Grow Minnesota! Quarterly Economic Snapshot: Spring 2022

The Quarterly Economic Snapshot is an overview of key indicators measuring Minnesota’s current economic performance. Analysis is provided in partnership with Grow Minnesota! and the Minnesota Chamber Foundation.

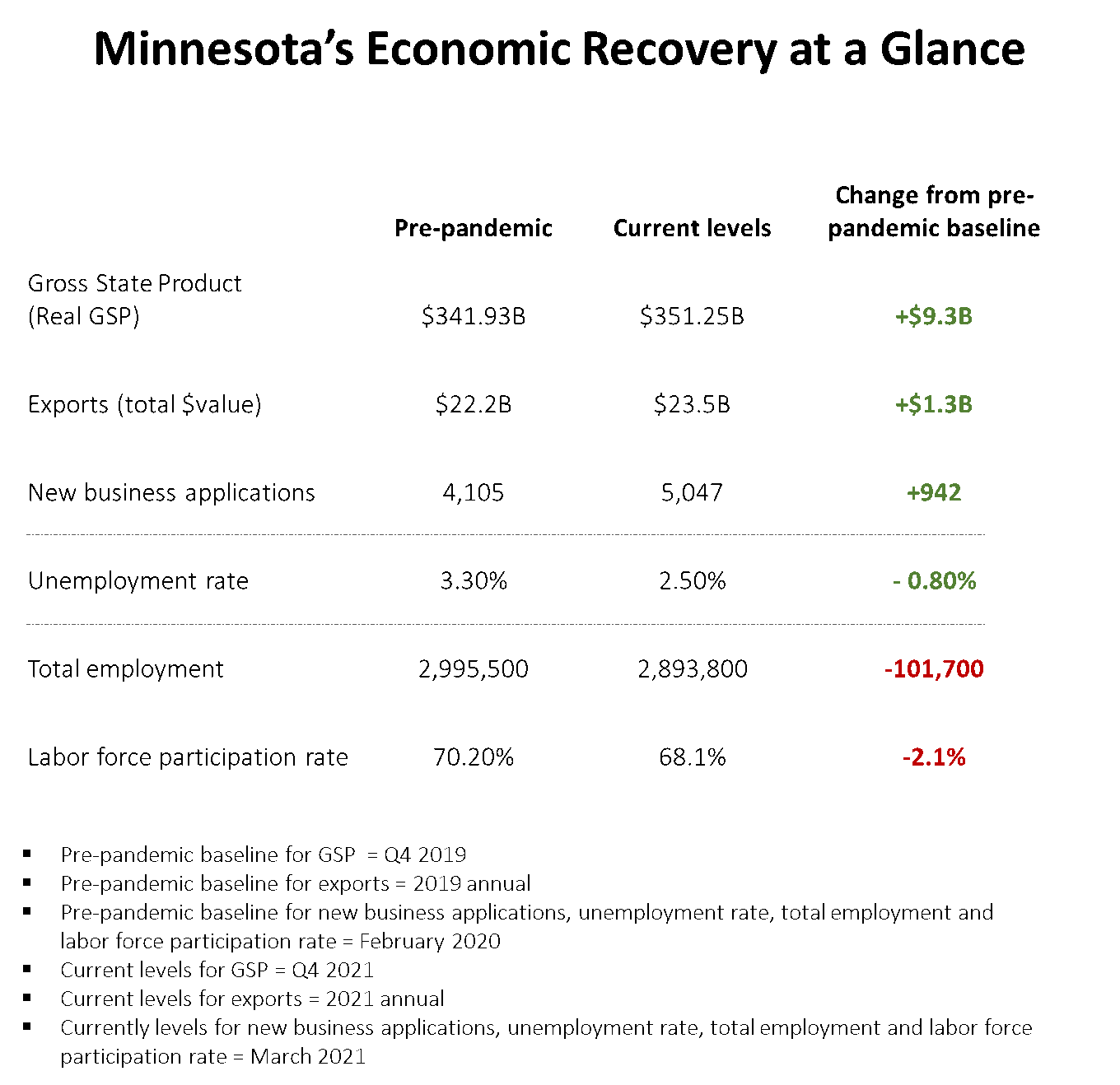

Highlights:

-

Minnesota’s real GDP expanded by 5.0% in the fourth quarter of 2021, ranking 37th best among all states.

-

Minnesota exports grew to $23.5 billion in 2021, rebounding strongly after declining in 2020.

-

New business applications remain high in early 2022. Total applications were 38% higher in January-March 2022 compared to January-March of 2019.

-

Total employment inched up in March 2022, reaching 2,893,800 jobs on a seasonally adjusted basis. Total employment expanded by 0.4% from the previous month and 2.3% year-over-year. Minnesota remained 101,700 jobs below pre-pandemic employment levels as of March 2022.

