Minnesota’s unsustainable tax burden

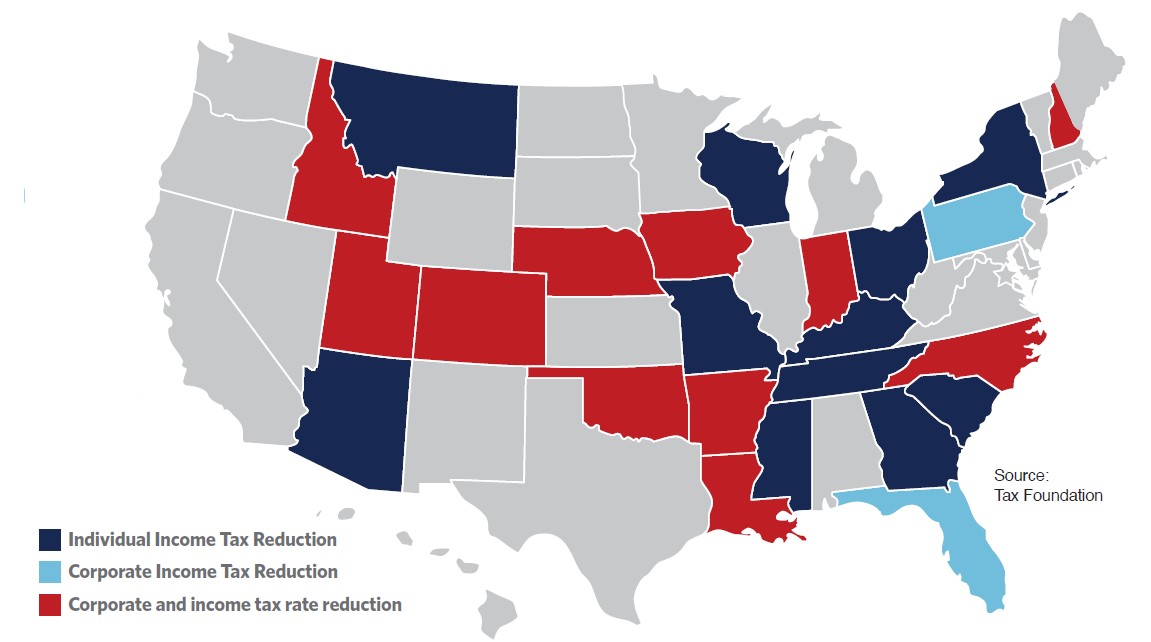

Minnesota’s taxes on private sector job creators and higher income taxpayers are higher than most other states. The gap between Minnesota and peer and neighboring states is wide, and getting wider. In the last two years, 27 states have reduced taxes and rates to make their states more attractive for investment and talent.

Minnesota’s tax rates are in the top ten highest for both individual and corporate taxpayers, making the state an outlier. It is also one of 12 states still imposing an estate tax. These tax burdens create a barrier to economic growth, as high tax rates undermine investment, entrepreneurship and attraction and retention of talent – all items needed for strong private sector growth.

States reducing corporate and/or income tax rate in 2021 and 2022 sessions

Economic potential

Minnesota’s economy is highly developed, with the fifthmost diverse economy in the nation. In fact, the state ranks high across a range of metrics, with leading industry clusters, 16 Fortune 500 headquarters, high rates of innovation and one of the highest workforce participation rates in the nation. Minnesota’s future economic success is not guaranteed, and policies need to reflect the realities of an ever-increasing competitive landscape.

Challenges

As is highlighted in the Minnesota Chamber Foundation’s Minnesota: 2030 report, the state’s overall economic performance is no longer nation-leading.

- Minnesota grew faster than the U.S. for decades, with job growth exceeding national job growth for 27 of 35 years from 1970-2004.

- Growth accelerated in the 1990s, with real GDP climbing 3.9% on average and employment growing 2.2% annually.

- Minnesota’s GDP growth and job growth lag the national average in nine of the last 10 years.

- Minnesota continues to have uneven outcomes across demographic groups and regionally, with populations of color and nonmetropolitan areas experiencing lower levels of economic well-being on average.

- Minnesota is losing population to other states. Domestic net migration ranks 42nd worst in 2021, and workforce growth has stagnated.

Choose to grow Minnesota

Many factors impact the decision for businesses and individuals on where to invest or locate, including family, weather, cost of living and natural amenities. Not all of these factors are within policymakers’ control. However, tax policies that hinder growth opportunities are within policymakers’ control, and tax policy changes can yield economic results much more quickly.

