2024 State of business retention and expansion in Minnesota

Quick Menu

-

Overview and key findings

-

Report methodology

-

2023 expansion activity in Minnesota

-

Public announcements of expansions in 2023

-

Trends and factors driving business investment decisions in Minnesota

-

Conclusions

Grow Minnesota!® background

Grow Minnesota!® is a program of the Minnesota Chamber of Commerce partnering with dozens of local chambers of commerce and economic development organizations around the state to collect on-the-ground economic insights and connect businesses with resources to grow and expand in the state. Since its founding in 2003, Grow Minnesota!® has conducted close to 14,000 business retention and expansion visits and provided direct assistance to thousands of Minnesota companies.

Grow Minnesota!® is grateful for its continued partnership with local chambers, economic development entities, resource providers and business investors for their engagement and continued support.

Back to top

Overview and key findings:

Minnesota experienced an interesting mix of business expansion activity in 2023. On one hand, the total number and size of business expansion announcements appear to be increasing steadily, continuing a three-year trend of heightened project activity coming out of the COVID-19 pandemic and 2020 economic downturn. Minnesota is leveraging its existing industry strengths, securing significant investments in health care and med-tech, biomanufacturing and food processing, data centers and advanced manufacturing, wood products and machinery, and more. These investments will create momentum in key industries and spur innovation in Minnesota for years to come.

However, Minnesota businesses also face a host of barriers to grow and expand. Businesses and economic developers cited numerous challenges, including continued hiring difficulties, local housing and child care shortages, a low supply of available sites and industrial properties, high borrowing costs, and growing concerns about the state’s tax and regulatory environment. While some companies successfully navigated these challenges and forged ahead with expansion plans, others indicated they are pausing new investments or placing expansions elsewhere.

Further, the broader economic landscape has shifted in recent years. A combination of market dynamics and federal policy factors have led to a rise in “megaprojects” in the United States, with companies investing billions of dollars in new facilities, particularly in electric vehicle and battery manufacturing, semiconductors, biomanufacturing and clean energy. These projects are so far most prevalent in the nation’s industrial centers of the Midwest and Southeast.

Minnesota’s economic development professionals indicate that these dynamics have increased the volume and scale of opportunities in their communities. Many described that they are busier than ever, fielding requests for information from companies interested in locating large industrial projects in their community. However, landing such large-scale projects in Minnesota may come with difficulties. Megaprojects often come with mega-requirements, including shovel-ready sites over 100 acres, enormous energy and water demands, access to hundreds or thousands of available workers and large state and local incentives. Speed-to-market is critical in many of these projects, requiring localities and states to have the existing infrastructure and streamlined approval processes in place to compete. In some cases, local communities may not be eager to commit the necessary resources to accommodate projects of this scale. In other cases, a project might be an attractive fit, but barriers related to workforce availability, environmental permitting delays and a shortage of large shovel-ready sites

could pose a hurdle to competing for such projects.

These trends and opportunities raise as many questions as answers and should foster a healthy dialogue from stakeholders around the state to assess how Minnesota can best position itself to further support business investments in the years to come.

Key findings:

Strengths

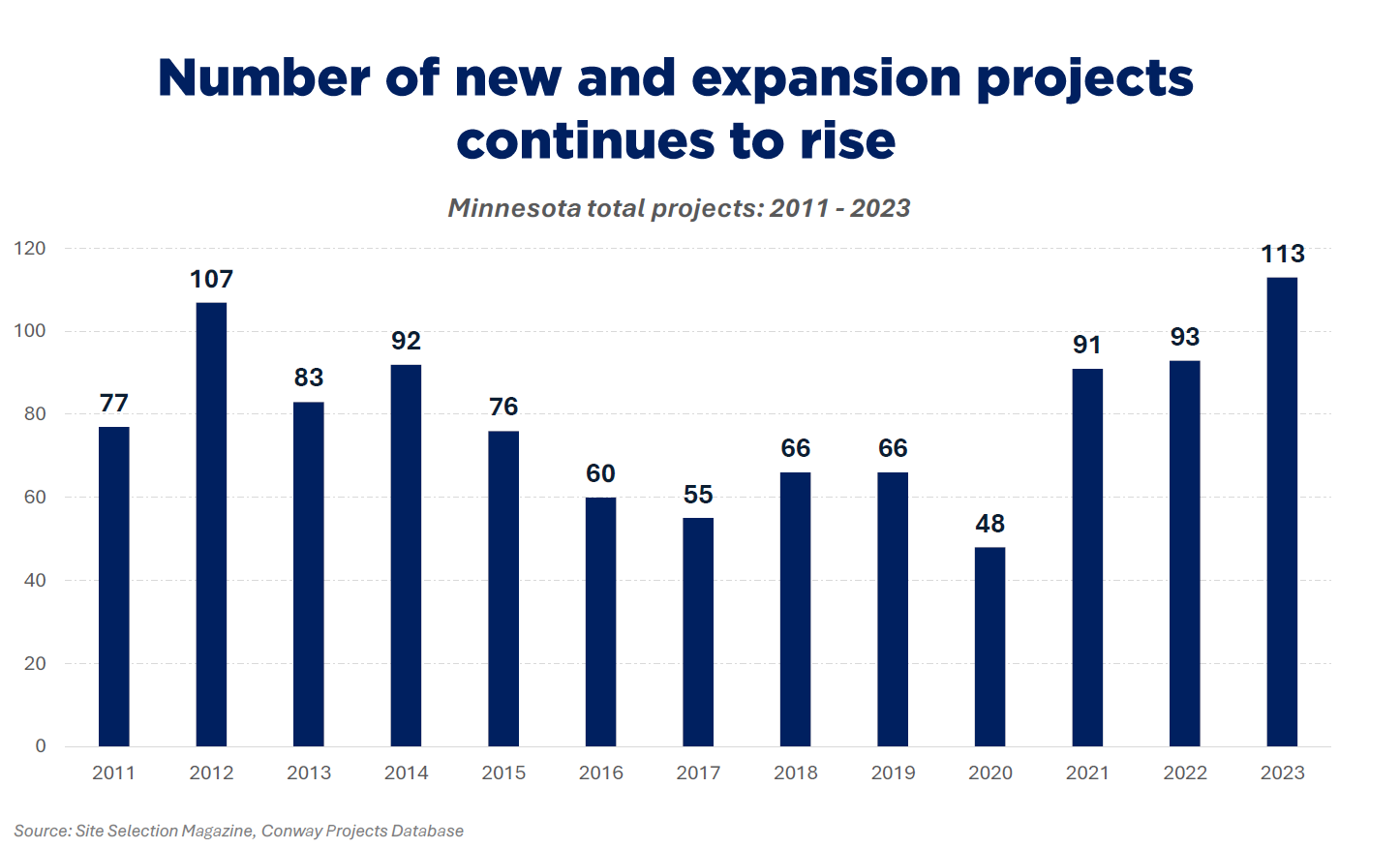

- Minnesota saw strong overall project activity in 2023, continuing its post-2020 rise. Data from Site Selection Magazine’s annual Governor’s Cup report shows Minnesota registered 113 new and expansion projects in 2023, up from 93 in 2022.

