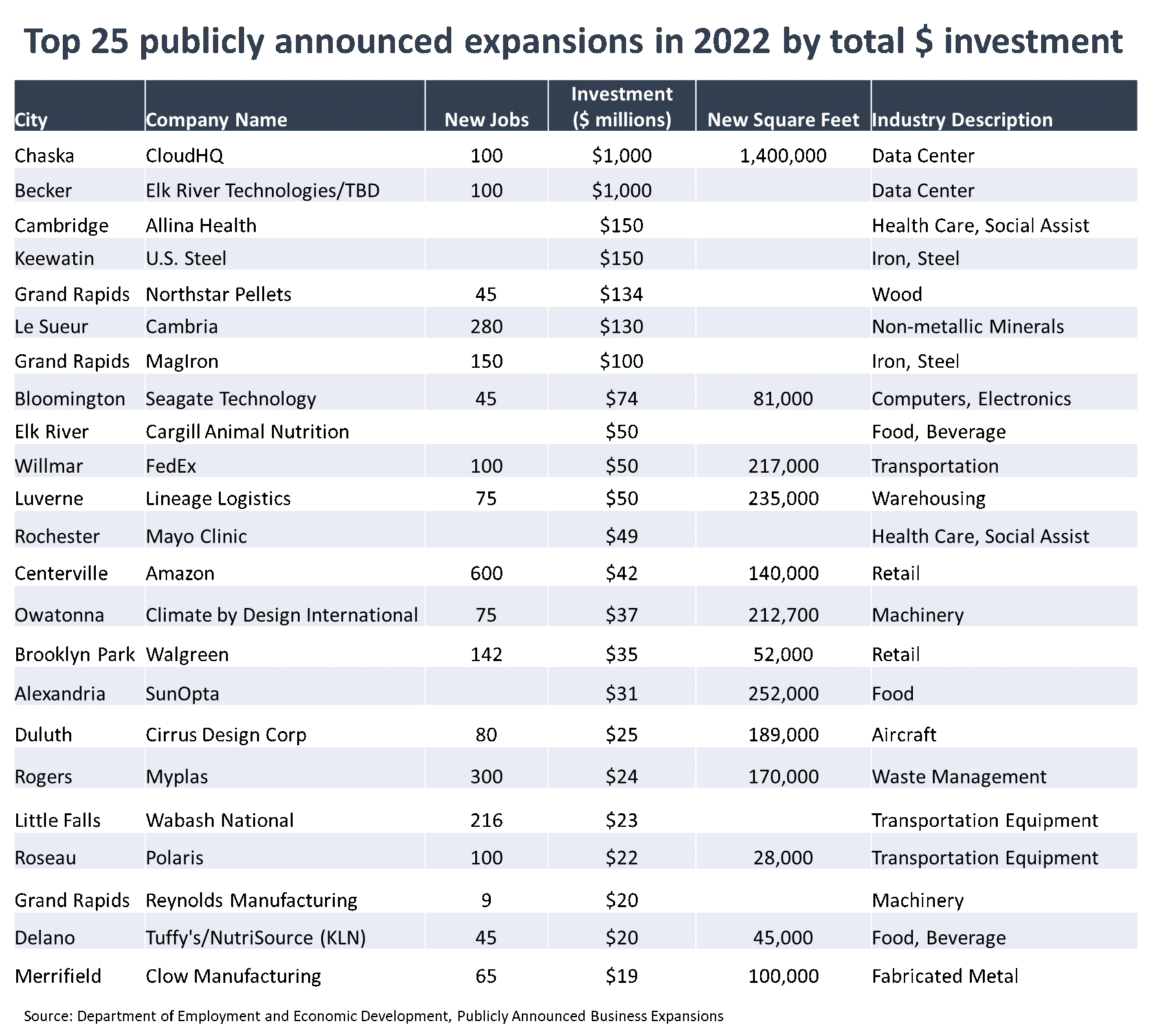

- In 2022, Minnesota generated expansions from companies in a wide range of industries spread broadly throughout the state. Minnesota’s largest expansion announcements included two proposed $1 billion data center projects, expected to take place in Chaska and Becker. The top 25 largest expansion announcements in 2022 plan to add an expected 2,527 jobs and invest $3.48 billion in capital expenditures.

- Minnesota lost three notable expansions due to regulatory barriers, totaling a combined loss of 350 potential new jobs and $1.2 billion in lost capital investment.

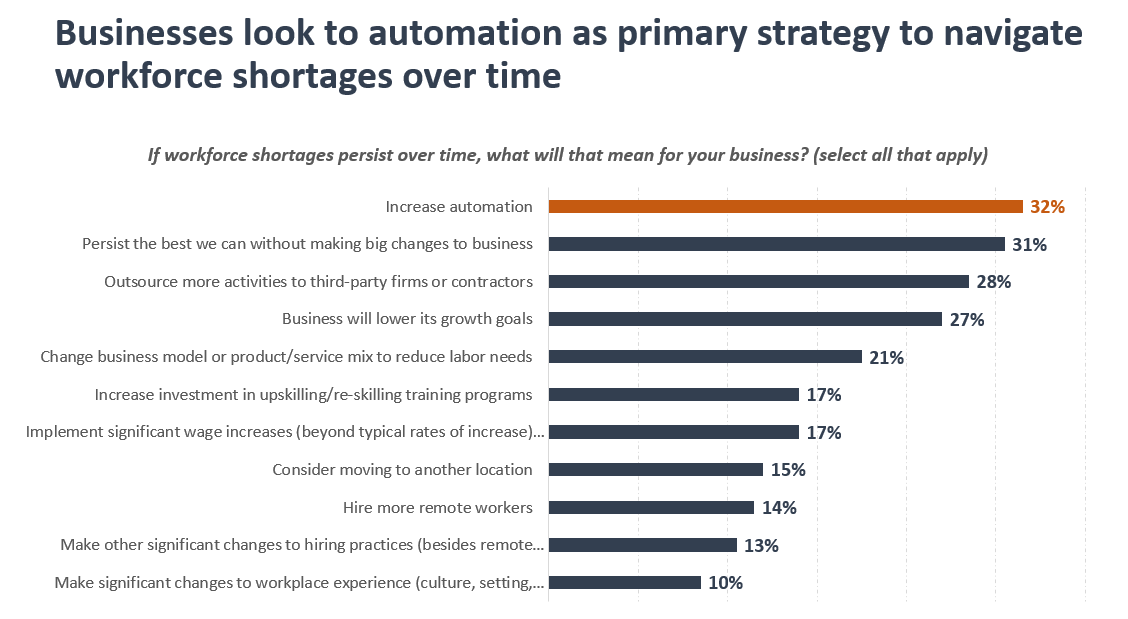

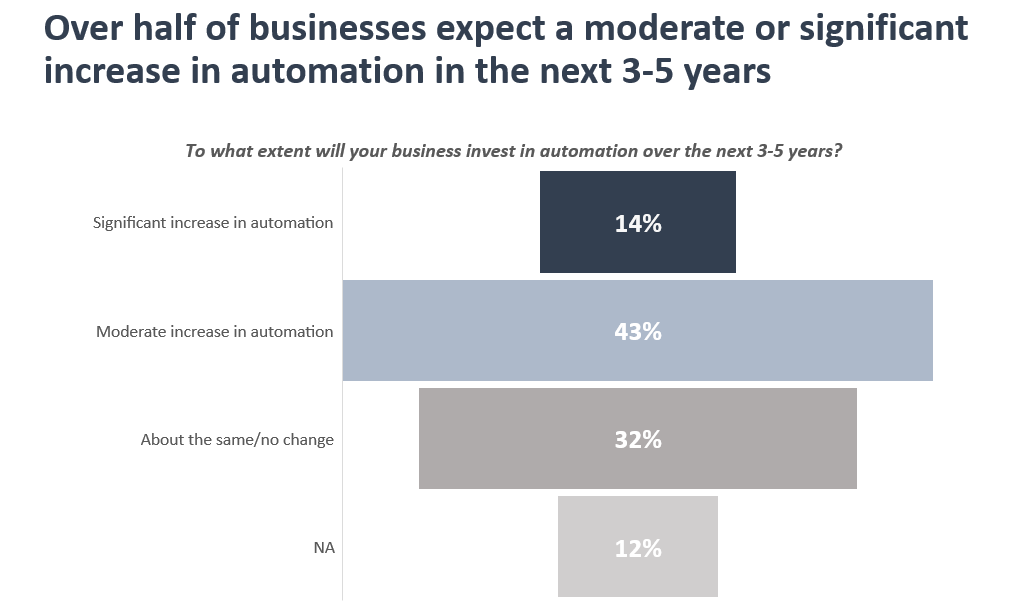

- Fifty-seven percent (57%) of survey respondents expect automation to increase moderately or significantly in the next 1—3 years, and a plurality (32%) indicated that they would look to increase automation if they continue to face workforce shortages over time.

