Minnesota Chamber Foundation quarterly economic snapshot: Winter 2023

The Quarterly Economic Snapshot is an overview of key indicators measuring Minnesota’s current economic performance. Analysis is provided in partnership with Grow Minnesota! and the Minnesota Chamber Foundation.

NOTE: The Minnesota Department of Employment and Economic Development (DEED) released revised jobs numbers on March 9 that are not reflected in this analysis. Stay tuned for the upcoming economic snapshot that will feature an analysis of this new data.

Overview and highlights:

News of layoffs in large U.S. companies, rising interest rates, and forecasts of a mild recession in 2023 have spread a sense of gloom across the U.S. economy. But so far, economic indicators in Minnesota and the U.S. have largely defied such pessimism.

Minnesota’s unemployment rate remains at a very low rate of 2.5%, despite an uptick in recent months. The state’s private sector added 19,800 jobs in the fourth quarter. Minnesota's GDP grew by 2.3% in the third quarter (most recent data available), and the U.S. economy grew by 2.9% in the fourth quarter, showing continued expansion through the end of the year. Inflation cooled further in the fourth quarter, providing some relief to consumers and businesses and widening the target for the Federal Reserve to achieve a “soft landing” in 2023.

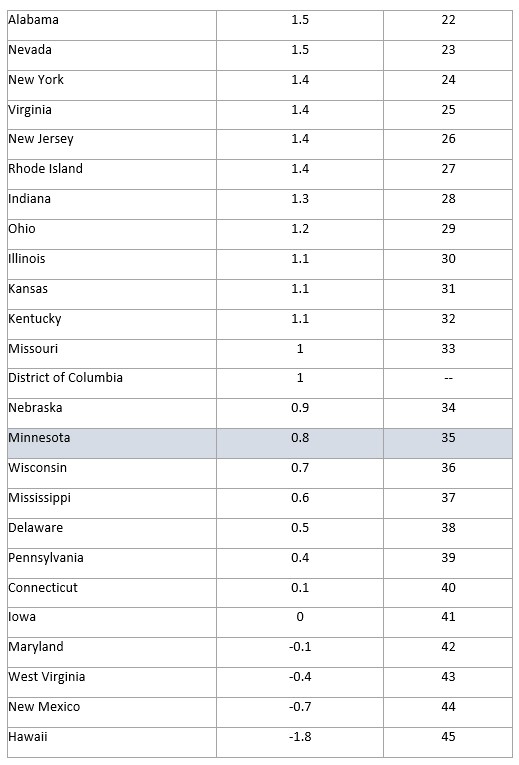

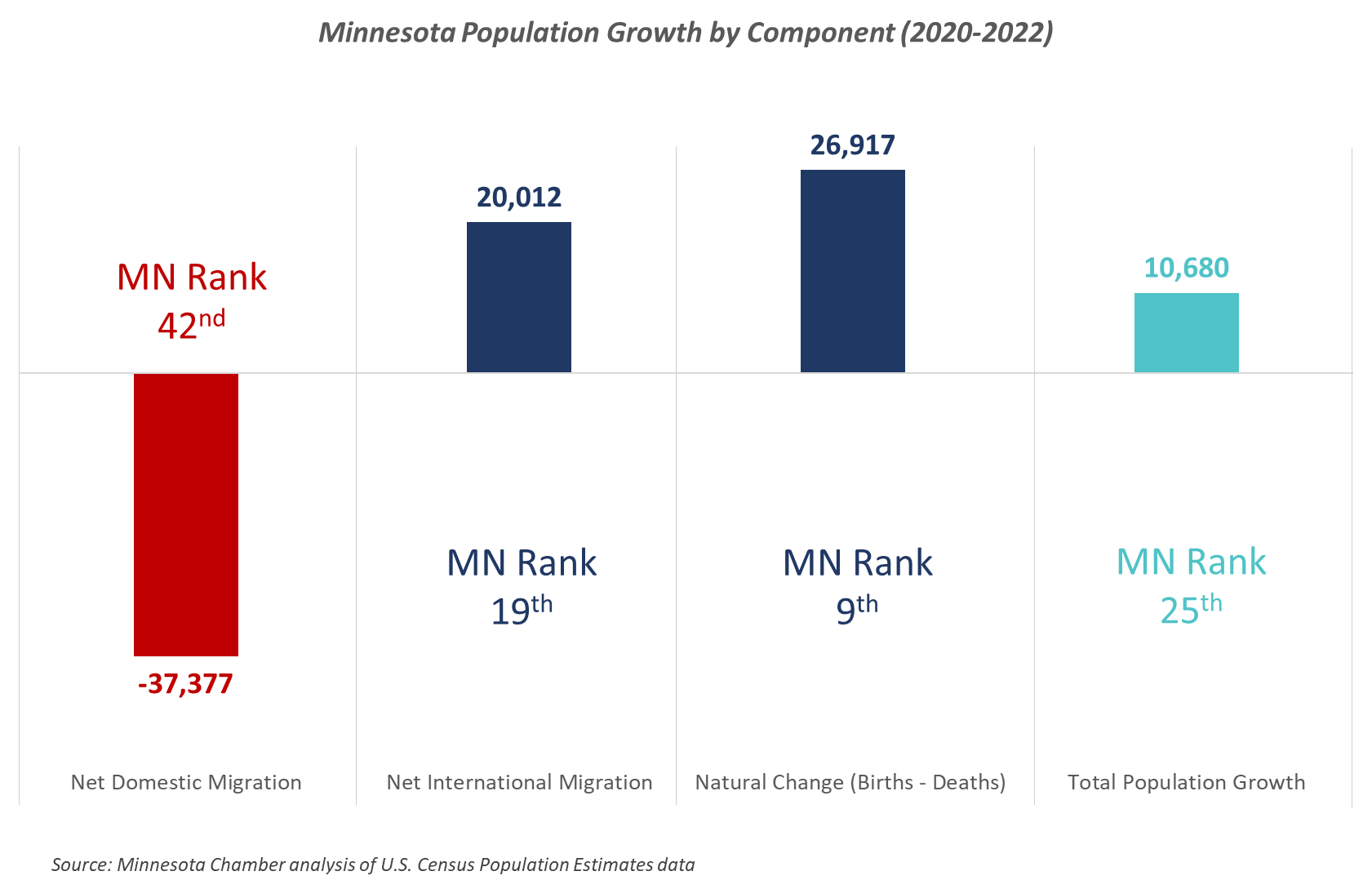

Yet, there are continued risks and uncertainty in the broader economy. Many forecasters predict slow growth or a mild recession sometime in 2023. The Federal Reserve has signaled that it will likely raise interest rates further this year to bring inflation down to its target of 2%. Minnesota’s labor market, while still strong, did cool in the last months of 2022, and labor force participation remains stuck at levels well below the pre-pandemic rate. Further, the state continues to underperform the U.S. economy in key areas the since the beginning of 2020, ranking 35th in GDP growth, 34th in job growth, and 42nd in net domestic migration.

Taken together, Minnesota’s economy heads into 2023 in a stable but uncertain place. Below we break down Minnesota’s economic performance over the past quarter.

Key Findings:

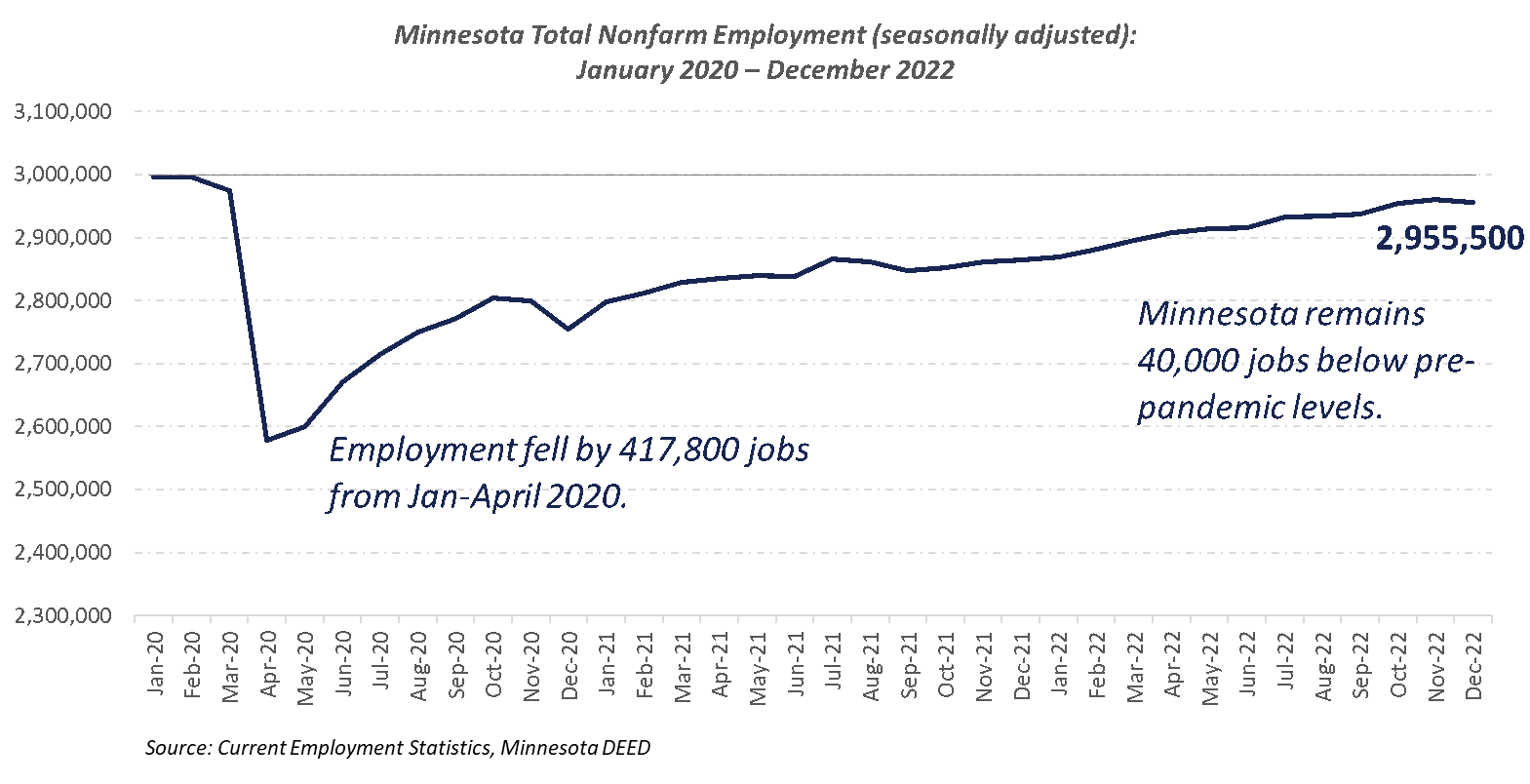

- Hiring demand cooled in late 2022 but the state’s labor market remained stable. Minnesota employment fell in December for the first time since September 2021, ending a 14-month job growth streak. However, Minnesota employers added 18,400 jobs in the fourth quarter and 91,000 jobs over the year, increasing by 3.2%.