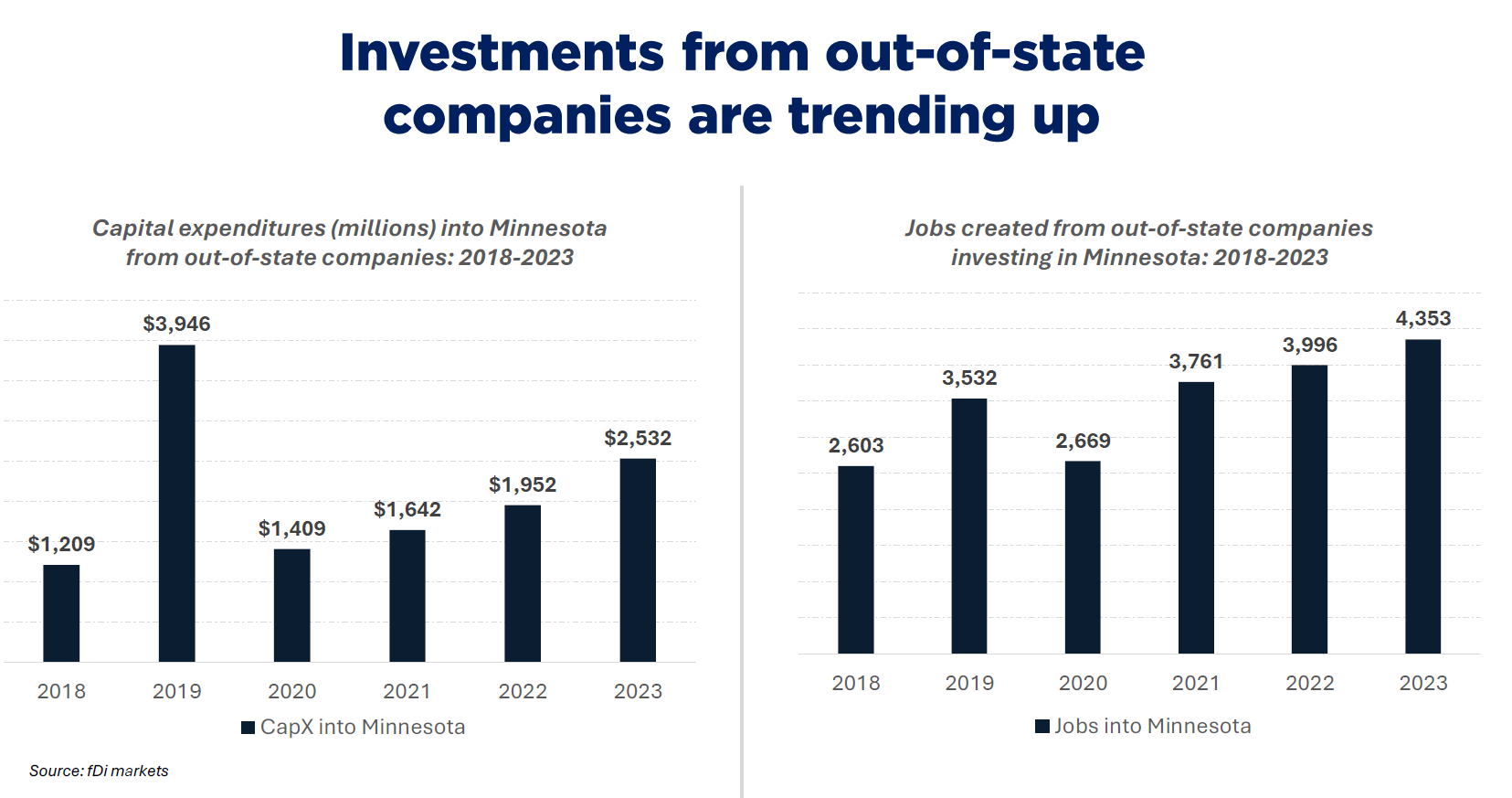

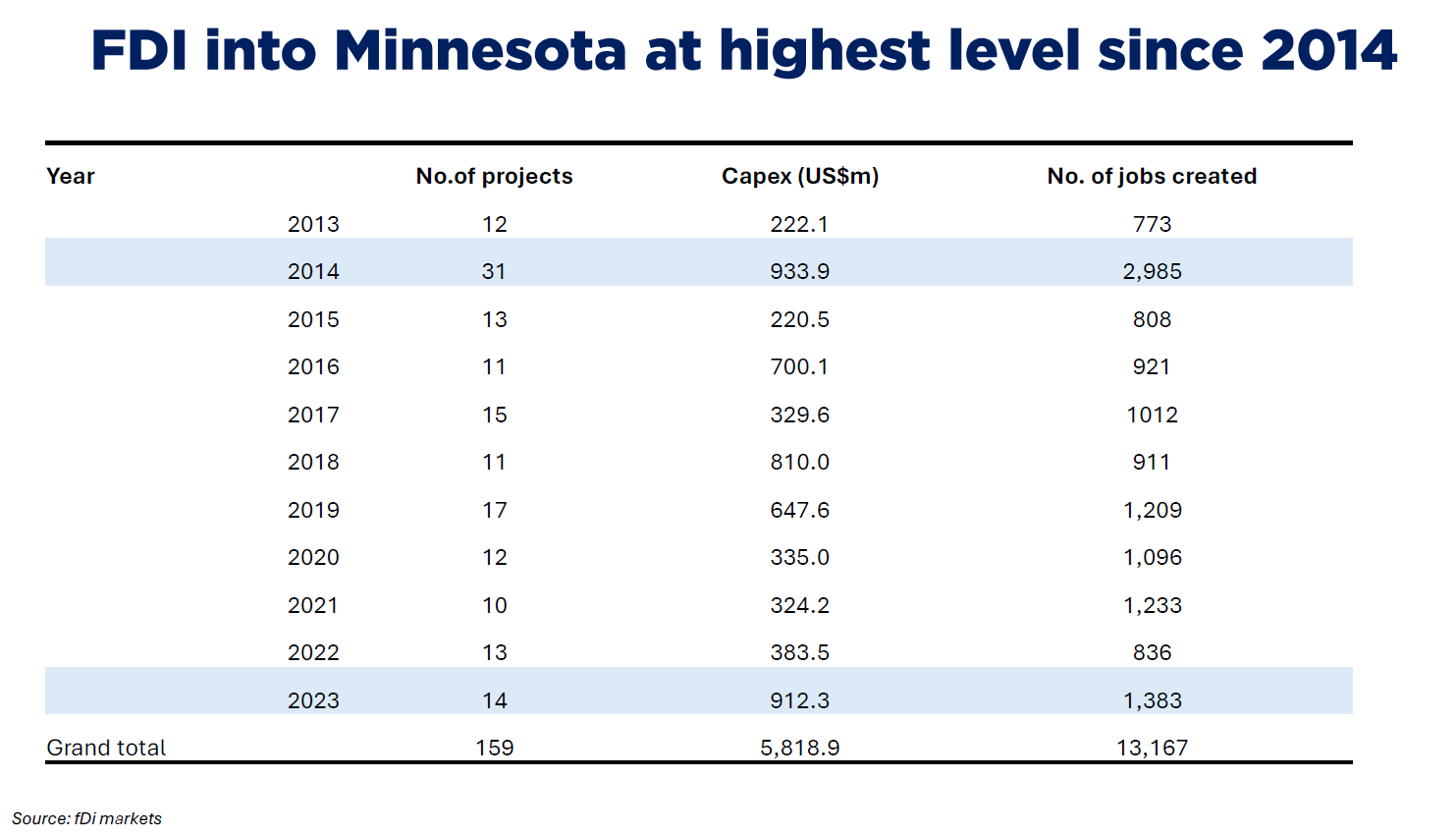

- Investments into Minnesota from out-of-state companies increased to $2.5 billion in capital expenditures and 4,353 jobs created in 2023. Likewise, the state attracted $912 million in foreign direct investment, which was the highest investment level since 2014.

- Minnesota secured notable, large investments across a range of sectors in 2023, from health care and med-tech to food and ag to data centers and high-tech manufacturing.