- Fifty percent (50%) of survey respondents expanded or made major investments in Minnesota in recent years. Comments from respondents suggested that many businesses expand locally as a default, as the owners and existing employees live here and have embedded operations in the community or have fundamental business considerations that drive their location decisions, such as proximity to markets or supply chains.

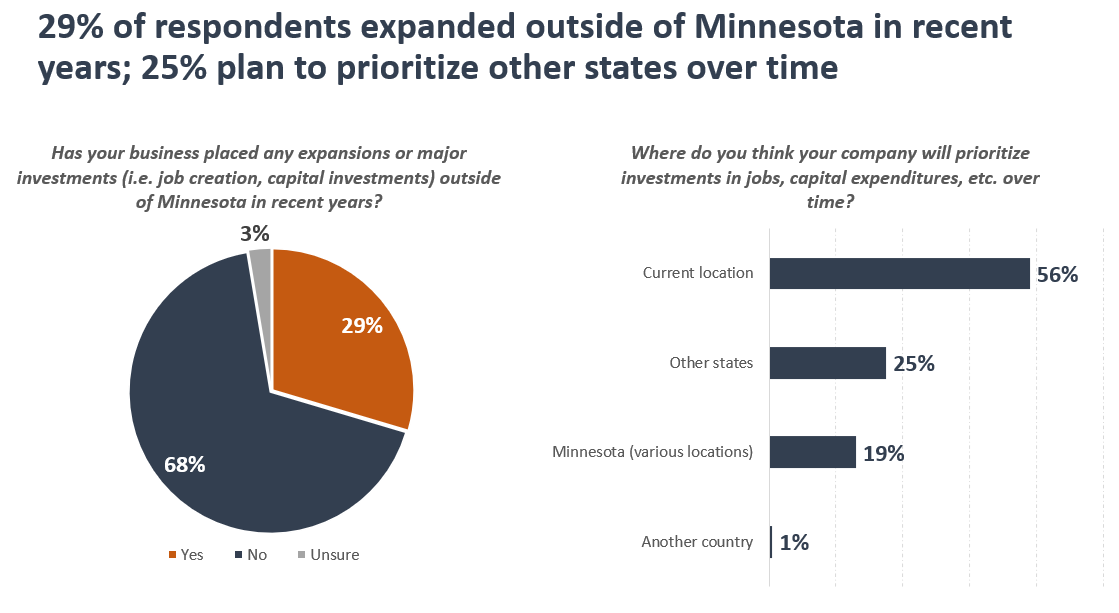

- A majority of businesses (56%) plan to prioritize their current location for future expansion activities, while 25% plan to prioritize locations in other states over time. 29% of respondents have current plans to expand outside of Minnesota.

- Businesses and site selectors cited Minnesota’s strong workforce, local communities, and existing industry clusters in areas like life sciences, skilled manufacturing and natural resource-based industries as competitive advantages to expand in Minnesota.

- Survey respondents ranked Minnesota’s high state tax rates and lack of available workers as the top two barriers that prevented businesses from expanding in Minnesota. Businesses and site selectors described that overall business climate and hiring issues have led some companies to expand outside of Minnesota in recent years.

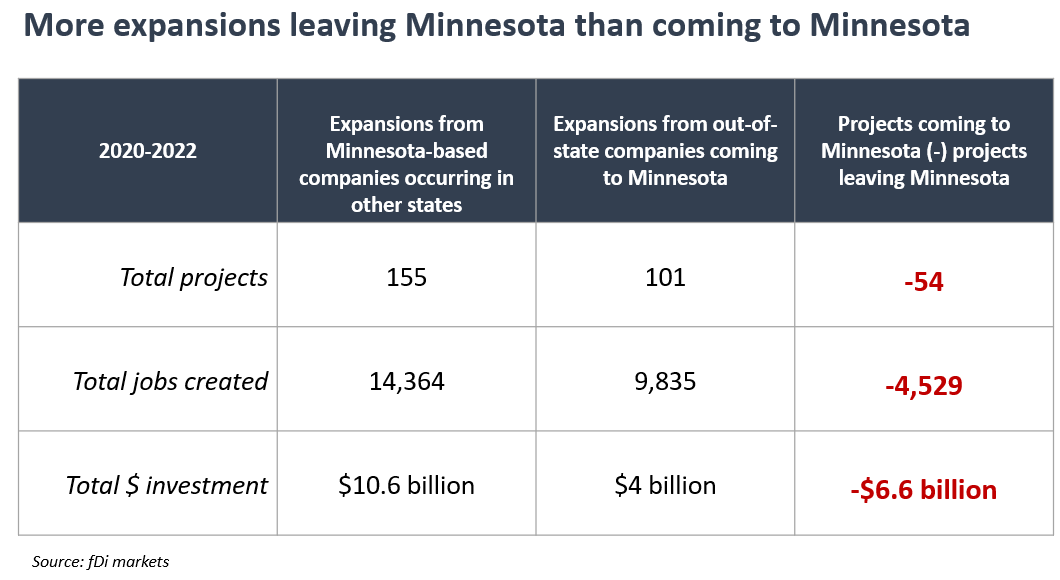

- Data from fDi Markets shows that Minnesota-based companies are expanding in other states at a higher rate than out-of-state companies are expanding in Minnesota. Since 2020, Minnesota had a net investment deficit of 54 projects, 2,500 jobs and $6.6 billion in capital expenditures.

- Minnesota companies are investing most heavily in Florida, Indiana, Colorado and Texas, with those states receiving $4.6 billion in capital investments from Minnesota companies from 2020—2022. Additionally, Minnesota had a net investment deficit with each of its neighboring states so far this decade, with Minnesota-based companies investing $562 million more in neighboring states than companies from those states invested in Minnesota projects.

Back to top

2022 expansion activity in Minnesota:

Total project activity as reported by Site Selection Magazine using Conway Projects Database

Key questions: How many projects are occurring in Minnesota over time? How does this compare to other states in the Midwest and around the U.S.?

Each March, Site Selection Magazine releases its annual Governor’s Cup report on business investment projects across all states in the U.S., using their proprietary database of new and expansion projects called Conway Projects Database. Their report tracks projects with “a minimum investment of $1 million, creation of 20 or more new jobs or 20,000 square feet or more of new construction.”

While this is not a comprehensive assessment of every project occurring in the U.S., it provides a consistent and standardized way to compare project activity over time and across geographic regions. A review of this dataset revealed several notable findings:

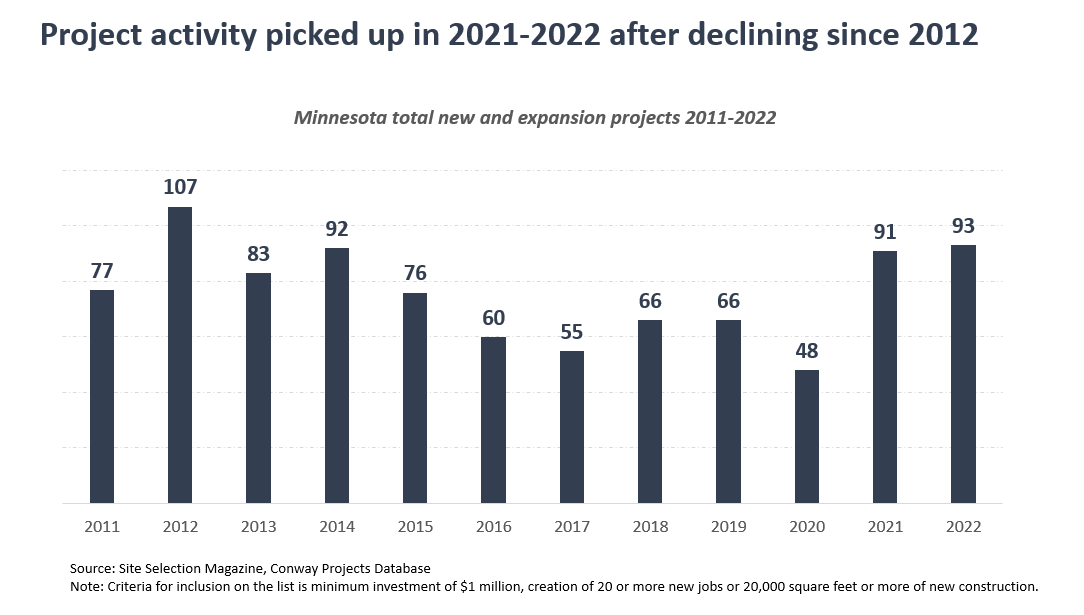

- Total project activity in Minnesota picked up in 2021 and 2022 after falling steadily since 2012. Minnesota received 107 new and expansion projects in 2012. Activity dropped off in the following years, however, and averaged just 65 new and expansion projects in the last five years of the decade. Project levels ebbed slightly throughout the U.S. in the late part of the decade as well, but the drop-off was steeper in Minnesota than the national average.