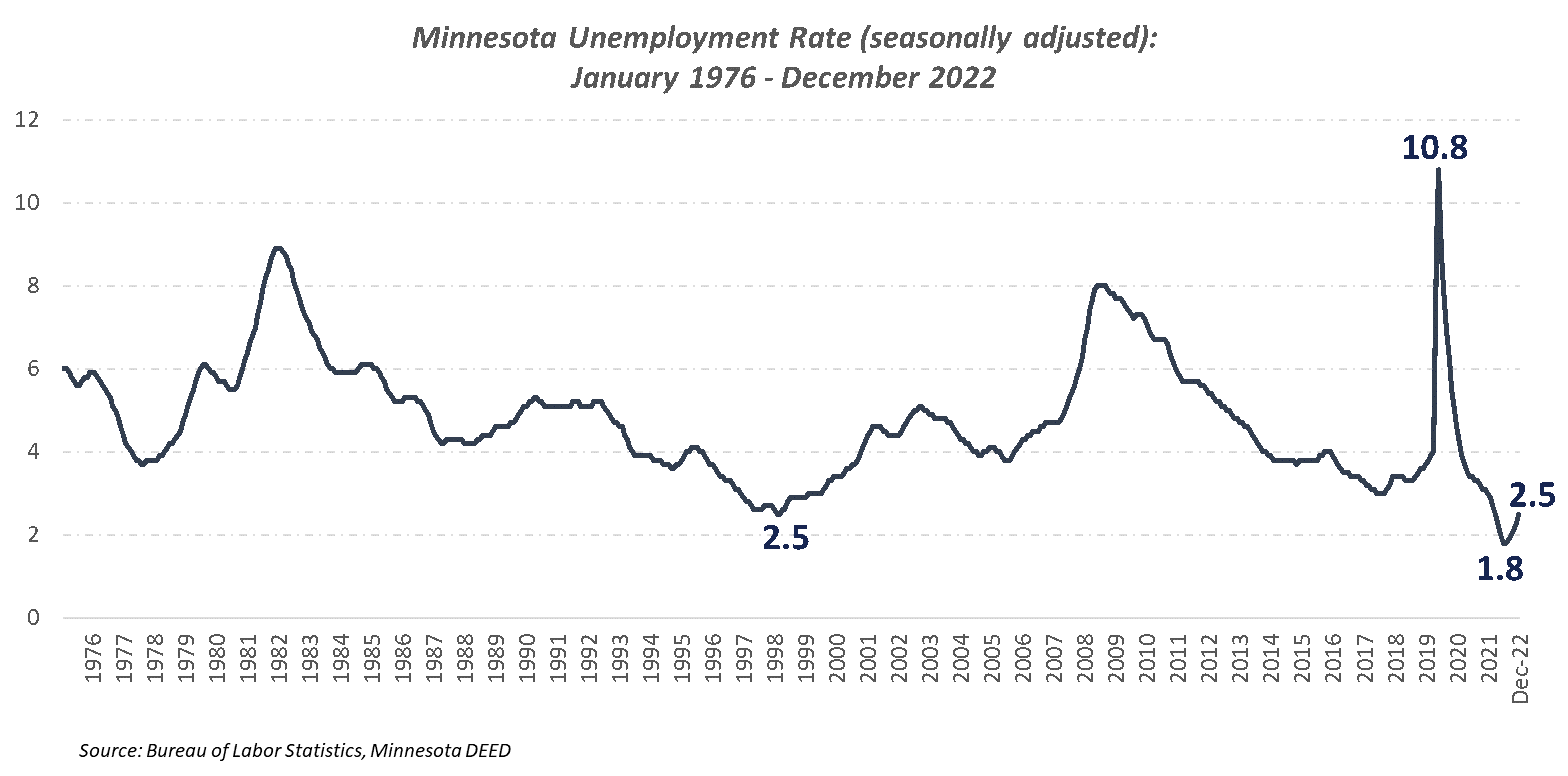

- Unemployment rose through the second half of 2022, ticking up to 2.5% in December from an all-time low of 1.8% in July. Despite the recent uptick, however, Minnesota’s unemployment remains very low by historical standards, matching the previous all-time low of 2.5% set in 1999.