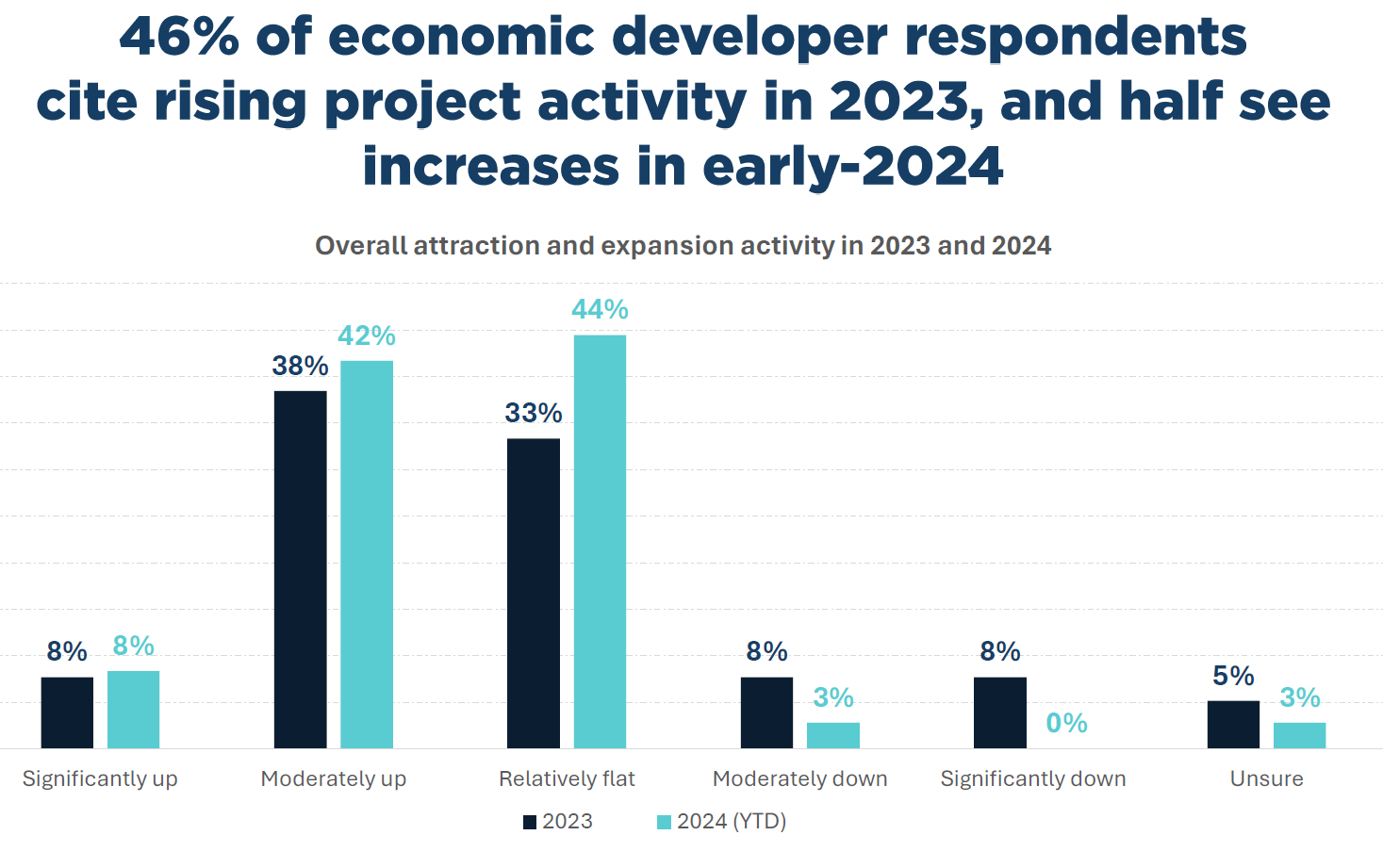

- Forty-six percent (46%) of local and regional economic developers surveyed reported that overall expansion and attraction activity was moderately or significantly up in 2023, and fifty percent reported increased levels in the early part of 2024.

- Interviews with economic developers revealed that both the volume and size of project leads are increasing, with communities seeing opportunities for large-scale investments.

Challenges

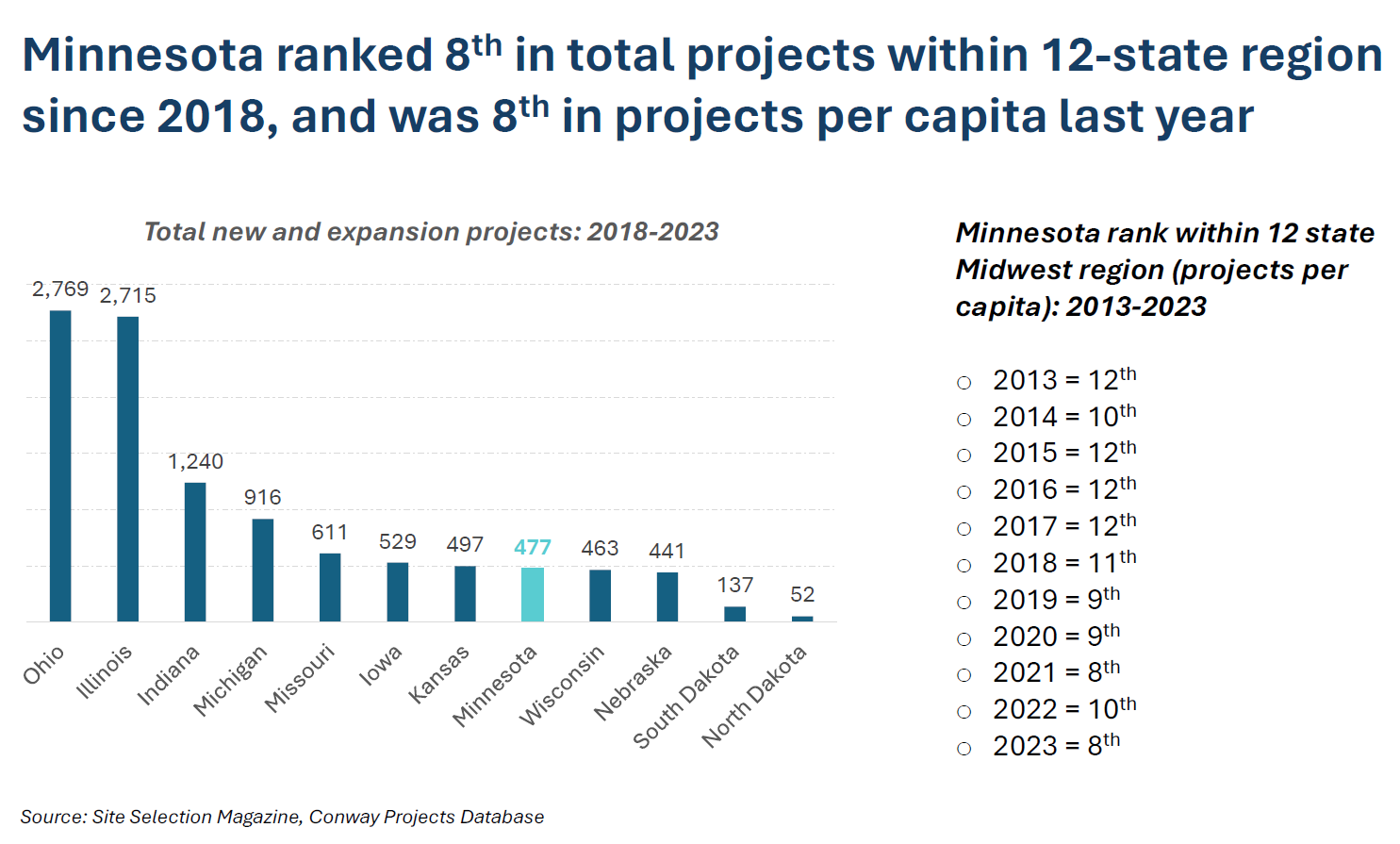

- Despite strong overall project activity, Minnesota still trails other states in the region over a five-year period and is failing to attract as much investment as it is sending out. Minnesota ranked 8th among the 12 states in the Midwest in total project activity from 2018-2023, and consistently ranks between 8th to 12th in projects per capita within the region.