Not surprisingly, activity declined sharply in 2020 as the COVID-19 pandemic impacted U.S. and global economic activity. Yet business investments surged in the following two years, with Minnesota receiving 184 projects and hitting an 11-year high in 2022. Interviews with economic developers and site selectors reflected this recent uptick as well. One economic developer stated that “things have gotten very, very busy with new projects.” Several site selectors mentioned that 2021 and 2022 were among their busiest years on record, particularly for new industrial projects.

Not only did project volume pick up, but the size of new projects soared as a wave of so-called “mega projects” shook up the economic development landscape in the U.S. For example, Rivian announced a $5 billion investment in an electric vehicle campus in Georgia in 2021. Ford Motor company announced a $5.6 billion facility project in Tennessee. And new semiconductor plants in places like Texas, Arizona and Kansas reached staggering investment levels, ranging from $4 billion to $30 billion in expected capital investments.

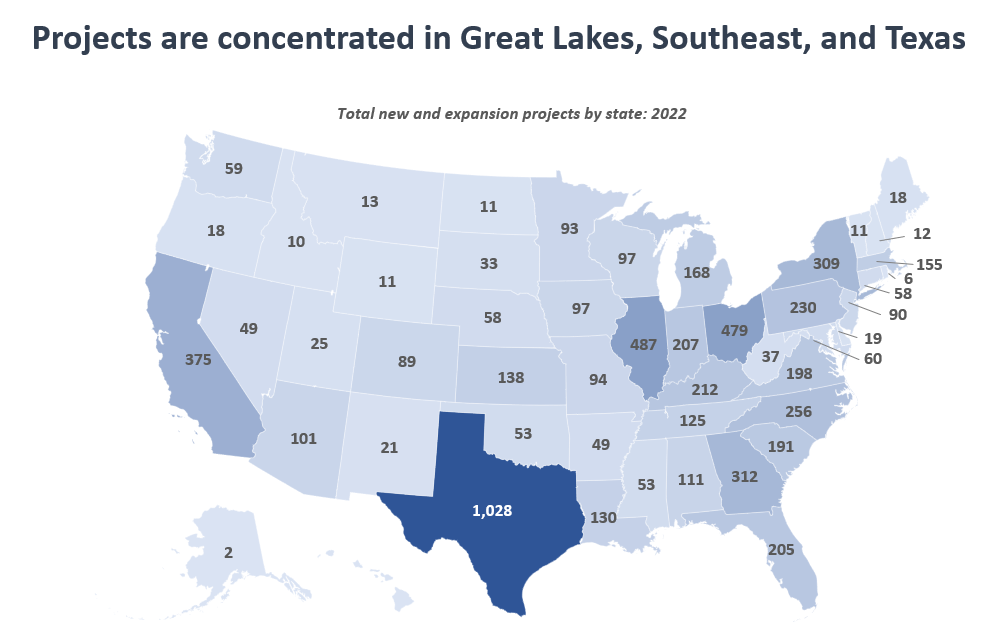

- Project activity is heavily concentrated in certain regions of the U.S., with states in the Great Lakes, Southeast and Texas dominating new and expansion projects. In 2022, the total number of new and expansion projects in Texas alone was greater than in the bottom 28 states combined, demonstrating the significant divergence of project activity across states. States in the industrial centers of the Midwest and Southeast also saw far greater project activity than in other regions.

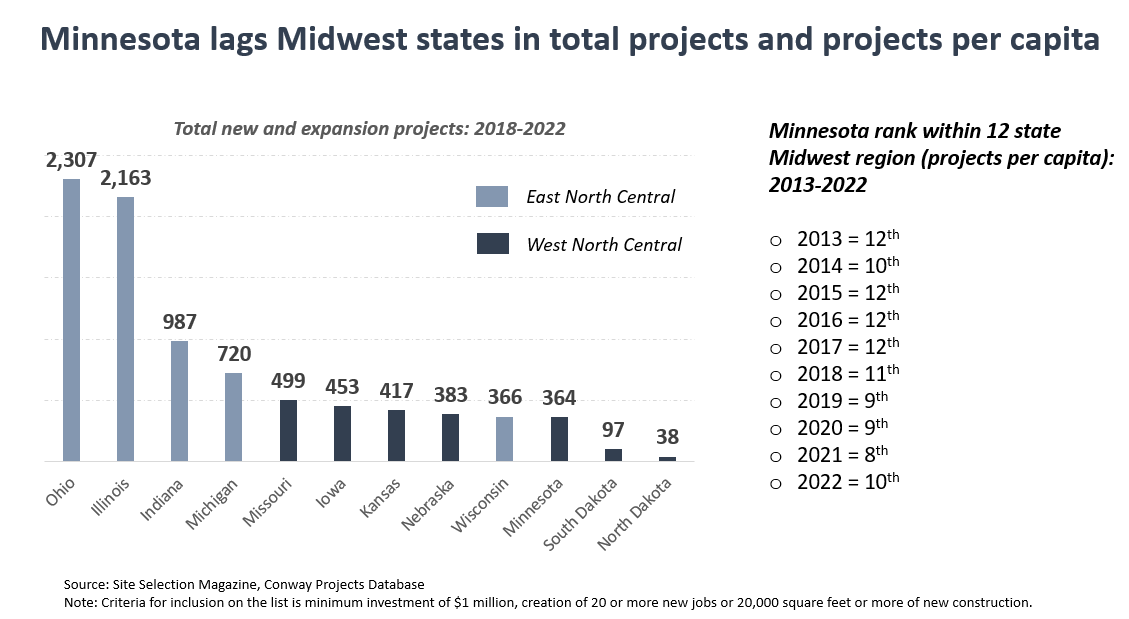

- Minnesota lags its peers in the Midwest, consistently ranking near the bottom in both total projects and projects per capita. Minnesota ranked 10th among 12 midwestern states in the total number of projects tracked by Conway Projects Database from 2018—2022, receiving 364 new and expansion projects in that time and faring comparably to its neighboring state, Wisconsin. Similarly, Minnesota’s regional ranking in projects per million residents ranged from 8th – 12th highest from 2013—2022, putting Minnesota consistently in the bottom quarter of states in the region. Interestingly, Minnesota’s per capita rankings improved slightly since 2019 after ranking dead last in four of six years between 2013 and 2018.