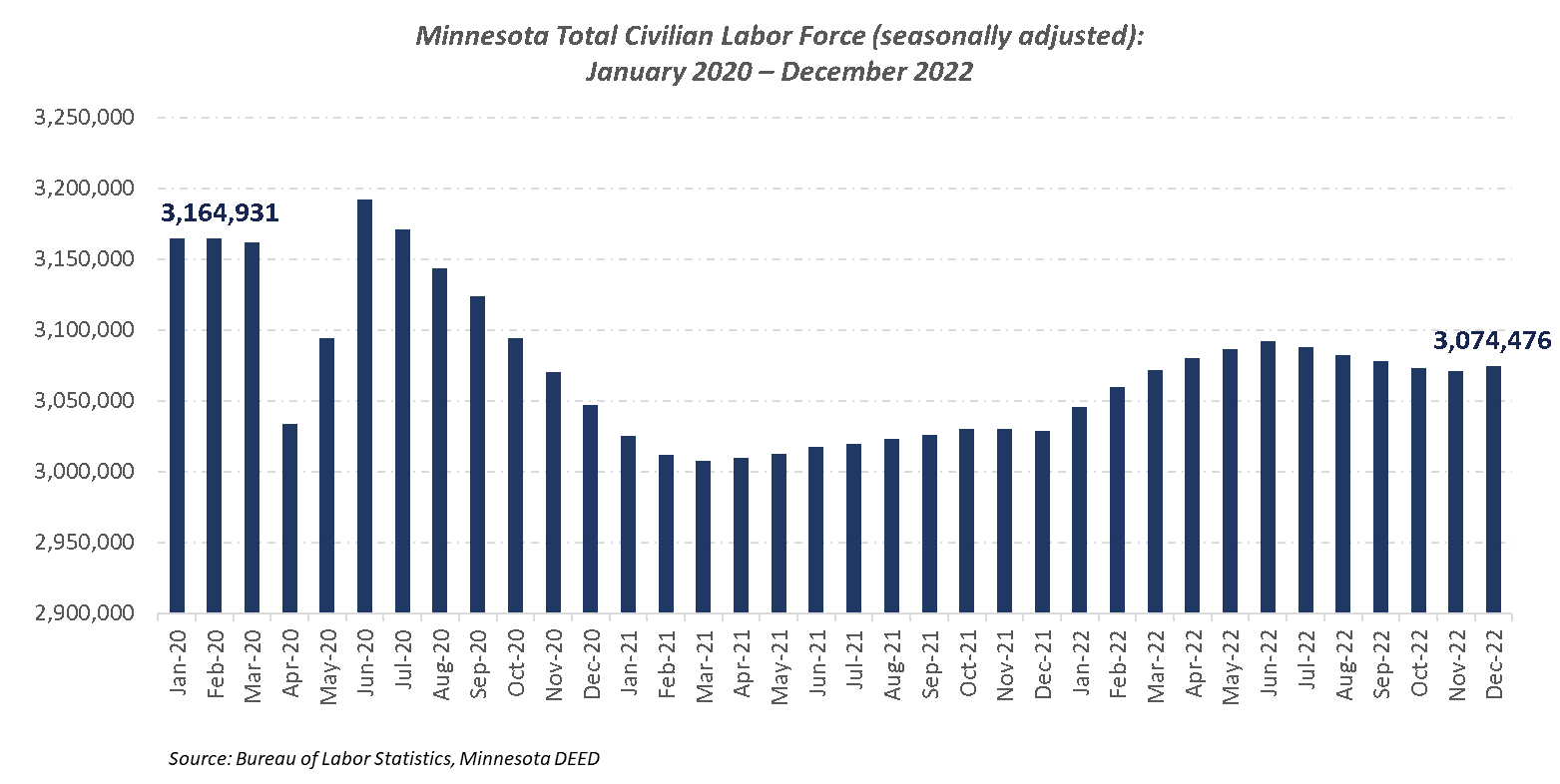

- Minnesota’s total labor force declined by 6,721 people from October to December, after showing some improvement in the first half of the year. The lack of recovery in Minnesota’s labor supply remains a critical challenge for the state’s economy.