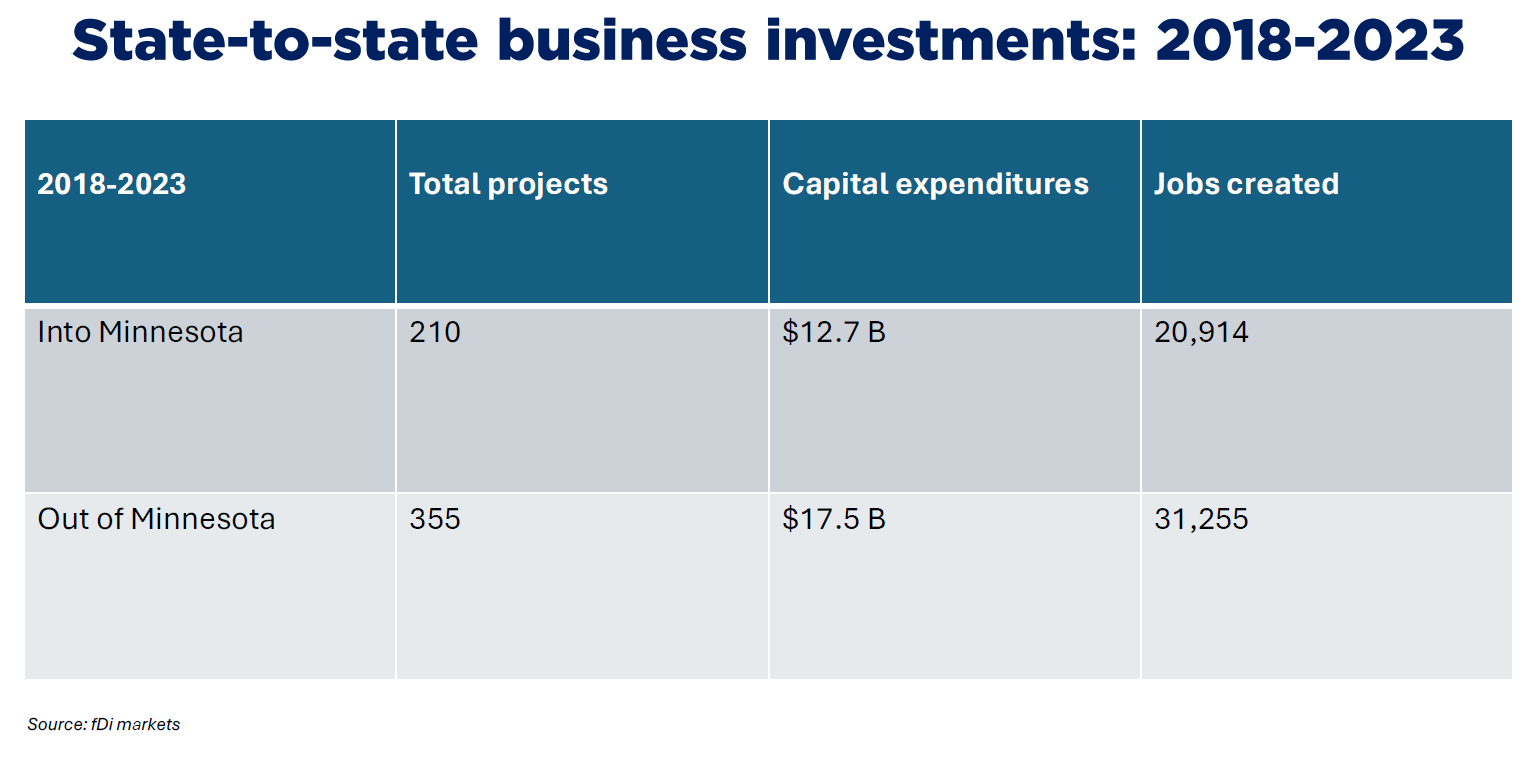

- From 2018-2023, Minnesota-based companies invested in 355 projects in locations outside the state, resulting in an estimated $17.5 billion in capital expenditures and 31,255 jobs created. In comparison, Minnesota received 210 projects from out-of-state companies, totaling $12.7 billion and 20,914 jobs created locally. This shows continued net deficits in incoming and outgoing business investments.

- Survey responses from businesses and economic developers show continued barriers to expansion, including hiring difficulties, inflation and high borrowing costs, lack of available sites and properties, and state tax and regulatory burdens.

Back to top

Report methodology:

Unlike other areas of economic measurement – such as unemployment or GDP – there is no singular source of data on business expansion activity for regions or states. Businesses are not required to publicly report on decisions to expand or invest in new activities. However, a variety of third-party entities collect expansion data through public announcements in news outlets or company websites, real estate and construction reports, economic development agencies and other sources to track and assess business investments.

This report uses several sources to piece together information on business expansion activity in Minnesota. While not a perfect science, it provides useful insights about a critical component of regional and state economic performance.

Note: The terms “business expansions,” “projects” and “business investments” used throughout this report refer to activities that typically include a combination of job creation and capital expenditures (e.g., real estate, equipment and machinery, etc.) to increase the productive capacity of the business. Focus is given toward tradable industries that aren’t locationally bound to one particular community or region, and thus could potentially relocate or expand across regional or state boundaries.

Sources used in this report:

- Grow Minnesota!® survey of Minnesota businesses: Grow Minnesota!® conducted an online survey of Minnesota businesses to collect insights on their recent and future expansion activities. The purpose was to better understand some of the factors that influence businesses’ decisions to expand and where to place those investments. Responses were collected through a nonscientific survey of 263 businesses, which was in the field in March and April of 2024. It was initially distributed by the Minnesota Chamber of Commerce and then distributed through local Grow Minnesota!® partners in various communities around the state.

- The largest share of responses came from manufacturers (20%), with the remaining responses coming from firms in 18 different industries at the 2-digit NAICS level. Responses were submitted from businesses in 32 counties throughout the state. Survey responses were weighted toward Greater Minnesota communities due to the location of participating local partners and to better understand expansion factors across Minnesota’s regions.

Since the survey did not use scientific sampling methods, readers should take caution in interpreting the results.

- Grow Minnesota!® survey and interviews of local, regional and state economic development professionals: Grow Minnesota!® distributed an online survey to a list of 118 economic development entities, business support organizations and other local government officials to garner input on business retention, expansion and attraction activity in their communities. A total of 45 individuals responded to the survey, with a majority (62%) of responses coming from city economic development agencies and an additional 18% coming from county economic development agencies. Respondents represented entities from each region of the state and served communities ranging in size from under 10,000 in population to over 100,000.

Additional insights were collected through interviews and focus groups with regional and state economic development organizations.

- Site Selection Magazine/Conway Projects Database: Site Selection Magazine uses a proprietary database called Conway Projects Database to track new and expansion projects throughout the United States. Its annual Governor’s Cup awards measure and rank activity across all states. Their report tracks projects with “a minimum investment of $1 million, creation of 20 or more new jobs or 20,000 square feet or more of new construction.”

- fDi Markets: This database tracks cross-border greenfield Foreign Direct Investment (FDI) and includes state-to-state project activity. This source shows the headquarters location of the company making an investment (source location) and the location of where the investment takes place (destination location), enabling analysis of investments into Minnesota from out-of-state companies and investments originating from Minnesota-based companies going to other states.

- Department of Employment and Economic Development (DEED), Publicly Announced Business Expansions dashboard: Each quarter, DEED updates an interactive online dashboard showing summary statistics and individual project information on expansion announcements throughout the state. As they note on their website, the list is not comprehensive of every expansion in the state. However, it includes valuable information on many impactful business expansion projects in Minnesota.