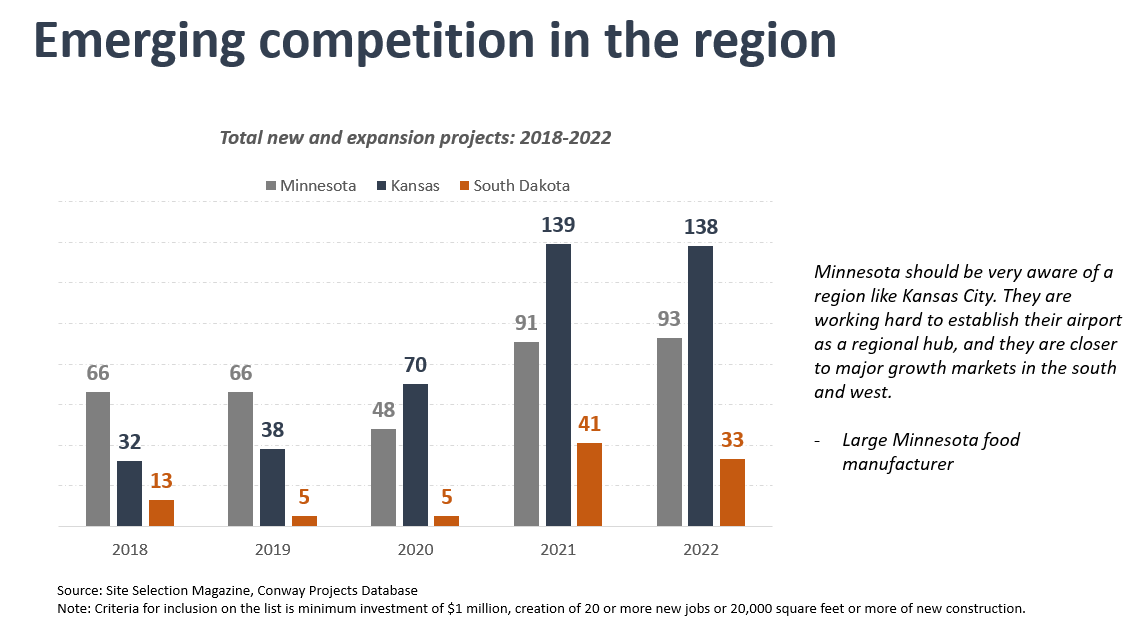

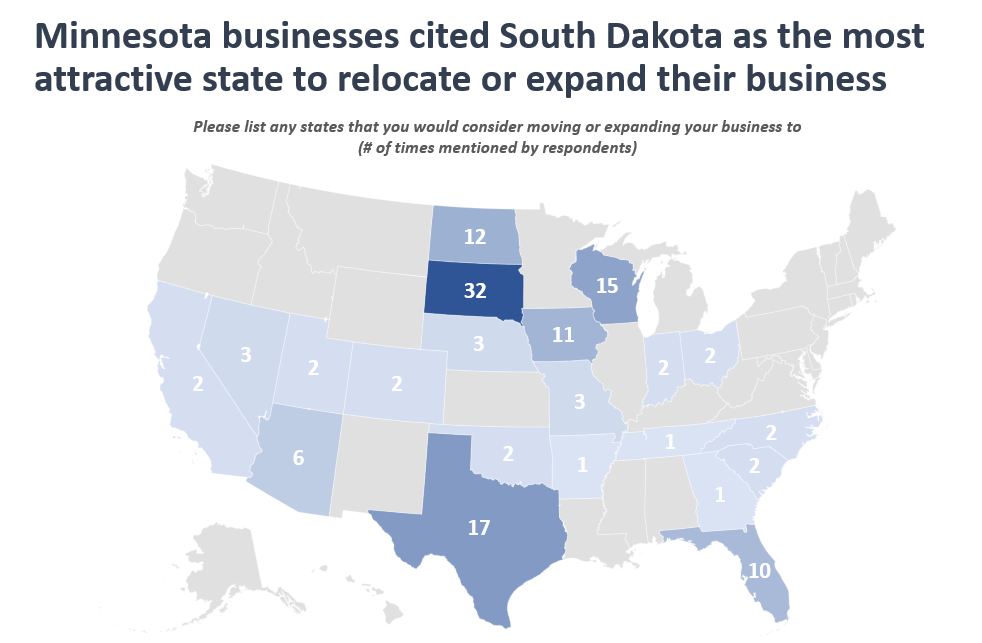

- South Dakota and Kansas are small but emerging markets within Minnesota’s competitive landscape. While states to Minnesota’s east – such as Ohio, Illinois and Indiana – make up a lion’s share of projects in the Midwest, smaller states in the western part of the region have shown emerging growth in recent years. For example, South Dakota and Kansas increased expansion activity significantly in the first two years of the decade, with Kansas receiving the most projects per capita in the U.S. and attracting large-scale investments in that time. South Dakota was one of only three midwestern states with positive net domestic migration since 2020 and was the most frequently cited state by respondents of the Grow Minnesota!® business expansion survey as an attractive place to locate or expand. These states have much smaller populations and labor pools, but their emerging presence should be noted as states in the region compete for business investments in coming years.

Back to top

Public announcements of expansions won and lost in 2022:

Business expansion projects in Minnesota as reported by the Department of Employment and Economic Development’s directory of publicly announced business expansions.

Key questions: What were the largest expansion projects in Minnesota in 2022? How were projects distributed across regions and industries? What projects did Minnesota fail to secure or lose to other states?

- Minnesota’s largest business expansion announcements in 2022 spanned a wide range of industries and communities around the state. Two data center projects, each expected to be around $1 billion, take top billing as the largest investment announcements last year. Each quarter, the Department of Employment and Economic Development (DEED) rounds up a list of publicly announced business expansions in the state. The list does not include all expansion projects in the state, as businesses are not required to publicly release information on expansion activities. However, it offers critical information on which businesses are expanding, how much they expect to invest, and how many jobs may be created through those activities. In 2022, DEED listed 134 projects that together would add 5,854 new jobs and invest $3.8 billion in the state. A review of the 25 largest projects shows that companies are investing in new expansions across a wide range of industries and communities, from a $150 million investment in advanced mining operations in Northeast Minnesota to a $50 million warehousing project in Southwest Minnesota to a $74 million high tech manufacturing and office project in the Twin Cities. The two largest expansion announcements, as measured by total capital investments, were two data center projects, each expecting to invest $1 billion and create 100 new direct jobs.

- Minnesota lost three notable expansions due to regulatory barriers and continues to leave major mining projects in limbo. In 2022, three economic development projects drew headlines, as businesses decided to pull out of proposed locations in Minnesota and take them to other states after facing lengthy permitting delays and complications. These three projects from Huber, Epitome Energy and Talon Metals represent a combined loss of 350 potential new jobs and $1.2 billion in capital investment. The loss of these projects, in combination with continued legal battles over two high profile proposed mining projects in Northeastern Minnesota, have sparked a renewed concern over the role that Minnesota’s permitting system plays in enabling or deterring business investment in the state.

Back to top

Trends and factors driving business investment decisions in Minnesota:

Findings from surveys and interviews with Minnesota businesses, site selectors and economic developers.

Key questions: What are Minnesota’s strengths and weaknesses relative to fostering business investments. How do business leaders and site selectors assess location factors when deciding on where to expand?

Grow Minnesota!® conducted an online survey of Minnesota businesses to collect insights on their recent and future expansion activities. The purpose was to better understand some of the factors that influenced businesses’ decisions to expand and where to place those investments. Responses were collected through a non-scientific survey of 171 businesses, which was in the field between February 15 and March 31, 2023. It was initially distributed by the Minnesota Chamber of Commerce and was further distributed through local Grow Minnesota!® partners in various communities around the state.

The survey sample prioritized businesses in industries that have higher rates of trade outside of their local communities. As such, the largest share of responses came from manufacturers (34%) and professional, technical, and scientific services (15%), though responses came from firms in 18 different industries at the 2-digit NAICS level. Responses were submitted from businesses in 31 counties throughout the state, with 49% coming from the seven-county Twin Cities metro, and 51% coming from Greater Minnesota.

Additional insights were collected through interviews and focus groups with Minnesota businesses, site selectors and economic developers around the state.

Since the survey did not use scientific sampling methods, readers should take caution in interpreting the results.