-

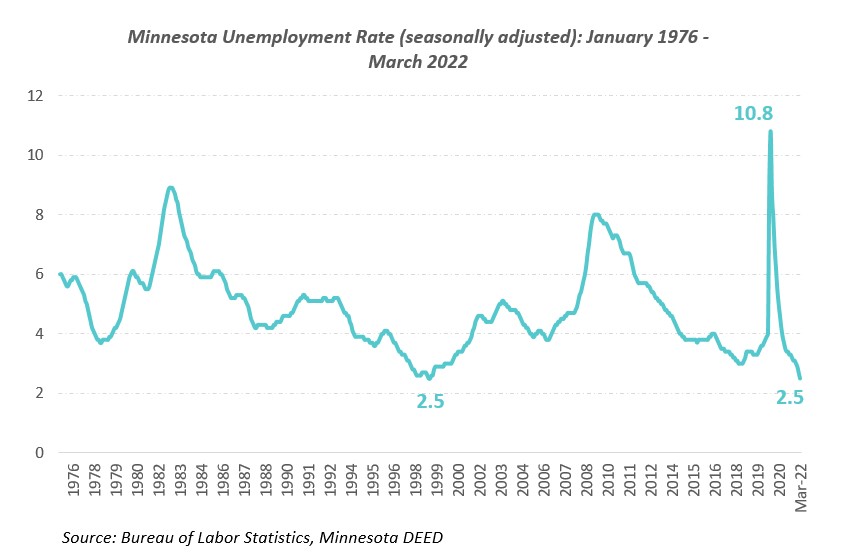

Minnesota’s unemployment rate reached record lows in March 2022, declining to 2.5% on a seasonally adjusted basis. Only twice since 1976 has Minnesota’s unemployment rate registered this low.

-

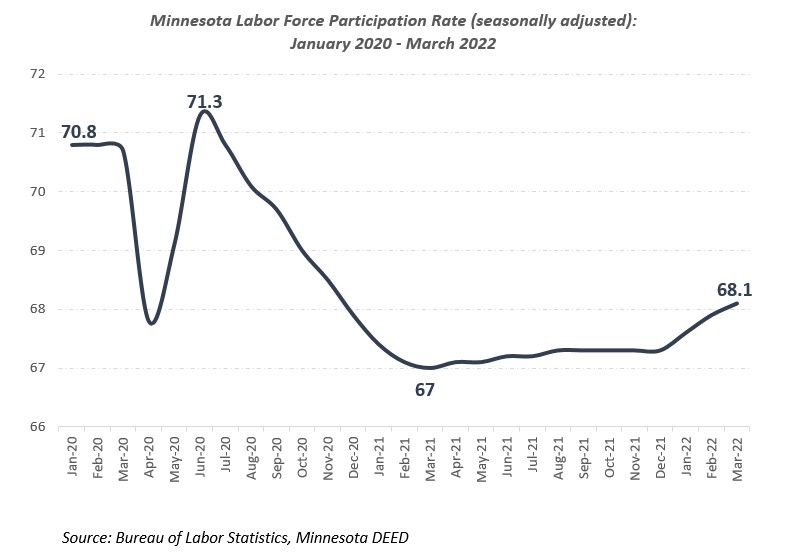

Labor Force Participation Rate (which measures the share of adults 16 and older who are working or actively looking for work) rose for the third consecutive month, reaching 68.1% in March.

-

U.S. inflation continued to rise in March 2022, with prices climbing 8.5% higher than a year prior in March 2021.

Overview

The Minnesota economy continued to expand in the fourth quarter of 2021 and first quarter of 2022.

State GDP and exports surpassed pre-pandemic levels in 2021 and have experienced growth over consecutive quarters. New business applications and venture capital investment surged during the pandemic and remain high in the early months of 2022. These are positive signs of investment and productivity in Minnesota’s economy.

However, notable challenges and uncertainties cloud the state’s outlook going forward.

Tight labor markets, rising inflation and supply chain challenges continue to constrain hiring and overall economic growth. Minnesota’s total employment remains 101,700 jobs below the pre-pandemic peak and grew by just 0.4% in March 2022, despite the state reaching a record low unemployment rate of 2.5% last month. The number of job openings far exceed the number of unemployed persons, creating sustained hiring challenges for employers across the state.

The state’s low unemployment has been explained in part by falling labor force participation during the pandemic. Some Minnesotans dropped out of the workforce altogether and are therefore not counted in the official unemployment rate. Yet, this may be changing. Minnesota’s labor force participation rose in January 2022 for the first time since June of 2020 and rose twice more since then, reaching 68.1% in March. While workforce participation remains below the pre-pandemic rate, it is a welcomed step in the right direction.