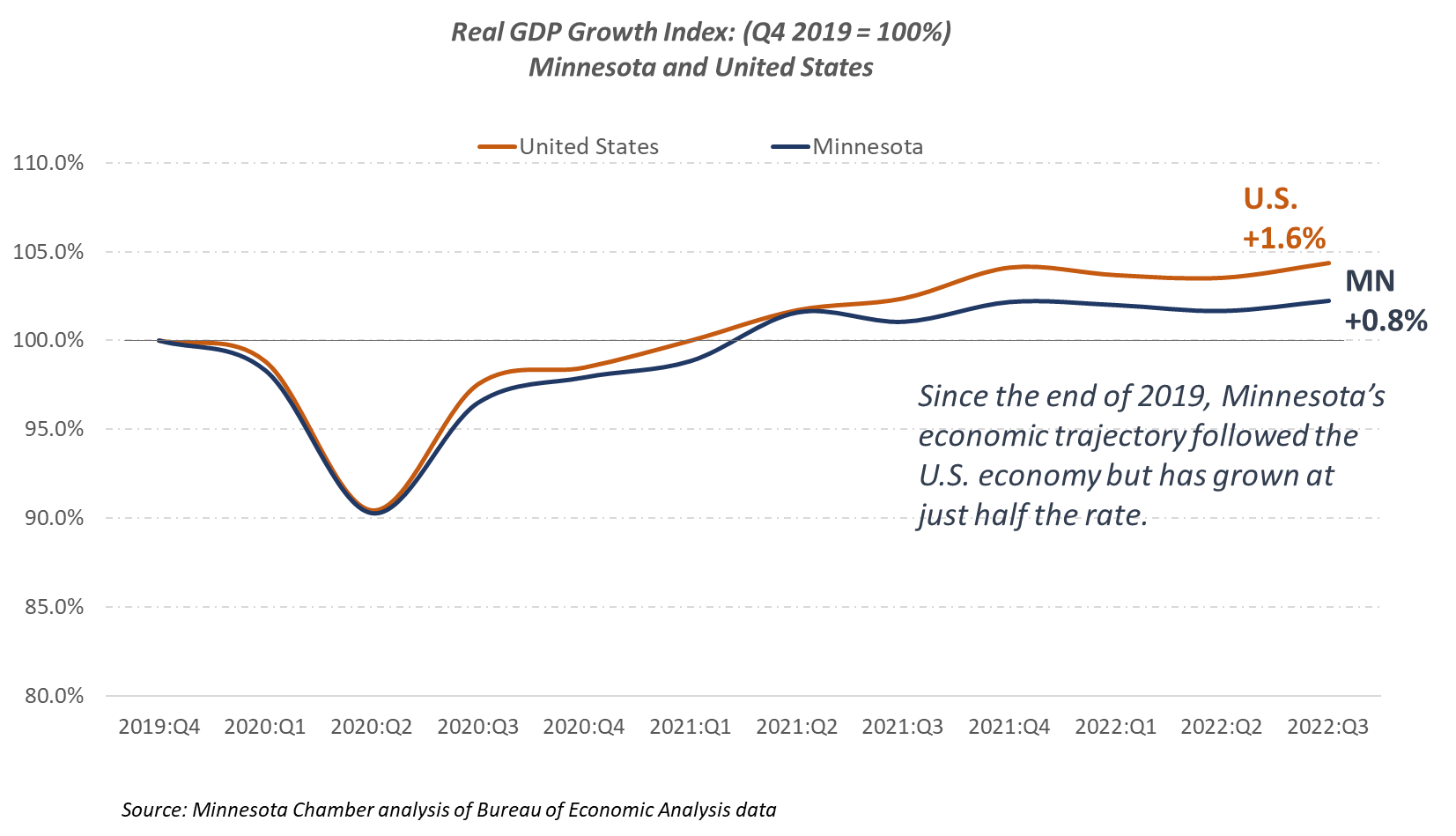

- Minnesota expanded GDP output in the third quarter but continues to trail U.S. growth. The state’s real GDP grew by 0.8% an average annual basis from the pre-pandemic peak (Q4 2019) to Q3 2022, ranking 33rd among all states, and trailing the U.S. growth rate of 1.6% in that time.

- U.S. inflation continued to cool in the fourth quarter. The consumer price index (CPI) slowed to 6.5% in December from a year earlier, down from a peak of 9.1% in June 2022.

- U.S. economic outlook remains uncertain, as forecasters show mixed possibilities in 2023. This article from the Federal Reserve provides a helpful historical review of how accurate forecasters have been in predicting recessions, and how this perspective can help shape expectations going forward.

Q3 2022 GDP Output

Minnesota’s GDP bounced back in the third quarter, increasing by 2.3% from the previous quarter. State continues to lag U.S. economic growth rates.

- Minnesota’s real GDP output grew by 2.3% in the third quarter of 2022 (most recent available data), after posting two consecutive quarters of negative growth in the first two quarters. Further, the U.S. economy grew by 2.9% in the fourth quarter, showing continued expansion through the end of the year.

- Minnesota continues to lag the U.S. economy. The state’s real GDP grew by 0.8% an average annual basis from the pre-pandemic peak (Q4 2019) to Q3 2022, ranking 33rd among all states, and trailing the U.S. growth rate of 1.6% in that time.

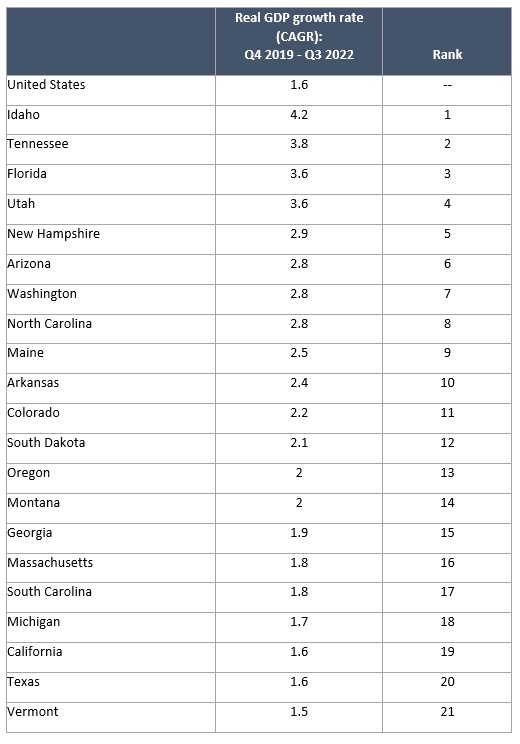

- GDP growth varied widely across states over the past two years. States in the sunbelt and mountain west grew fastest, while states in the midwest and northeast regions lagged. Idaho expanded fastest since the end of 2019, increasing real GDP by 4.2% on an average annual basis. Louisiana trailed all states with a -3.0% decline in real GDP in that time.