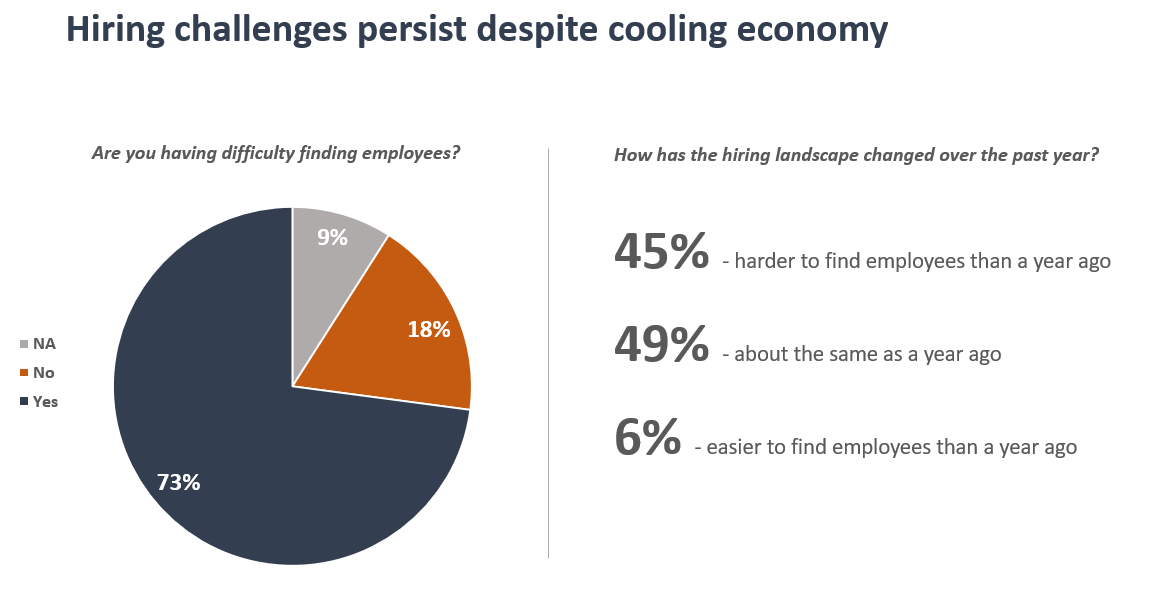

- Business expansion projects may become more capital-intensive as firms look to automation to manage workforce shortages.

Job creation has long been a central marker of economic development projects, with public support for new projects largely hinging on the total number of jobs retained and created. But with historically tight labor markets and slow labor force growth over time, businesses may be increasingly reliant on capital equipment and technologies to help them increase output and value amidst workforce shortages. Survey responses seem to confirm this. Fifty-seven percent of respondents said they expect automation to increase moderately or significantly in the next 1—3 years. Further, a plurality (32%) indicated that they would look to increase automation if they continue to face workforce shortages over time. Interviews with regional economic developers shared that they are seeing projects involve more automation and capital investment than in past years, even as job creation totals remain modest.

Yet the relationship between automation and labor availability is complex. The shortage of workers may increase the incentive for firms to seek productivity gains through capital investments, but such automation solutions require a significant amount of time and human resources to plan and implement. With businesses trying to manage day-to-day activities while short-staffed, firms may have less capacity to focus on long-term strategies. Further, some businesses we visited said that automation projects can create new hiring or training needs that are difficult to manage in an already-tight labor market. For example, one Twin Cities equipment manufacturer shared that it takes around 100-150 hours to create the training materials for each new machine they add to their production facility. Therefore, the pace of automation may be limited by the very staffing issues that firms are seeking to resolve through those investments in the first place.

- Why Minnesota? What factors help drive business expansions in Minnesota?

Each year, dozens-to-hundreds of Minnesota businesses decide to expand their operations, investing in new equipment, facilities and employees. Fifty percent of survey respondents said they expanded or made major investments in Minnesota in recent years, and 41% said they have plans to expand going forward. We asked businesses to describe where they are placing their investments and what is driving their location decisions.

Homegrown companies with embedded operations in the state: The predominant reason given by survey respondents of why they expanded in Minnesota is that the owners and employees already live in the state and their operations are already here. While this may seem obvious, it is an under-appreciated fact that the vast majority of businesses are privately held, small-to-midsized firms without sprawling operations across states. Businesses with an existing presence in the state already have embedded operations, workforces, and supply chains – and their expansions often reflect the natural outgrowth of those operations.

For many of these businesses, the decision about where to expand is chosen more by default than through a rigorous location analysis.

Yet this default setting does not mean businesses are value-neutral about their location. Respondents cited a mix of positive and negative reactions about their decisions to expand in Minnesota.

Strong workforce and ties to the local community: Survey respondents cited the strength of Minnesota's workforce and their commitments to the local community as positive draws to expanding in the state. Interviews with business leaders and site selectors reflected this theme as well. One national site selection firm stated, “Minnesota’s workforce is second to none.” Another site selector said, “Workforce is huge, it’s almost everything when thinking about location decisions these days.” This fact may be increasingly important as firms place greater importance on talent in their location and expansion decisions.

Minnesota’s strong workforce is often cited by business leaders as they announce decisions to expand in the state. For example, in a public meeting announcing a $23 million expansion in Little Falls which would add an expected 216 new jobs, Wabash National Chief Strategy Officer, Dustin Smith, stated, “You can’t replicate the workforce. You just can’t. That’s what’s keeping us in Little Falls, is the workforce and the potential.”

A state government affairs director for a large manufacturing company echoed a similar statement in an interview with Grow Minnesota!® about their recent decision to expand in the Twin Cities. He described that the company assessed its existing facilities around the U.S. and chose Minnesota because a.) they had available space to expand at their local plant and b.) their workforce at that facility was among their best throughout their U.S. locations.

Minnesota has competitive advantages in areas like life sciences, skilled manufacturing and natural resource-based industries. Interviews with economic developers and industry associations suggested that Minnesota has advantages in some of the state’s established industry clusters. For example, Minnesota has among the highest concentrations of health care and med-tech employment in the U.S., with specialized talent ecosystems, existing facilities with relevant specifications (such as clean rooms), and industry support organizations to help companies locate and expand here. One industry representative also described that federal regulations for new med-tech facilities are so rigorous and lengthy that concerns around state permitting timelines may be less of a crucial factor than in some other industries. Additionally, several competing life sciences clusters are in high-cost regions of the U.S., such as Boston and the Bay Area, allowing Minnesota to position itself as a lower cost alternative. This fact was mentioned by a commercial construction firm who described a scenario where a biotech company was locating a new facility and deciding between California, the Twin Cities and northern Florida. The Minnesota location, he described, was a lower cost alternative to California while having a larger pool of skilled labor than northern Florida. In this case, Minnesota offered a sweet spot of cost and talent that led the company to locate here.

Economic developers and businesses also shared that Minnesota’s natural resources provide advantages for projects requiring access to certain raw inputs. Several Minnesota-based food companies explained that their Minnesota plant locations are largely driven by proximity to their key farm suppliers. Similarly, a paper manufacturer stated that their location decisions are based on access to low-cost roundwood. Such operational considerations may help explain new projects like a proposed biogas facility in Benson, Minnesota from a Danish-based company, Nature Energy. As stated on their website regarding the proposed project, “Benson is an ideal location for several reasons, including access to good workers, reliable infrastructure, and a sufficient number of farms within about 20 miles of the plant. Those farms are needed as a source of dairy manure, turkey litter, and food processing waste that will feed the plant and who are able to receive the plant’s nutrient(s) output after biogas has been produced.”

Minnesota’s position in an agricultural-rich region provides built-in advantages that can be leveraged going forward.

- Why not Minnesota? What factors inhibit investment in Minnesota?

Despite Minnesota’s strong workforce and existing industry base, survey responses and interviews revealed substantial headwinds to business investments in the state. Interestingly, these challenges were noted even from businesses that recently expanded in Minnesota. Responses indicated that some businesses may expand in Minnesota in spite of its challenges, not because of its strengths.