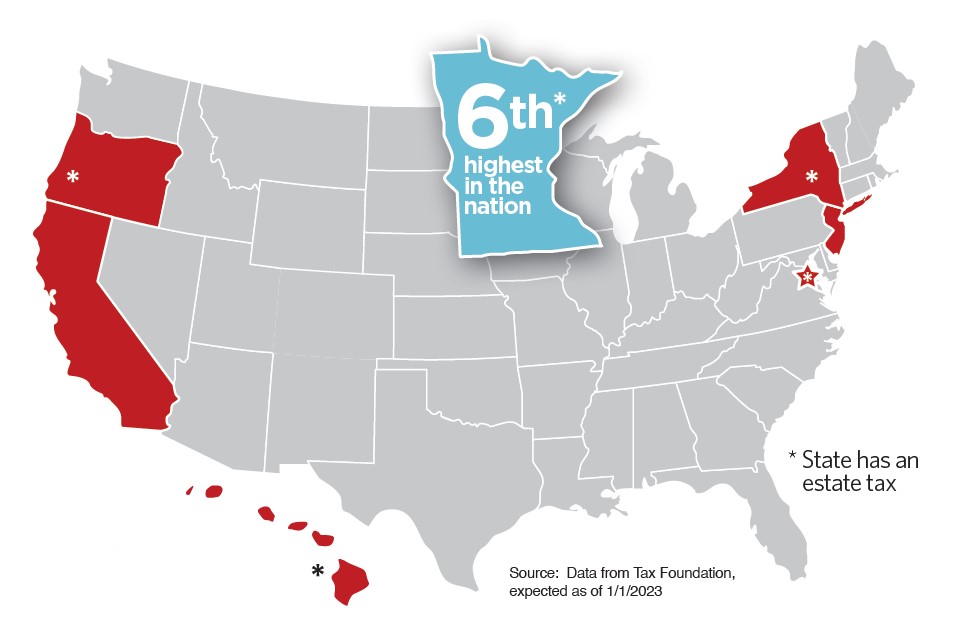

States with individual income tax rates higher than Minnesota

Minnesota’s top rate is the sixth-highest in the nation at 9.8% and is higher than all non-coastal states. Minnesota’s top rate kicks in at a lower threshold than other states’ top rate, so for some incomes, Minnesota’s tax burden is secondhighest in the nation. Minnesota’s next rate of 7.85% also ranks in the top 10 highest in the nation. Numerous economic research has found that high-income taxes negatively impact talent recruitment, investment and entrepreneurship.

Minnesota is also only one of 12 states that still has an estate tax. The high income tax combined with estate tax creates a large financial disincentive for wealthier taxpayers to remain in Minnesota and hinders transfers of family businesses and farms.

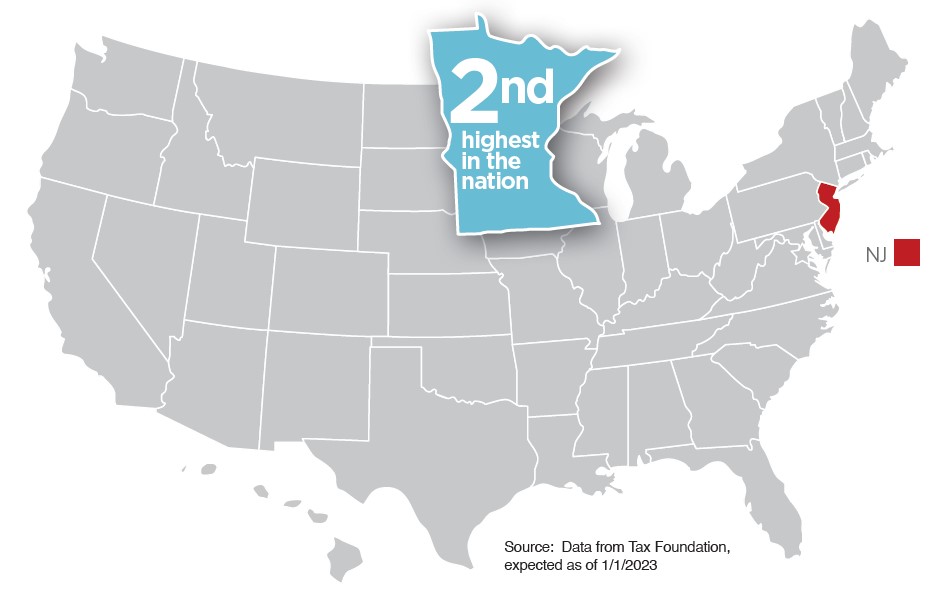

Only one state will have corporate rate higher than Minnesota in 2023

By 2024, Minnesota will have the highest corporate income tax rate in nation at 9.8% with the sunset of New Jersey’s 2.5% surcharge (imposed on income above $1 million). In 2023, Minnesota’s tax will already be highest in the nation for corporate taxpayers with net income under $1 million.

Other states with high tax rates have implemented tax reforms to improve business competitiveness, including Pennsylvania and Iowa. Pennsylvania is phasing in corporate rate reductions with a reduction from 9.99% to 8.99% beginning in 2023 and then a 0.5% rate decrease until it reaches 4.99% in 2031. With a top rate of 9.8%, Iowa is phasing in corporate rate reductions based on revenue triggers until the rate reaches 5.5%.

The corporate tax is a regressive tax as, ultimately, it is paid by consumers, employees and investors. According to economic research, the corporate tax is also one of the most volatile and economically detrimental taxes.

Want to learn more?

To ensure a strong future with a growing economy for all, Minnesota must take action to reduce our high tax rates to get Minnesota out

of the top ten highest tax states!