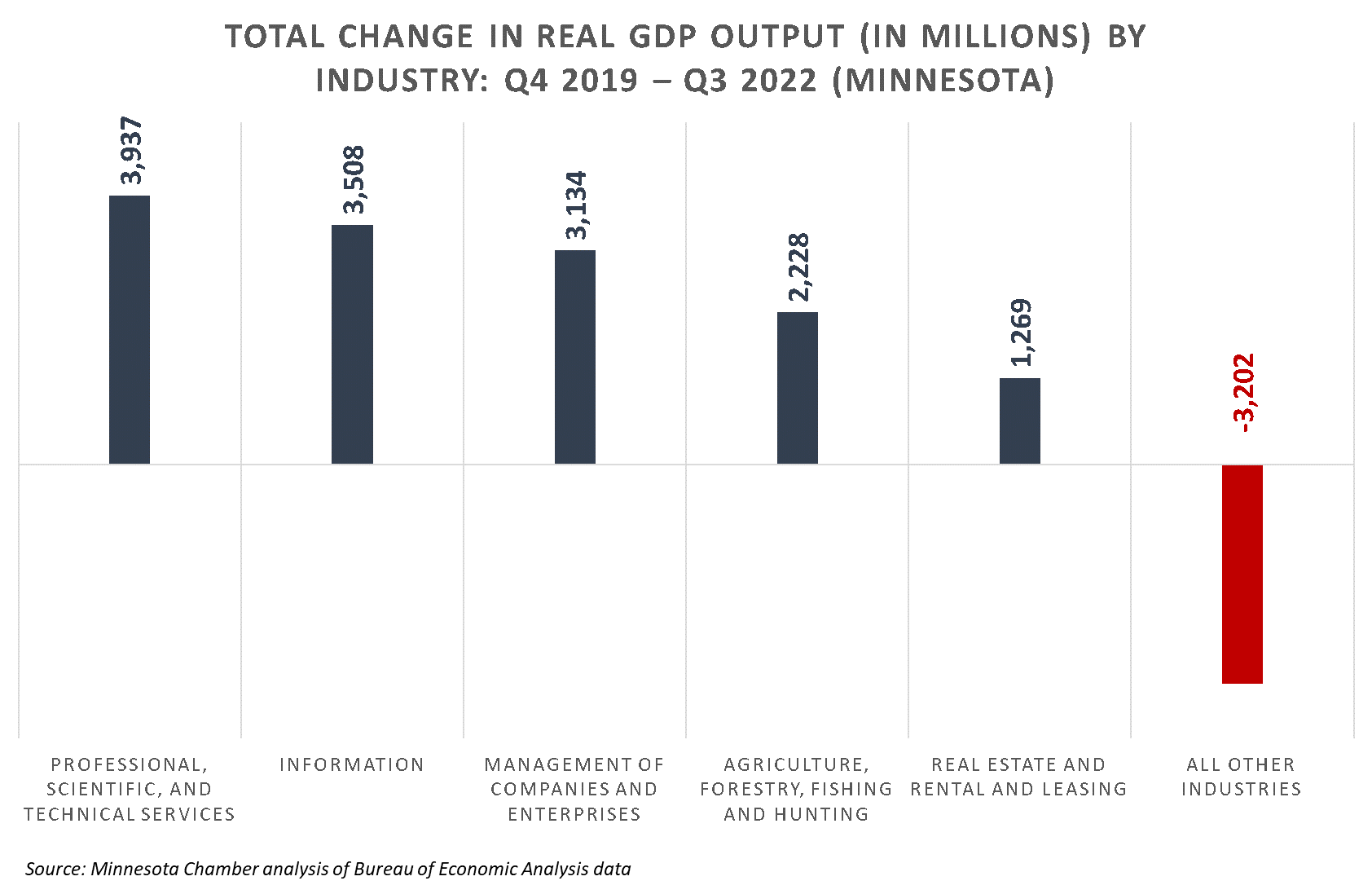

- Since the end of 2019, thirteen of twenty major industry sectors in Minnesota expanded real GDP output, while another seven remain below pre-2020 levels. The state’s five fastest growing industries – which include professional services, corporate headquarters, tech and other information activities -- accounted for over 100% of the state’s net growth in GDP output since Q4 of 2019. This shows the outperformance of high-skilled service industries since the beginning of 2020.