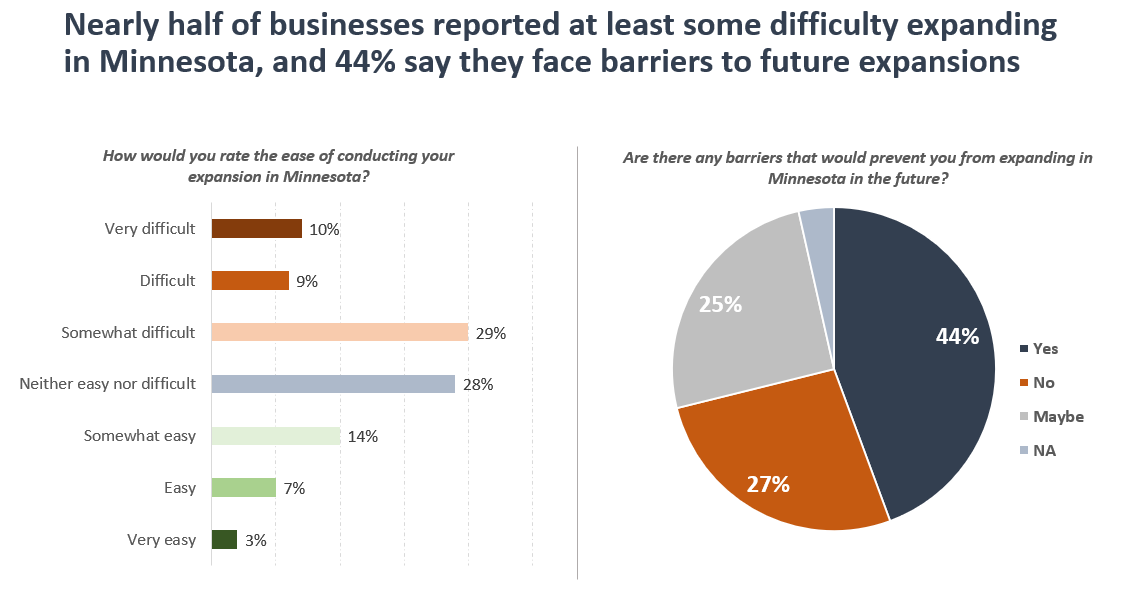

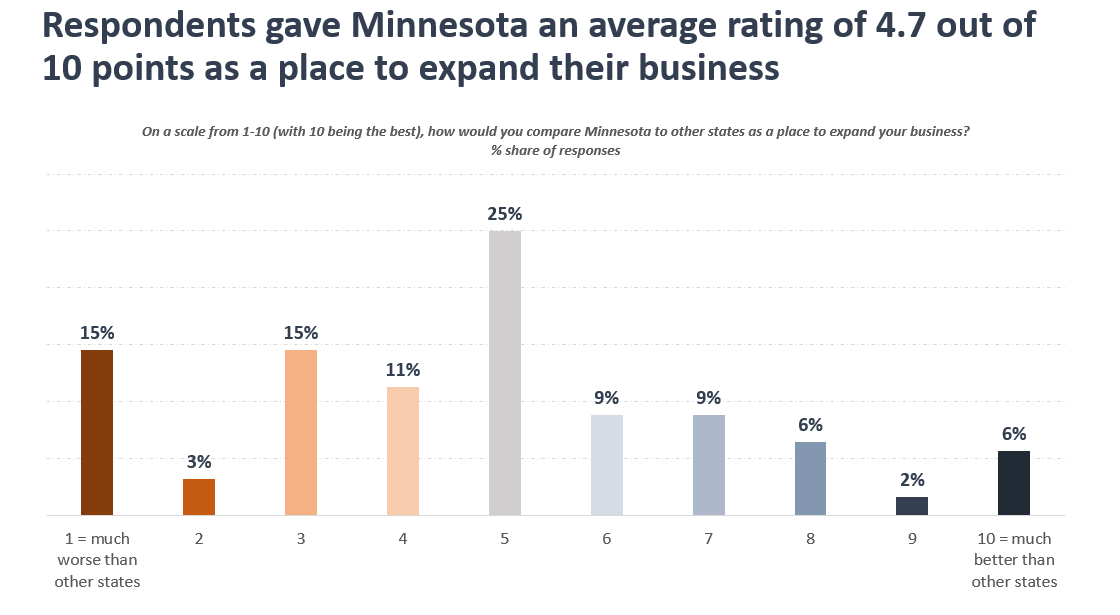

Indeed, twice as many respondents (48%) rated their ability to expand in Minnesota as somewhat difficult to very difficult, compared to the 24% that said it was somewhat easy to very easy. Respondents gave Minnesota an average rating of 4.7 out of 10 points (with 10 being the best) as an attractive place to expand compared to other states. And 44% of respondents reported that they face barriers to expanding in Minnesota in coming years.

Why did you expand in Minnesota? Examples from survey responses:

“We are committed to the local community.”

“Good business environment because of educated talent pool available in the state.”

“General quality of life, freight/parcel transportation considerations.”

“We are a local company in Minnesota. A group of six management members purchased the business in 2021 to keep it local and we would like to continue to invest through equipment and facility expansion at our current location.”

“Because it's one of the best states to do business - highly educated workforce.”

“We have already invested in local knowledge, connections and expertise for our local engineering market.”

“Because Minnesota has some of the most highly educated and caring people. It is also a great place to live and work and we have significant connections in town. We are also a social enterprise dedicated to gender equity and Minnesota ranks one of the highest for women in the country.”

“Minneapolis is my home and I love Minnesota. We've been able to find great people locally and hire software developers through MNTech.”

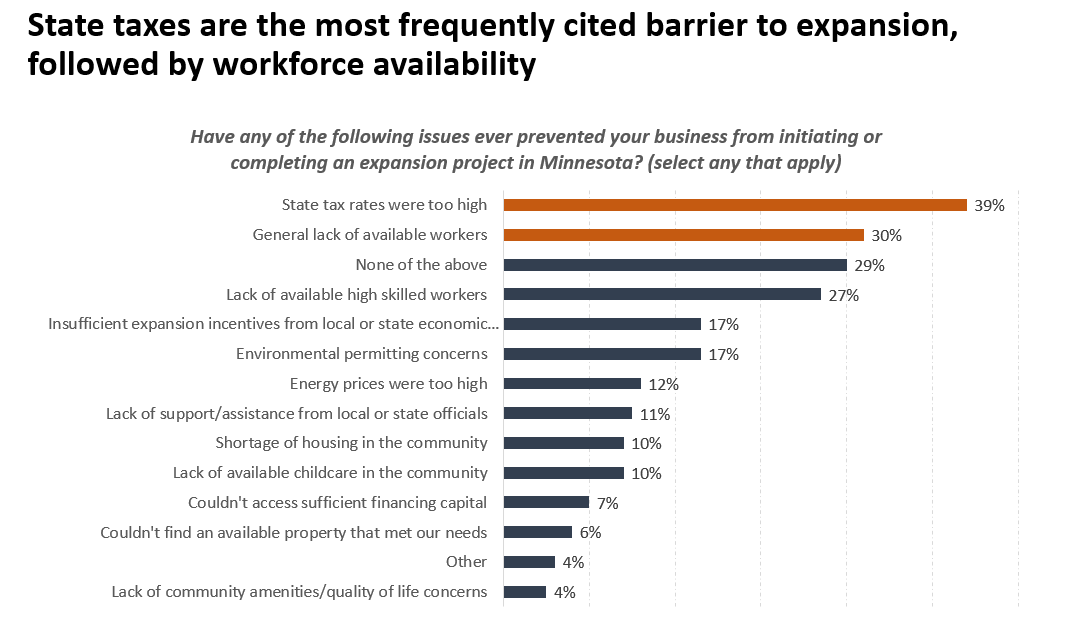

Minnesota’s business climate is cited by some respondents as a significant barrier to expanding in the state. The state’s high tax rates were the most commonly cited factor that prevented their businesses from initiating or completing an expansion project in Minnesota.

Business climate and workforce shortages inhibit investments from existing companies and makes it difficult attract new ones. A consistent theme in survey responses and from interviews with site selectors and business leaders was that Minnesota’s business climate often poses a meaningful barrier to investment. Respondents referenced a combination of factors that, taken together, create competitive disadvantages for companies to expand in Minnesota. These factors include Minnesota’s high corporate and personal income tax rates, complex and slow permitting processes, incentive programs that can be difficult to navigate, growing concerns over new state mandates, and a general attitude of skepticism from some public officials regarding new business investments. These policy related issues – combined with ongoing labor availability challenges – can create a difficult environment for business expansion projects to take place.

Survey respondents indicated that Minnesota’s high tax rates were the most frequently experienced barrier to initiating or completing an expansion project in the state. This was followed by 30% who said that a general lack of workforce availability prevented them from expanding here and 27% who said that they lacked access to high skilled talent. Seventeen (17%) percent of businesses reported that permitting challenges or insufficient local or state incentives prevented them from expanding here.

To be sure, these issues are not universally shared among every business, nor is each issue relevant in every circumstance. For example, incentive programs are only awarded toward a small fraction of all new investments. Similarly, many new projects do not require intensive environmental permit applications, making permitting concerns irrelevant to their location decisions. Further, some businesses rated Minnesota as a much better location than other states to expand, and 10% said that expanding here was easy or very easy.