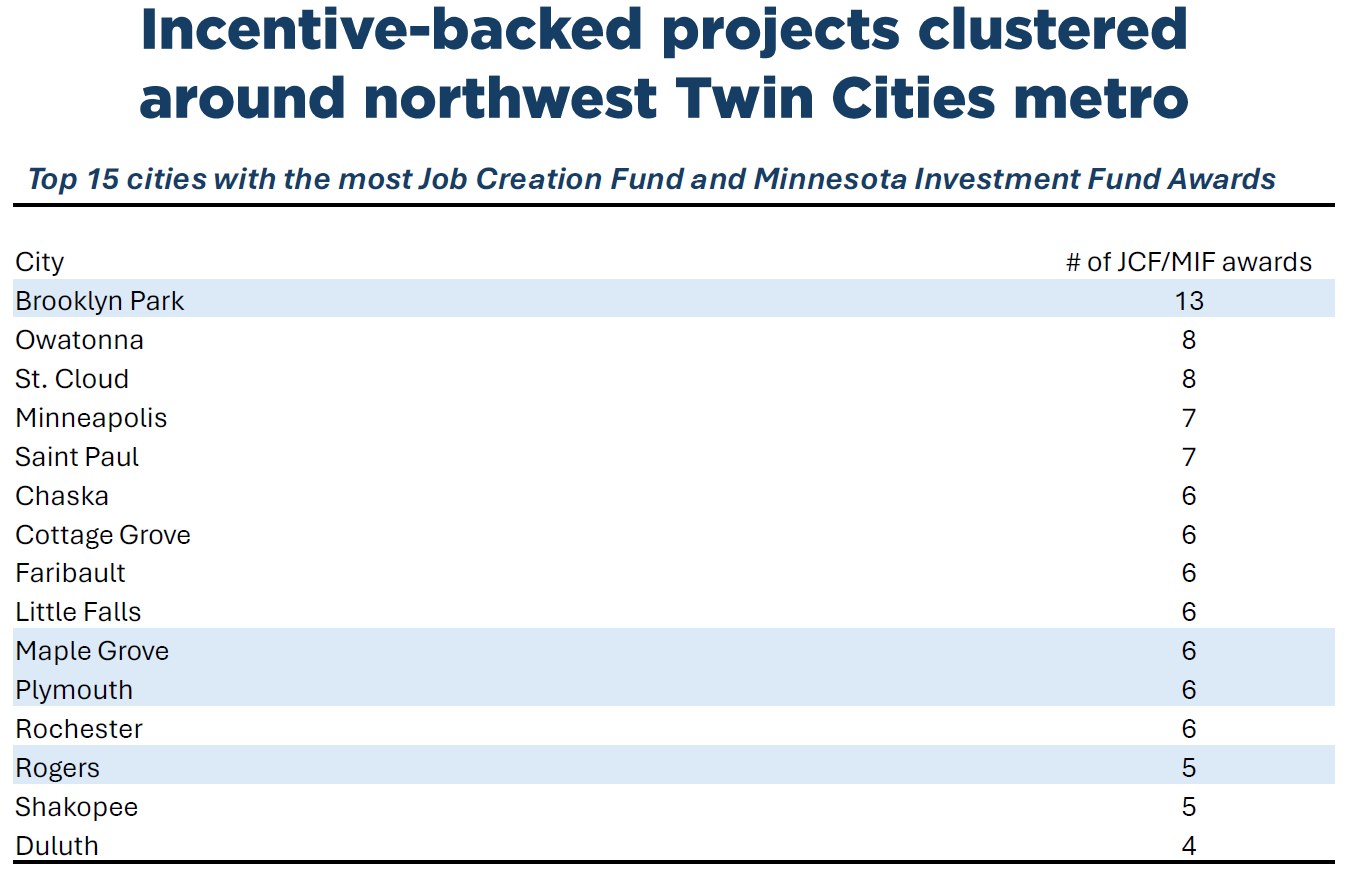

- Job Creation Fund and Minnesota Investment Fund funding awards map: DEED publishes information on awards issued through the Job Creation Fund and Minnesota Investment Fund, which are two of the state’s primary expansion incentive programs. Their online map of awards lists the funding recipients, award amounts, job creation and capital investment estimates and other related information.

Back to top

2023 expansion activity in Minnesota:

Total project activity as reported by Site Selection Magazine, fDi Markets, and direct surveys and interviews with regional and state economic development organizations.

Key questions: How many projects are occurring in Minnesota over time? How does this compare to other states in the Midwest and around the U.S.?

Minnesota saw strong overall project activity in 2023, continuing its post-2020 rise. Data from Site Selection Magazine’s annual Governor’s Cup report shows Minnesota registered 113 new and expansion projects in 2023, up from 93 in 2022. This continues a notable uptick since 2021, reflecting a surge in project activity throughout the United States. According to Site Selection Magazine, Minnesota improved its regional rankings, moving to 1st out of seven states that make up the West North Central in total number of projects and 5th out of 12 states in the broader Midwest region.

This increase in total project activity aligns with alternative sources as well. Data from fDi Markets shows an upward trend of investments into Minnesota coming from companies headquartered in other states and countries. Investments into the state increased to $2.5 billion in capital expenditures and 4,353 jobs created in 2023. Likewise, the state attracted $912 million in foreign direct investment, which was the highest level since 2014.

Such trends were corroborated in surveys and interviews with economic development professionals who indicated steady overall expansion and attraction activity over the past year. Forty-six percent (46%) of local and regional economic developers surveyed reported that overall expansion and attraction activity was moderately or significantly up in 2023, and fifty percent reported increased levels in early 2024. Officials from DEED indicated that leads on attraction and expansion projects remain significantly elevated from pre-2020 levels. This is partially reflected in the sharp rise in business expansion incentives awarded through the state’s Job Creation Fund (JCF) and Minnesota Investment Fund (MIF) programs. In 2023, the state issued a record $30.25 million in JCF and MIF awards to incentivize business investment projects.

Taken together, these various pieces of evidence point to steady increases in total project activity in 2023.

Despite strong overall project activity, Minnesota still trails other states in the region over a 5-year period and is failing to attract as much investment as it is sending out. While expansion activity has increased in Minnesota since 2021, the same is true for many other states around the U.S., as a combination of market and federal policy factors have aligned to create heightened investments across a variety of sectors. Over the 5-year period from 2018-2023, Minnesota ranked 8th among the 12 states in the Midwest in total project activity, and consistently ranks between 8th to 12th in projects per capita within the region.