Finally, rising costs and supply chain challenges continue to constrain production and growth of Minnesota firms. The war in Ukraine and broader inflationary pressures only create further uncertainty in the near term.

The Minnesota Chamber of Commerce’s Grow Minnesota! program is currently conducting a survey of supply chain leaders in the state to better understand how supply chain issues impact business performance, and what companies are doing to respond to these challenges. Findings will be released later this spring.

GDP

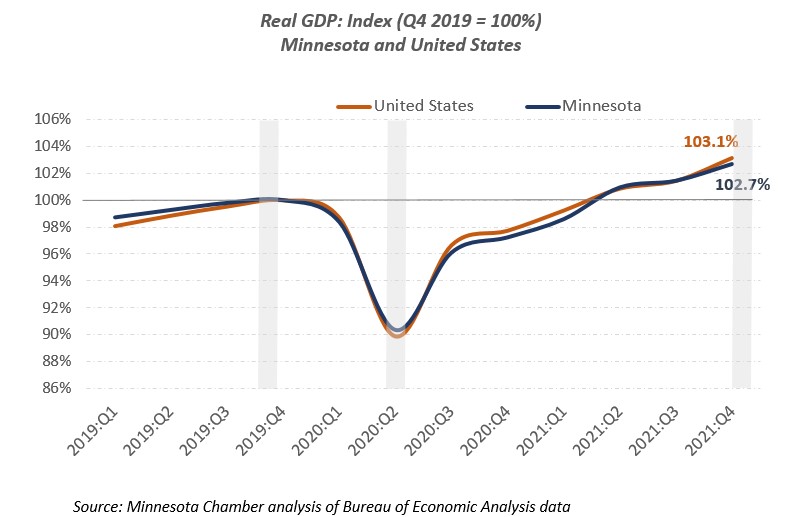

Minnesota’s economy continues to expand, with GDP growing at 5.0% in Q4 2021

- Minnesota’s real GDP expanded by 5.0% in the fourth quarter of 2021, ranking 37th best among all states.

- Minnesota surpassed pre-pandemic GDP levels in Q2 2021 and has had six consecutive quarters of expansion since plummeting by an unprecedented -28.9% in Q2 2020.

- Minnesota’s GDP growth has closely mirrored the U.S. trendline since 2020. The state ranks 24th nationally in GDP growth from Q4 2019 (pre-pandemic peak) to Q4 2021.

- The fastest expanding sectors in the fourth quarter in Minnesota were:

- Information (19%)

- Administrative and support and waste management and remediation services (16.4%)

- Wholesale trade (12.5%)

- Manufacturing (12%)

- Professional, scientific, and technical services (11.8%)

Exports

Minnesota exports bounce back strongly after 2020 decline

- Minnesota exports grew to $23.5 billion in 2021, rebounding strongly after declining in 2020.

- Largest export markets and product categories:

- Minnesota’s top three largest export markets in 2021 were Canada ($6.6 billion), China ($2.7 billion), and Mexico ($2.5 billion). Exports to these three countries together account for nearly half of the state’s total export value.

- Machinery ($4.2 billion), optic/medical goods ($3.7 billion), and electrical equipment ($3.1 billion) led all product categories in exports last year.

- Fastest growing export markets and product categories:

- As reported by the Minnesota Trade Office, North American markets drove growth in 2021, with exporting increasing by 36% in Canada and 27% in Mexico. Additionally, exports to the Philippines surged, growing by 135% last year and becoming the state’s 6th largest export market.

- Mineral fuel/oil, machinery, and electrical equipment were the fastest growing exports by product category in 2021, while optical/medical goods fell by -5%.

New business applications and startup investment

Startup activity surged during the pandemic and remains elevated in early 2022

- Minnesota business applications (i.e., planned business starts) accelerated during the pandemic and remain high. Total business applications increased by 26% in 2020 and 2021 compared to the prior two-year baseline of 2018 and 2019.

- New business applications remain high in early 2022. Total applications were 38% higher in January-March 2022 compared to January-March of 2019.

- A record 175 Minnesota startups raised a total of $1.34 billion in venture capital in 2021. Venture capital investment continues to surge in Minnesota, following national trends.

- The Minnesota Chamber Foundation released a detailed analysis of the state’s entrepreneurship activity in May 2022.