Yet, these issues do not need to be universally shared to have an impact on overall investment activity. Concerningly, these issues may play an outsized role in expansion decisions from large companies with greater location options due to their national and global footprint. Interviews with site selectors and large companies with global operations offered examples of how they or their clients (in the case of site selectors) often look to other states when making investments in a new or expanded facility.

One site selector stated that 2022 was their busiest year on record for new projects, but not one of their Minnesota clients put a project in the state, with several clients explicitly instructing them to look outside the state for their project locations. Asked why their clients are looking to other states, he described a combination of contributing factors, including: high tax rates, a general “anti-business” attitude, perceptions of racism and crime, and a lack of cooperation from local officials over small items like parking stalls and minor building code issues.

Another site selector described that a lack of coordination between state agencies and challenges regarding how Minnesota’s incentive programs are designed have created frustrations for clients trying to expand here. He stated that by the time a client reaches out to them about a new project, it is fairly late in the process and speed is critical to secure a location, with twelve months being a typical timeline. This factor, he said, puts Minnesota at a disadvantage, as securing a location and navigating any relevant incentives or permitting agreements can take much longer in Minnesota than other states. Over the past year, their Minnesota clients chose to expand in states like North Carolina, Texas and Florida, even in cases when expanding in Minnesota would have been operationally feasible.

A third site selector agreed, describing that these issues impact both expansions from existing Minnesota companies and new investments from out-of-state firms. He stated that he “couldn’t remember the last time we put a project Minnesota.” This was due both to barriers to investment here and a strong economic development push in other states to attract new companies and investments.

These themes were echoed by individuals within several large Minnesota companies as well. One large publicly held manufacturer stated that they “don’t even consider Minnesota” for new projects, describing that the business climate and lack of population and labor force growth is a strong deterrent. Another large manufacturer stated that while they make investments here for certain kinds of projects due to supply chain considerations or specialized skillsets that they can access locally, it is “hard to make a strong business case for Minnesota” in projects where they have locational flexibility. A third large company described how the longer average time that it takes to get an air permit in Minnesota has led them to add capacity to plants in places like Tennessee where it can take 6-12 months less time to get the same type of permit than it does in Minnesota.

Interestingly, nearly every site selector and business leader we spoke to said that Minnesota’s workforce and quality-of-life is exceptional and contributes to the fact that businesses don’t leave the state altogether. None of the site selectors or firms we spoke to described scenarios where a business relocated their existing operations out of the state. Yet, these positive factors were not enough to drive new project activity in situations where a company had viable options to expand outside of the state.

Why did you expand in Minnesota? Examples from survey responses:

“Home base for the business; considering the need to locate part of the business in other states to expand workforce potential and lower taxes.”

“We live here, but the current business environment is making us feel un-welcome and it harder to stay. Less than 10% of our revenue comes from customers in Minnesota. There is no business reason for us to stay.”

“The only reason we stay here is because this has been our family's home for 150 years, we do business in every state & 100 foreign countries.”

“It is our one and only location to expand. Wishing we had not done it now.”

“Legacy and families alone.”

“I am from here, my customers are here. It is getting harder to be here.”

“It was a default decision. [I] purchased a Minnesota company and it was located in Minnesota. It made sense as that is where I am located. I intend to relocate that business to another state as soon as possible as the business grows.”

“Lease was running up, pre-pandemic, secured new 10-year lease in a downtown high rise building and complete fit out. Still plan to remain at this location, despite challenges with concerns of safety downtown which challenges recruiting, and market belief that downtown parking is either costly, or not as easy as a job in the suburbs which challenges recruiting.”

“We have [expanded here] but not as much as other locations and that will continue to be the trend.”

- Defining the real problem – it’s not the businesses leaving the state; it’s the projects that go elsewhere or never come here at all.

Corporate relocations make headlines and capture the attention of policymakers and the public. But more common are the ongoing investments that firms make in new jobs, equipment and facilities across various locations over time. In other words, a business may be more likely to expand or add capacity in another state than to relocate its operations altogether from one state to another. If this is the case, then state policymakers, economic developers and communities should seek to understand how businesses choose the location of their investments even if their headquarters remain rooted in their home state.

Survey findings and data from a third-party database called fDi Markets, show that a meaningful number of Minnesota businesses are expanding outside of Minnesota. Twenty-nine (29%) of respondents said that they have expanded outside of Minnesota in recent years, and 25% said they plan to prioritize other states for future investments. While some out-of-state expansions are driven by Minnesota companies looking to increase access to other markets or by other logistical considerations, others appear to be influenced by barriers to investing in their home state.

Encouragingly, most respondents plan to continue adding capacity to their Minnesota operations. But a meaningful subset of businesses cited that they chose other states because of preventable headwinds to operating in Minnesota.

Further, data from fDi Markets -- which tracks cross-border greenfield investments – shows that Minnesota has a net deficit in business investments with other states in recent years. From 2020 to 2022, out-of-state companies invested in 101 projects in Minnesota, generating 9,835 new jobs and $4 billion in capital investments. However, companies headquartered in Minnesota invested in 155 projects outside of the state, resulting in 14,364 new jobs and $10.6 billion in capital investments in non-Minnesota locations. This gave Minnesota a net deficit of over 4,500 jobs and $6.6 billion in expansion projects so far this decade.