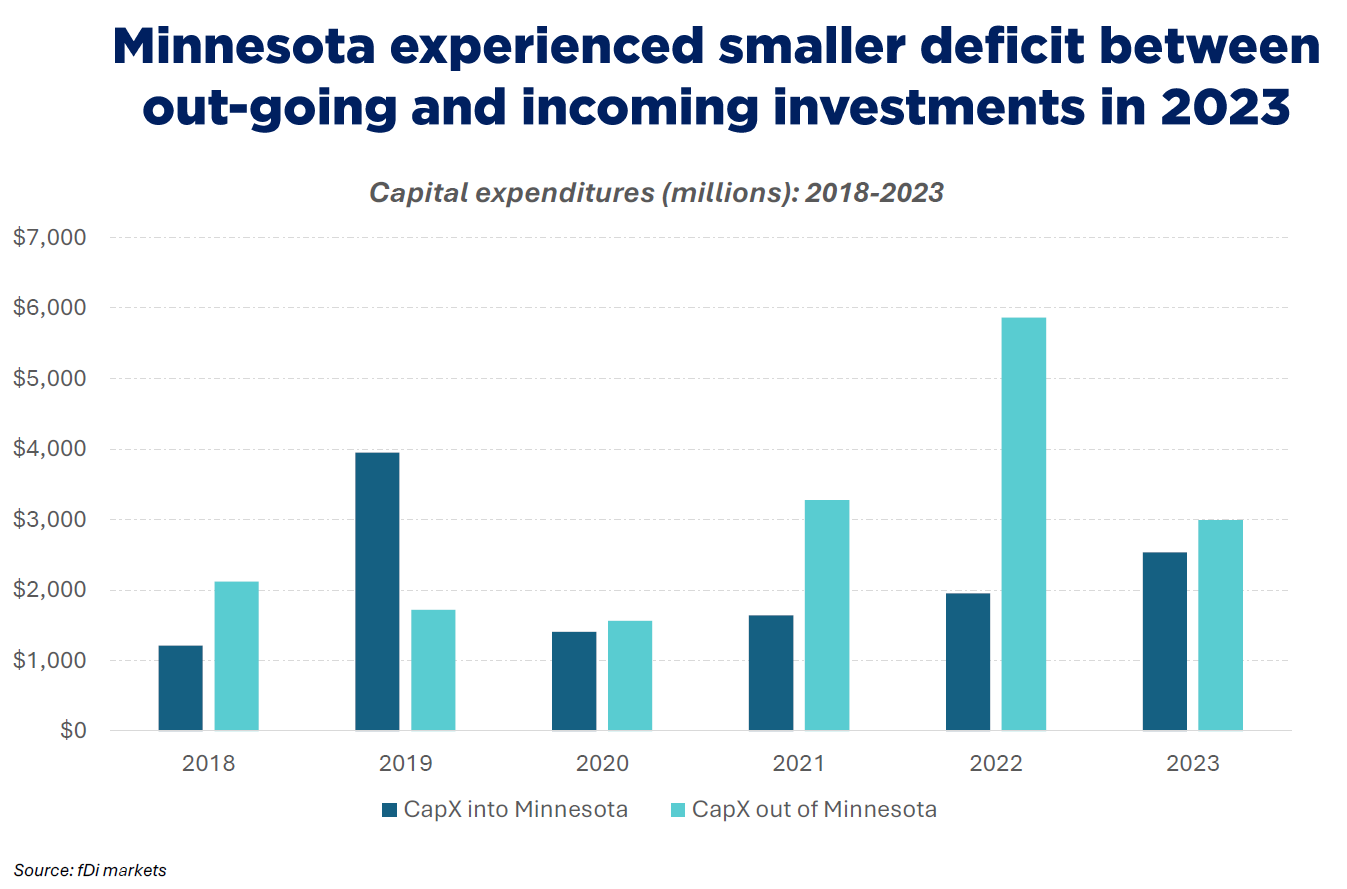

Further, despite the increase in investments into Minnesota from out-of-state companies, the inverse is also true; Minnesota companies are increasing their level of investment in projects outside the state. From 2018-2023, Minnesota-based companies invested in 355 projects in locations outside the state, resulting in an estimated $17.5 billion in capital expenditures and 31,255 jobs created. In comparison, Minnesota received 210 projects from out-of-state companies, totaling $12.7 billion and 20,914 jobs created locally. This shows continued net deficits in incoming and outgoing business investments.

Two notes of caution are warranted here. First, these data may not fully capture all projects occurring in Minnesota or in other states, making measurements more directional than precise in tracking business investments. Second, more research is needed to understand the implications of differences between incoming and outgoing investments. These remain areas for further development and exploration.

Back to top

Public announcements of expansions in 2023:

Business expansion projects in Minnesota as reported by the Department of Employment and Economic Development’s directory of publicly announced business expansions.

Key questions: What were the largest expansion projects in Minnesota in 2023? How were projects distributed across regions and industries?