Source: Minnesota Chamber of Commerce analysis of Bureau of Economic Analysis data

EXPORTS

Minnesota exports grew through the third quarter as Canada continues to drive export growth for the state.

- Minnesota’s total export value increased by 28% in Q3 2022 (most recent available data) compared to the same quarter in 2021. The state outpaced U.S. exports which grew by 23% in the third quarter.

- Following a two-year trend, exports to Canada continued to drive much of the state’s growth in global activity. For example, Minnesota exported $1.2 billion in goods to Canada in Q3 2019 – which accounted for approximately 21% of the state’s total exports. But by the third quarter of 2022, exports to Canada more than doubled from their 2019 values, growing to $2.5 billion and making up 34% of Minnesota’s total exports.

- Exports grew in eight of Minnesota’s top 10 largest foreign markets in the third quarter but declined in China (-3%) and Japan (-13%).

ENTREPRENEURSHIP AND STARTUP INVESTMENT

Startup activity slowed in the fourth quarter but remains above the long-term average.

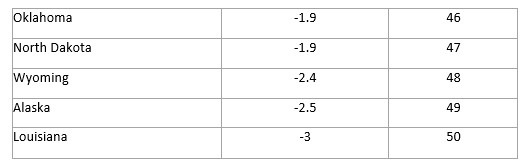

- New business filings in Minnesota slowed in the fourth quarter, dropping below 5,000 new monthly applications for the first time since December of 2020. However, new business applications remained well above the long-term average. From 2005-2019, Minnesotans filed an average of 3,440 new applications each month. Applications spiked in the second half of 2020, as disruptions from the COVID-19 pandemic spurred both need-based and opportunity-based entrepreneurship. Minnesotans filed an average of over 5,400 new business applications each month in 2021 and filed an average of 4,800 in 2022.

- Minnesotans filed a total of 61,014 new business applications in 2022. Of those, just over 20,000 are designated by the U.S. Census as “high propensity” applications, meaning that they are likely to hire paid employees within 8 business quarters. While entrepreneurial interest has risen in recent years, Minnesota can expect a less dramatic rise in the number of employer-based businesses.

- As Minne Inno reports, Minnesota startups are likely to face tighter fundraising conditions in 2023, as venture capital funds reign in deal activity and right-size valuations compared to the past two years. Minnesota reached record venture funding levels in 2021, with 196 startups raising $2.7 billion. Data from Pitchbook shows that 2022 deal activity slowed in Minnesota in line with national trends. Yet, Minnesota startups still raised $2.2 billion in 2022, which is significantly higher than pre-2020 levels.

Job Growth

Total employment fell in December, ending a 14-month job growth streak.