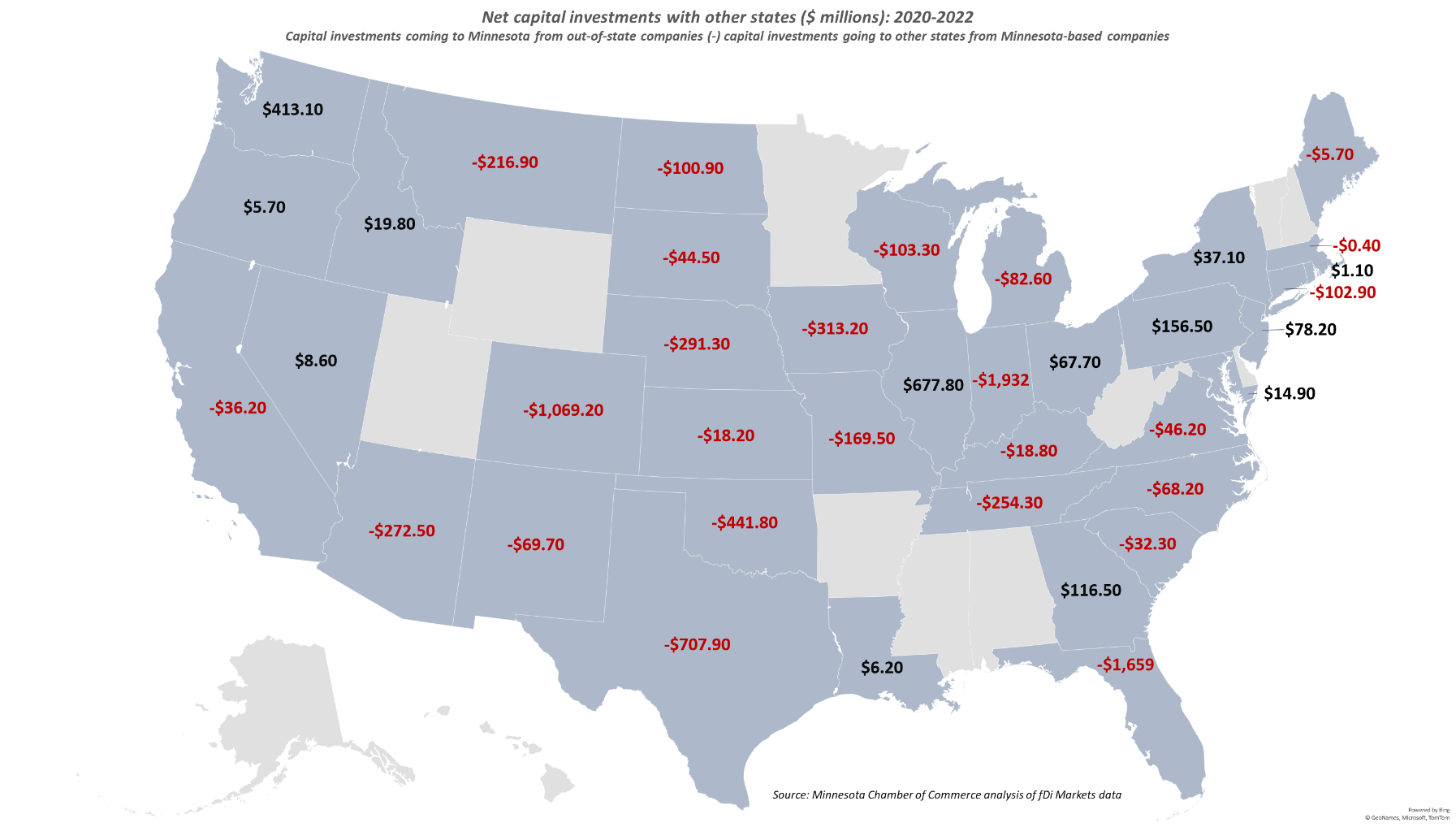

Minnesota companies invested in projects in 32 states since 2020, with investments being most heavily concentrated in Florida, Indiana, Colorado and Texas. Those four states alone received $4.6 billion in capital investments from Minnesota companies from 2020 to 2022. Additionally, Minnesota had a net investment deficit with each of its neighboring states so far this decade, with Minnesota-based companies investing $562 million more in neighboring states than companies from those states invested in Minnesota projects.

Minnesota experienced a net surplus with thirteen states, including Illinois, Washington, Pennsylvania and Georgia as the four largest net investors in Minnesota projects. Interestingly, Minnesota received the highest total level of investment from companies based in Florida, with $798 million in project investments coming to Minnesota and creating 680 new jobs. However, the amount of capital investment and job creation from Minnesota firms into Florida was far greater, with nine projects going into Florida being valued at $2.46 billion and creating 1,774 jobs.

Why did your business expand outside of the state? Examples from survey responses:

“We invested in our facilities in Nebraska because we have been more successful in hiring/retaining employees there compared to Minnesota.”

“Expanded into North Dakota for a more stable business operation and stronger hiring opportunities.”“Doing business in Minnesota is more difficult than most states.”

“We are currently building a new facility in Missouri and the welcome of manufacturing in Missouri is extremely refreshing compared to Minnesota!!”

“Since 2020, 50% of our workforce is now outside of Minnesota. Prior to 2020, only 10% of our workforce worked outside of Minnesota. I expect us to continue to grow outside of Minnesota.”“Closer to cheap supplies/inputs and better support from the state than from Minnesota”

“Labor, business friendly, proximity to customer base. Most of our customers have left Minnesota.”

“Better business climate.”

“Ease of standing up a new business in other states.”

“Access to more staff in the southern belt of the United States.”

“Growing economies in other geographies and a more business friendly climate in which to operate.”

“The states we operate in compete for our investments. Capital flows to locations it is welcome.”

“Much easier to do business. More support from local and state governments.”

Back to top

Conclusions and recommendations:

Minnesota has substantial strengths to draw from as the state seeks to foster business investments. The state’s highly skilled and hardworking workforce, innovative entrepreneurs and business leaders, leading industry clusters, and strong local communities all contribute to a virtuous cycle of business growth and expansion. As the report shows, many business expansions occur as the natural outgrowth of the success of local companies. Fostering the ongoing success of Minnesota’s existing companies can be expected to drive future investments in the state.

However, the report also details notable challenges and headwinds that businesses face to investing in Minnesota. Direct survey responses and interviews with businesses and site selectors described how Minnesota’s tax and regulatory climate, shortage of available workers, and inconsistent support from local and state leaders have led some businesses to place new investments in other states. Further, data from fDi Market and Conway Projects Database tracking project-level investments show that Minnesota lags other peer states in fostering new and expansion projects. While Minnesota has a strong base of homegrown companies, those companies are investing more in other states than companies from other states are investing in Minnesota. These are areas that Minnesota should seek to address to sustain and further develop the state’s economy in coming years.

Below are five high-level recommendations that should guide local and state efforts to increase business expansion activity.

- Outreach and support at the local level goes a long way toward helping businesses expand here. The Grow Minnesota!® program was founded with a belief that existing companies drive expansion activities, and that local communities play a large role in supporting the growth of their businesses. Findings from this report confirm the vital importance of this approach, with expansions being driven by existing companies looking to grow their operations locally. In most cases, it is more efficient and effective to retain existing companies than attract new ones. And while local communities cannot directly control state-level policies, they can initiate ongoing outreach activities to their businesses and find ways to collect intelligence on companies’ future plans and provide direct assistance to help them expand here. In many cases, this involves collaborations between local chambers of commerce, leaders at the city or county level, local and state economic developers, and private business service providers who can help businesses navigate the logistical hurdles involved with an expansion. Strengthening this ecosystem of business retention and expansion partners can help Minnesota retain more expansion activities over time.

- Minnesota needs a “get-to-yes” attitude toward business investments. Feedback from businesses and site selectors revealed an inconsistent level of support from policymakers and public agencies regarding new business investments. As one business described, officials in other states often put significant energy into working with businesses to figure out how they can “get-to-yes” on a new project. This sentiment was shared by some survey respondents who said that their business is often less “welcomed” in Minnesota than elsewhere. Fostering a widespread culture of welcome and support is a necessary starting place to retain and attract business investments.

- Minnesota’s business climate should do more than simply prevent companies from relocating out of the state; it should encourage and foster investment from its existing companies and attract new ones. Outreach and support to local companies must be coupled with improvements to Minnesota’s business climate. As further described in the Minnesota Chamber Foundation’s report Minnesota: 2030 – 2023 edition, policymakers should look for opportunities to streamline permitting processes and economic development programs to reduce the time and complexity involved with both. In each case, the intended public benefit and economic impact of these policies could be strengthened by making it easier for businesses to understand and comply with state rules and move through the process faster. For example, expansion incentive programs like the Job Creation Fund and Minnesota Investment Fund could be examined to reduce the complexity of the application process and streamline the sequencing of events that businesses must comply with to be eligible to receive awards. As businesses and site selectors described, competitive projects face very fast-paced timelines, and state programs and regulations must be agile enough to achieve their public purpose without pushing away investments. Additionally, Minnesota should continue monitoring and adapting economic development programs to help businesses invest in automation and other productivity-enabling technologies, looking for best-practices from other states in the process.

Further, Minnesota must be mindful of the role that state taxes play in influencing expansion activities. Our analysis shows that corporate investment is flowing most heavily to states with competitive tax climates, and that Minnesota has a net outflow of expansions to surrounding states. Survey respondents cited state tax rates as a leading barrier to investment and several cited that taxes influenced recent expansion decisions. Addressing the long-term operating costs of doing business in Minnesota could help existing firms increase local investments and also attract new investments from outside the state.

- Continue leveraging Minnesota’s skilled workforce and strong industry clusters to support business investments. Minnesota has one of the nation’s most educated and hard-working workforces and has leading industry clusters in areas like life sciences, skilled manufacturing and natural resource-based industries such as food and agriculture, mining and forestry products. Minnesota’s economic development efforts should build on areas such as these where the state has a competitive advantage over other states. Projects involving a modest number of skilled workers in areas that align with the state’s existing industry strengths can help Minnesota find a sweet spot of cost, talent and existing infrastructure needed to support new investments.

- Be future minded: entrepreneurship and business attraction are the feedstocks for future expansions. While retention and expansion of existing firms remains a bedrock of economic development, it is also true that today’s new startups and business attraction projects are tomorrow’s business retention and expansion successes. Minnesota policymakers and economic developers should think holistically about the range of activities that produce a robust stock of businesses who will add jobs and drive future economic activity. For example, one way to bridge the gaps between these various components is to focus BRE activities on high-growth companies in their early years, helping increase the likelihood that those firms’ future expansion activities occur locally.

NEXT STEPS

Grow Minnesota!® will continue to examine business expansion trends in coming months and work with our partners to provide direct assistance to businesses. Minnesota has a robust ecosystem of local chambers, local and state economic development entities, universities, business support organizations and private businesses that play a role in helping secure business investments in the state. By increasing the collaboration across these entities, we can strengthen the underlying support system needed to help Minnesota businesses to thrive and grow. We will look for opportunities to convene partners and stakeholders, share insights and best-practices, and develop new resources to increase the impact of this collective work

Back to top