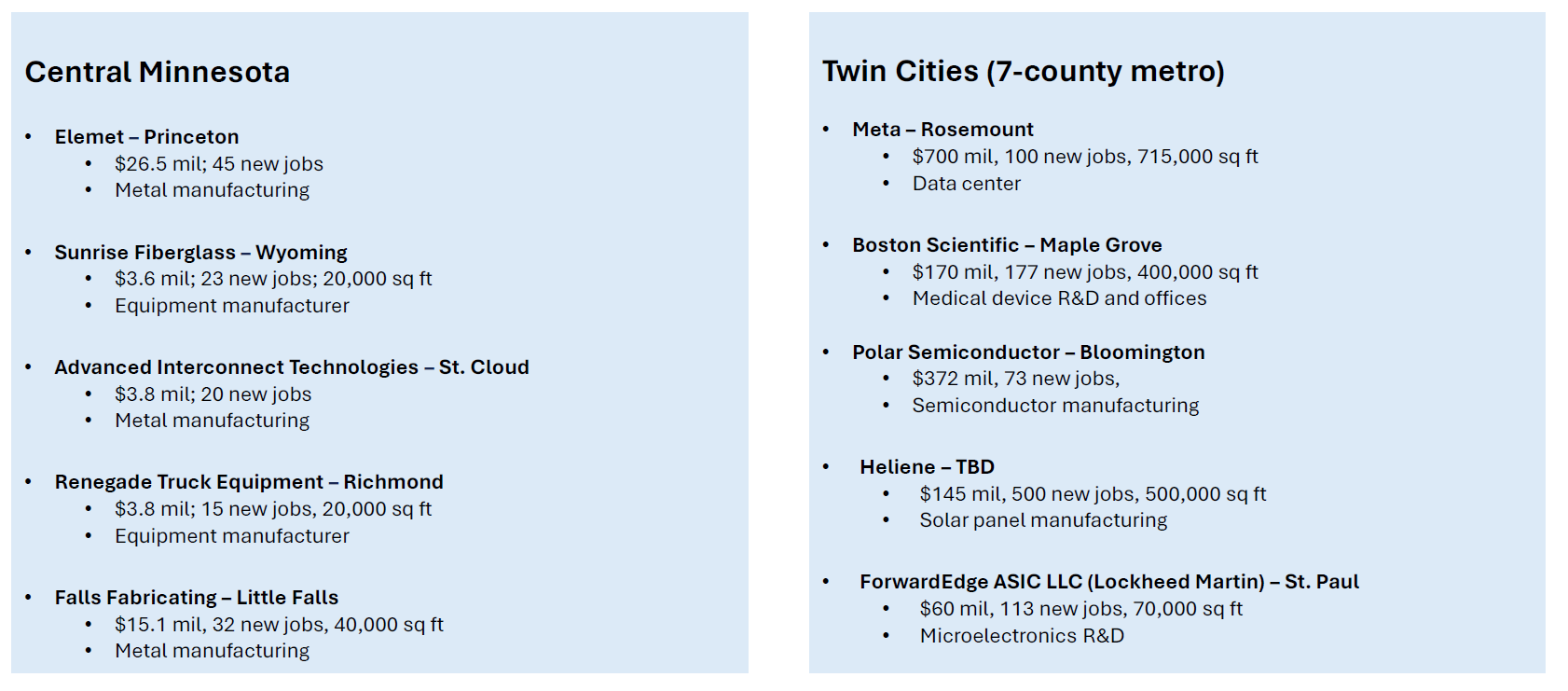

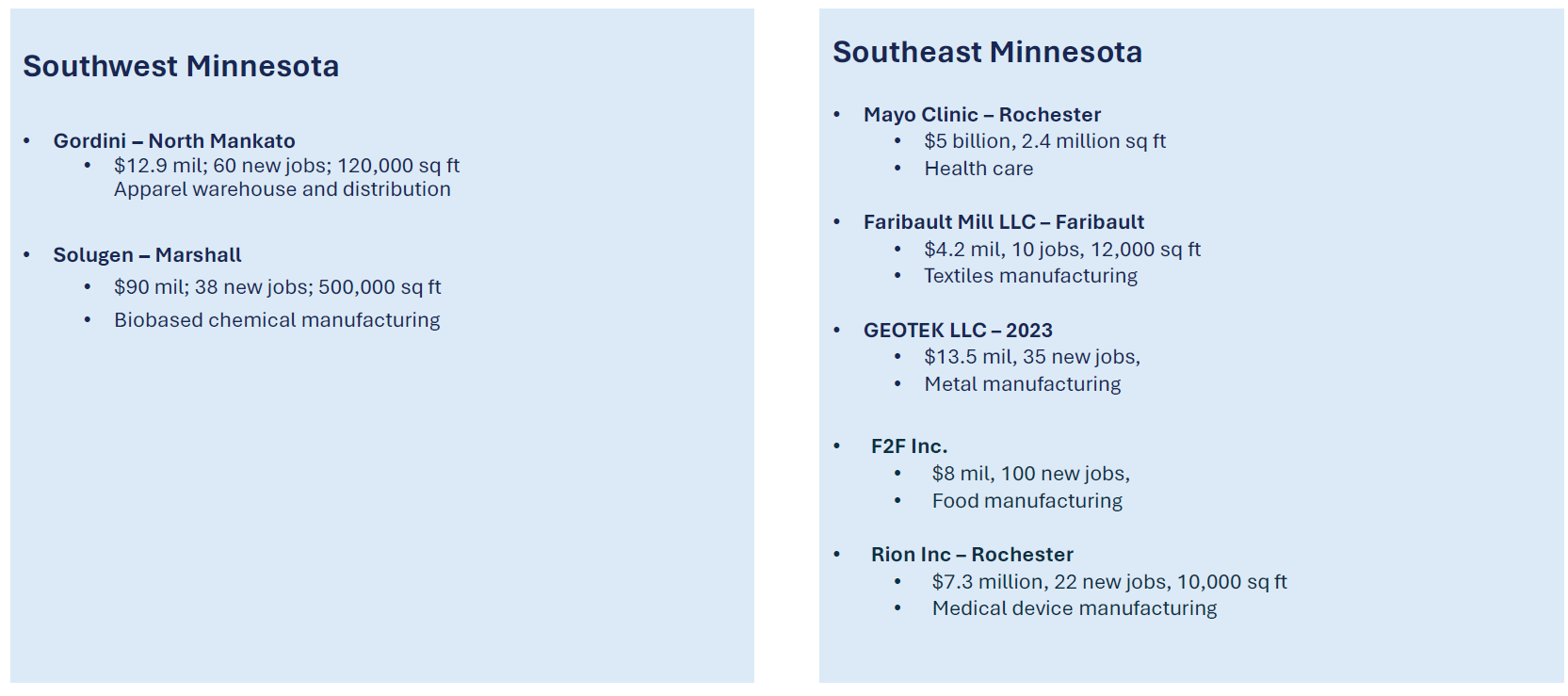

Minnesota secured notable, large investments across a range of sectors in 2023, from health care and med-tech to food and ag to data centers and high-tech manufacturing. The Department of Employment and Economic Development (DEED) – which reports quarterly on publicly announced expansions through an interactive online dashboard – shows 108 project announcements in 2023, estimated to result in $7.7 billion in capital expenditures and 3,955 new jobs. Seven projects over $100 million in capital expenditures were announced last year, with the announcement by Mayo Clinic of $5 billion in renovations and expansions in downtown Rochester dominating the top spot.

Data centers continue to be an important component of large economic development projects in the state as well. In 2023, preliminary plans were announced for Meta to construct a $700 million data center on 280 acres at the former UMore Park site in Rosemount, making it the second-largest capital investment announcement of the year. Other top project announcements included a $372 million expansion of Polar Semiconductor’s chip manufacturing facility in Bloomington, a $258 million bottled water plant in Elko New Market from California-based Niagara Bottling, and a $170 million project from Boston Scientific to build a new campus in Maple Grove.

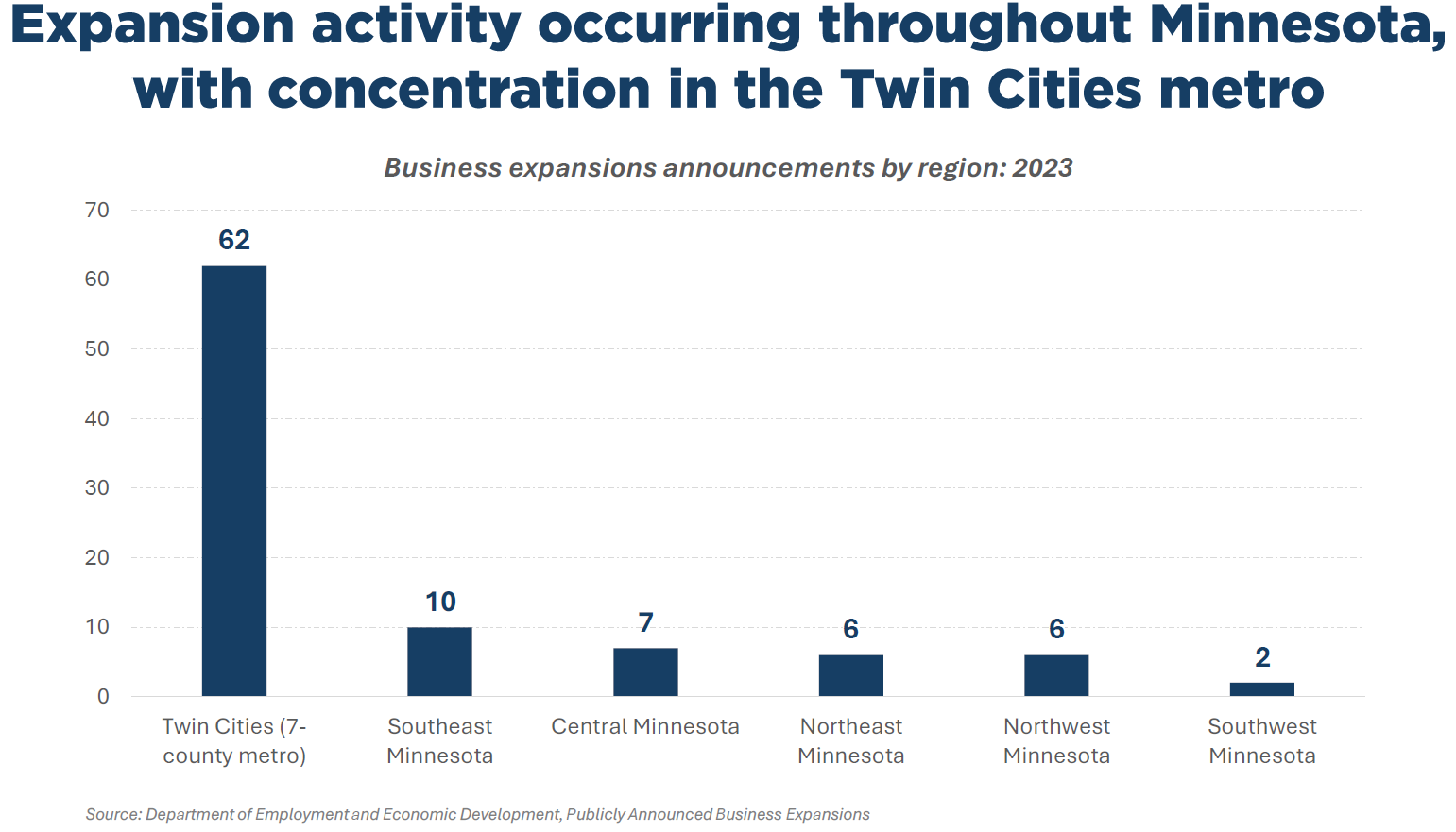

Business expansions occurred throughout each region of the state, with the largest concentration of projects taking place in the Twin Cities. Of 93 expansion announcements listed by DEED, two-thirds (67%) were located in the Twin Cities with the remaining third occurring outside the 7-county metro region.

A look at state incentive awards over the past decade shows a similar picture of expansions by region. Since 2014, 146 of 340 (43%) Minnesota Investment Fund and Job Creation Fund awards have gone to companies in the 7-county Twin Cities metro, receiving 52% of total program dollars awarded. Interestingly, project activity appeared to be concentrated within submarkets of the Twin Cities, particularly in the Northwest metro communities of Brooklyn Park, Maple Grove, Plymouth, Rogers and other surrounding areas. This clustering of activity may relate to a combination of factors, including site availability, industry concentration (e.g., many of the Twin Cities’ med-tech companies are located in the Northwest metro), and local economic development efforts to leverage state incentives for business expansions.

Notable projects by region in 2023

The table below shows examples of impactful business expansion projects by each of the state’s economic regions.

Back to top

Trends and factors driving business investment decisions in Minnesota:

Findings from surveys and interviews with Minnesota businesses and local, regional and state economic developers.

Key questions: What factors influenced overall expansion activity in Minnesota in 2023? What opportunities and challenges do economic developers face to increase business attraction and expansion outcomes in their communities? What barriers do businesses report as they seek to grow and expand?

Last year’s 2023 State of Business Retention and Expansion report showed that Minnesota possesses a host of distinct strengths in supporting business expansion activity. Among the top positive factors identified were Minnesota’s deep bench of homegrown companies, existing industry clusters and its skilled workforce. Notable challenges were also presented, including how Minnesota’s workforce shortages and challenging business climate have prevented some companies from expanding or led them to place investments in other states. These strengths and barriers remain relevant and continue to shape business decisions for Minnesota companies.