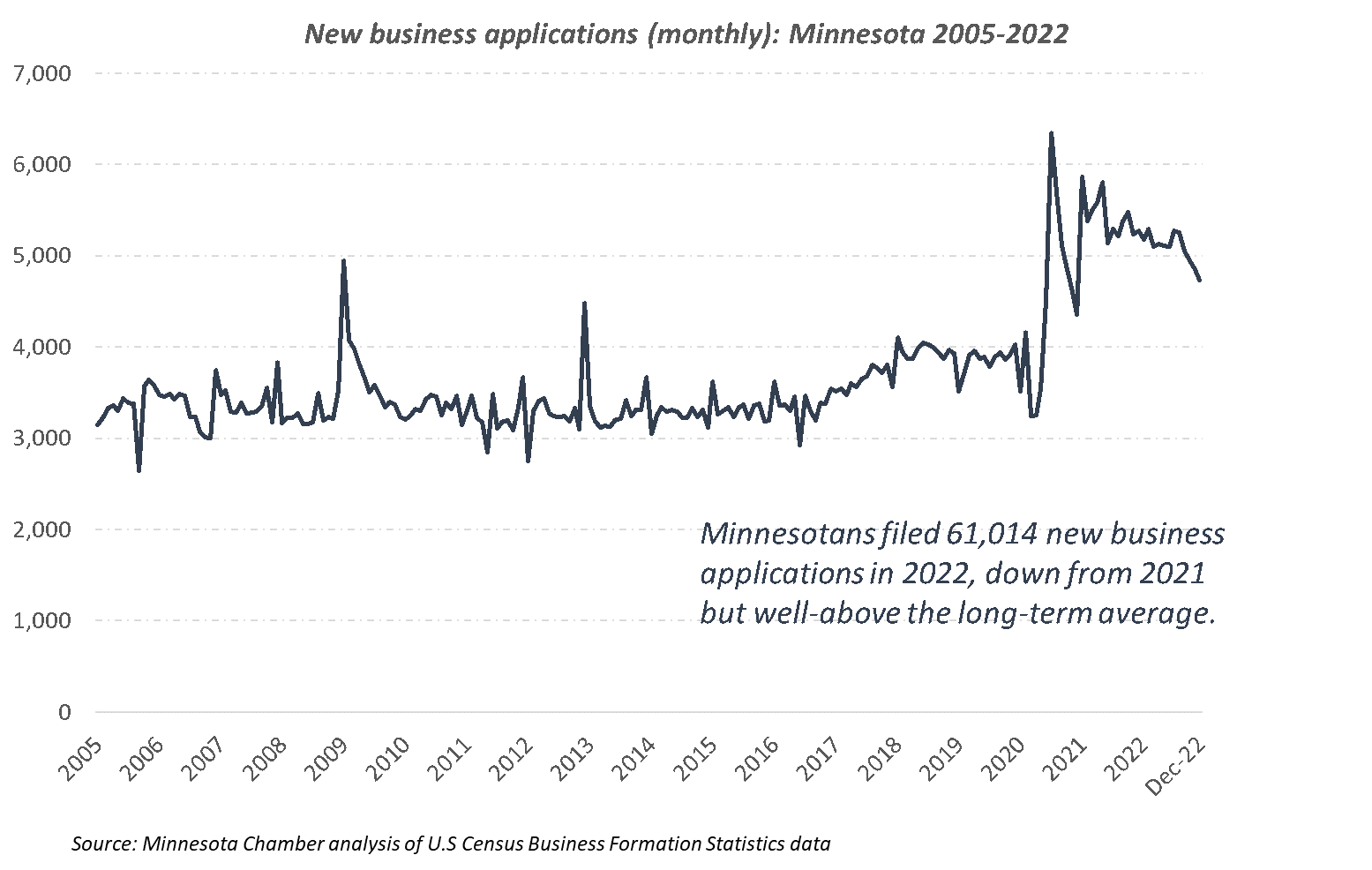

- Hiring demand showed signs of cooling in late 2022. Minnesota’s total nonfarm employment fell in December for the first time since September 2021. However, Minnesota employers added 18,400 jobs in the fourth quarter and 91,000 jobs over the year, increasing by 3.2%.

- Minnesota job growth outpaced U.S. in 2022 but still trails the U.S. since early 2020. Minnesota ranked 34th among states in job growth from January 2020 – December 2022, as reflected on the Minnesota Chamber Foundation’s Economic Dashboard. As of December, twenty-eight states (including Washington D.C.) matched or surpassed pre-pandemic job levels, and twenty-three states have yet to recover the jobs lost in spring of 2020.

- The recent decline in total employment is a warning sign, but it may mask other areas of continued strength in the labor market. First, job losses were concentrated in just a handful of industries, including areas like local government, temporary employment/staffing agencies, construction, and food manufacturing. Many sectors continued to add jobs in December, led by Leisure and Hospitality and Education and Health Care. Other notable industries important to Minnesota’s economy, such as the management of companies and enterprises industry (which includes corporate headquarters locations), also added jobs in December. In total, private sector employers added 900 jobs in December, while government shed 6,100 jobs.

UNEMPLOYMENT AND LABOR FORCE PARTICIPATION

Unemployment rate ends the year at 2.5% while labor force participation remains flat.

- Minnesota’s unemployment rate ticked up through the fourth quarter but remains very low by historical standards. Minnesota’s unemployment rate rose to 2.5% in December, up from a low point of 1.8% in July.

- Encouragingly, the unemployment rate for Black Minnesotans declined significantly in late 2022, hitting 3.9% in December (on a 12-month moving average). This occurred alongside increasing labor force participation rates for Black Minnesotans, which rose to 69.8% in November and surpassed the White workforce participation rate.

- After increasing in the first half of 2022, Minnesota’s total available labor force declined by 6,721 in the fourth quarter. As of December, Minnesota had 90,000 fewer people in the workforce than at the beginning of 2020. Drivers of Minnesota’s decline in available workers include falling labor force participation (i.e. the share of adults 16 and older that are actively working or looking for work) and negative net migration.

- Labor force participation declined sharply and has not recovered. Minnesota’s labor force participation rate flattened out at 67.9% in late-2022, sitting nearly 3 percentage points lower than January 2020. The sharp decline in workforce participation is linked to early retirements among a host of other factors, including lack of childcare availability, health concerns, and other family care responsibilities. Notably, labor force participation in Minnesota declined by nearly twice as much for women as men during the pandemic, according to an analysis from DEED.

- International migration to Minnesota increased in 2022 but could not offset large domestic migration losses. Minnesota faired among the worst among all states in net domestic migration in 2021 and 2022, losing a combined 39,000 people to other states over the two years and ranking 42nd in the nation. Minnesota did better at attracting international migrants – which increased by a net 14,194 in 2022 and ranked 19th among states since 2020. However, unlike past years, the positive flow of international migrants was not enough to offset domestic migration losses.

SUPPLY CHAIN AND INFLATION

U.S. inflation rate continues to ease in late-2022.

- U.S. inflation continued to cool in the fourth quarter. The consumer price index (CPI) slowed to 6.5% in December from a year earlier, down from a peak of 9.1% in June 2022. December marked the sixth consecutive month of easing inflation in the U.S. economy.

- Despite the encouraging cooling of inflation, high prices continue to impact businesses’ bottom lines and hamper near-term investments. A recent survey conducted by DEED and the Minneapolis Federal Reserve showed that while Minnesota manufacturers raised prices and increased orders in 2022, overall profits still contracted slightly.

More Grow Minnesota! findings and business resources:

Recommended Articles

The Minnesota Chamber of Commerce released this letter on behalf of more than 60 CEOs of Minnesota-based companies today.

The...