Job Growth

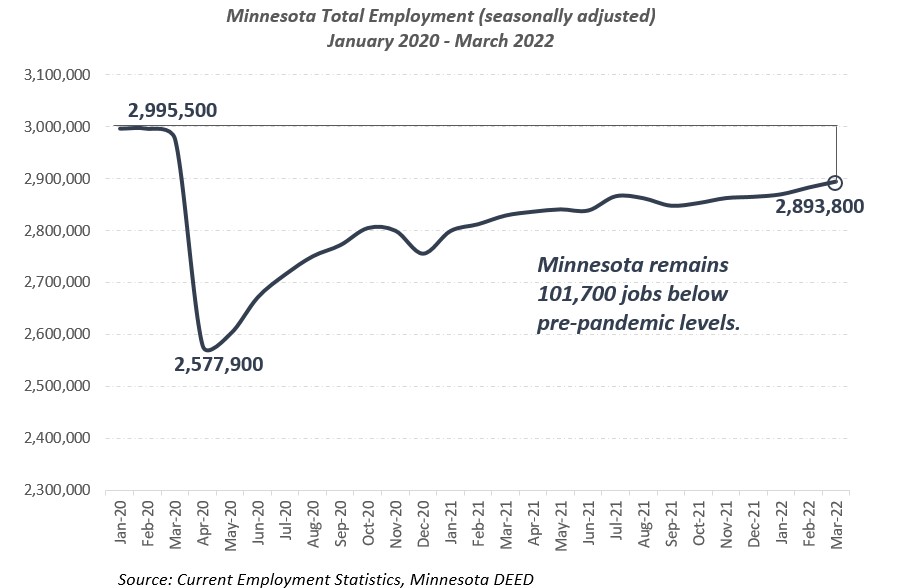

Employment demand continues to outpace supply, constraining job recovery

- Total employment inched up in March 2022, reaching 2,893,800 jobs on a seasonally adjusted basis. Total employment expanded by 0.4% from the previous month and 2.3% year-over-year.

- Minnesota remained 101,700 jobs below pre-pandemic employment levels as of March 2022.

- As evident in the following sections, slow job recovery is due largely to labor force availability challenges. Minnesota employers reported 254,000 job openings in January 2022 and had the 5th highest openings rate in the U.S.

- Employment grew fastest in the following sectors in March:

- Arts, Entertainment, and Recreation (2.6%)

- Real Estate and Rental and Leasing (1.7%)

- Mining and Logging (1.5%)

- Information (1.2)

Unemployment and labor force participation

Minnesota reaches record low unemployment rate, while labor force participation rises for the third straight month.

- Minnesota’s unemployment rate reached record lows in March 2022, declining to 2.5% on a seasonally adjusted basis. Only twice since 1976 has Minnesota’s unemployment rate registered this low.

- Concerningly, however, Black unemployment rose by 0.6% in March and is 2.6% higher than the pre-pandemic baseline, according to data by the Department of Employment and Economic Development. Hispanic unemployment is just 0.1% higher than pre-pandemic rates and rose slightly to 5.1% in March.

- Minnesota’s Labor Force Participation Rate (which measures the share of adults 16 and older who are working or actively looking for work) rose for the third consecutive month, reaching 68.1% in March.

- Recent labor force participation gains are an encouraging sign that some Minnesotans who dropped out of the workforce during the pandemic may be reentering the job market.

- Minnesota had the 6th highest labor force participation nationally in March, trailing only the District of Columbia (72.1%), Nebraska (69.85%), North Dakota (69.2%), Colorado (68.9%) and South Dakota (68.5%).

Supply chain and inflation

Rising costs and supply chain bottlenecks continue to hinder business operations

- U.S. inflation continued to rise in March 2022, with prices climbing 8.5% higher than a year prior in March 2021.

- As Curtis Dubay of the U.S. Chamber of Commerce describes in a recent article, inflationary pressures point to supply and demand imbalances, supply chain disruptions, worker shortages, and monetary measures to increase liquidity earlier in the pandemic.

- While state-level inflation data is limited, the Mid-American Economy survey – conducted each month by Creighton University – provides some insight. Supply chain managers from a nine-state area, including Minnesota, reported surging wholesale prices and supply chain pressures.

- The report states, “Creighton’s monthly survey is tracking the highest and most consistent inflationary pressures at the wholesale level in more than a quarter of a century of conducting the survey.”

- The Minnesota Chamber of Commerce’s Grow Minnesota! program is currently conducting a survey of supply chain leaders in the state to better understand how supply chain issues impact business performance, and what companies are doing to respond to these challenges. Findings will be released later this spring.

More Grow Minnesota! findings and business resources:

Looking for ways to grow your business? We can help.

Contact Grow Minnesota! staff at growminnesota@mnchamber.com today to get answers to your questions and/or to schedule your Grow Minnesota! visit.

Recommended Articles

The Minnesota Chamber of Commerce released this letter on behalf of more than 60 CEOs of Minnesota-based companies today.

The...