In the spring of 2024, Grow Minnesota!® again sought input from businesses and economic development professionals through surveys and interviews to uncover additional factors that influence Minnesota’s ability to support business investment in the state.

The following section summarizes some of the key themes and topics that arose in these outreach activities. Note: See methodology section for more details on surveys and interviews referenced in this section.

Key issues reported by businesses and economic developers in 2023:

Overall economic conditions:

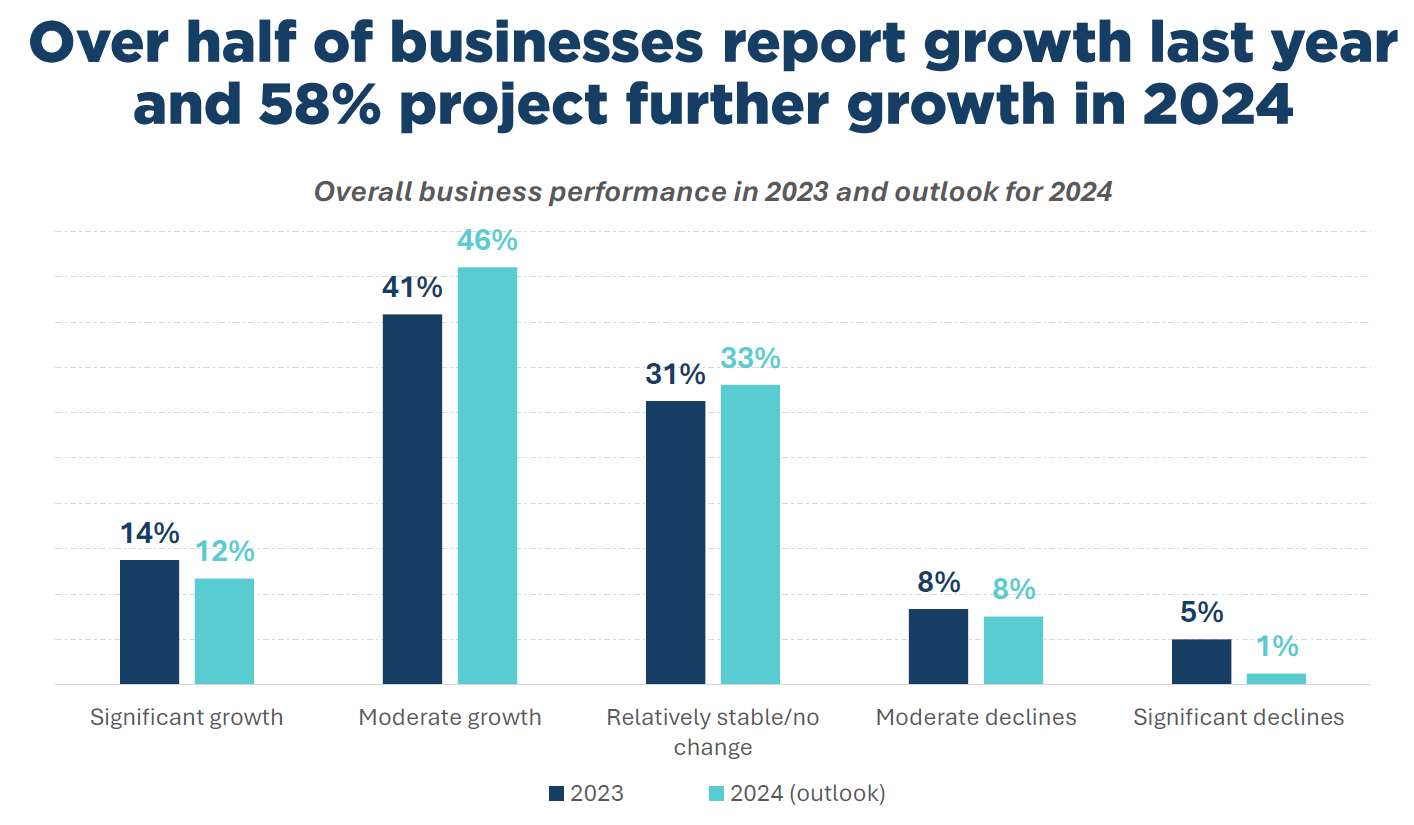

Not surprisingly, overall conditions in the economy play a large role in businesses’ decisions about whether and when to expand. Survey responses from businesses and economic developers noted moderate growth in overall performance and expansion activity in 2023. However, inflation and high borrowing costs posed a drag on business investments, leading some companies to delay expansion until interest rates come down.

Positives

- 55% of businesses surveyed reported moderate or significant overall growth in 2023, and 58% expect further growth in 2024. This mirrors economic developers’ responses related to overall expansion activity in their communities, with 46% reporting an uptick in expansions last year and 50% seeing an increase in the first quarter of 2024.

- 36% of businesses said they have plans to expand their business, with a majority (77%) planning to do so in Minnesota.

- When asked about the factors driving expansions last year, economic developers responded with comments such as: “Pent up demand from COVID. Good economic conditions.” Other comments reflected similar sentiments, saying that overall strong economic conditions led to expansion activities.

Negatives

- While economic conditions were favorable for some businesses, persistent inflation and high interest rates were cited by both businesses and economic developers as a current barrier to expansion. When asked about why expansions were flat or down, economic developers stated:

- “I got a sense of a strong desire for expansions but the difference was the planned expansions went from immediate need to future need (1-2 years out). Much of this was due to high interest rates tampering down the businesses’ desires to immediately do the project.”

- “Interest rates are prohibitive.”

- “Interest rate environment, inflation in construction costs, lack of labor supply.”

- “Cost of capital is still high, banks are a bit more conservative right now, lack of workforce.”

- “Interest rates are up, access to capital is challenging.”

- “Since a lot of work is on the industrial side, in particular with new spaces, it has slowed because of economic factors. Sites are ready to go, but no one is quite ready to start.”

- “I got a sense of a strong desire for expansions but the difference was the planned expansions went from immediate need to future need (1-2 years out). Much of this was due to high interest rates tampering down the businesses’ desires to immediately do the project.”

- Likewise, when asked about their most significant challenges to growth, businesses noted challenges of rising costs, such as:

- “Cost of goods and services, interest rates, customer businesses down.”

- “Materials, labor, utilities - everything has gone up and we can only raise prices so much.”

- “Economy, high interest rates, employee recruitment and retention.”

- “Higher interest rates are delaying purchases of assets.”

- “Increasing cost of products and services we use including credit card fees. Paying higher wages to compete and subsequently having to raise prices to customers to compensate. Price increase of freight and length of time to deliver to customer.”

- “Inflation. Cost of everything has increased, wages have not kept up with the cost of inflation. Growing increases in health insurance costs.”

- “Interest rates and trained employees.”

- “Interest rates. We need to build an expansion.”

- “Rapidly increasing cost of labor due to steadily increasing wage rates & health insurance rates.”

- “Raw material inflation and supply chain issues, followed by finding employees.”

- “Right now interest rates are what’s hurting us.”

- “Cost of goods and services, interest rates, customer businesses down.”

Workforce:

Responses on workforce issues indicated that hiring challenges remain a top barrier to businesses’ ability to grow and expand in Minnesota. At the same time, some economic developers suggested that workforce availability might not be a limiting factor in all cases, feeling that companies can compete for talent within the local market depending on the wages offered and type of skill sets needed.

Positives

- Interviews with regional economic development organizations revealed the two-sided nature of Minnesota’s current workforce. One economic developer described how workforce attributes are a competitive advantage for their region, stating that “we win on workforce” in competitive site selection projects. At the same time, they noted that spurring growth in targeted industries would require a substantial increase in key occupations, such as engineers.

- Similarly, another regional economic developer suggested that they are somewhat “optimistic” that they could support a new 1,000-employee project given the right kind of company and positions. They perceived hiring challenges as a greater barrier to expansion for existing companies than for attraction of new companies into the region.

Negatives

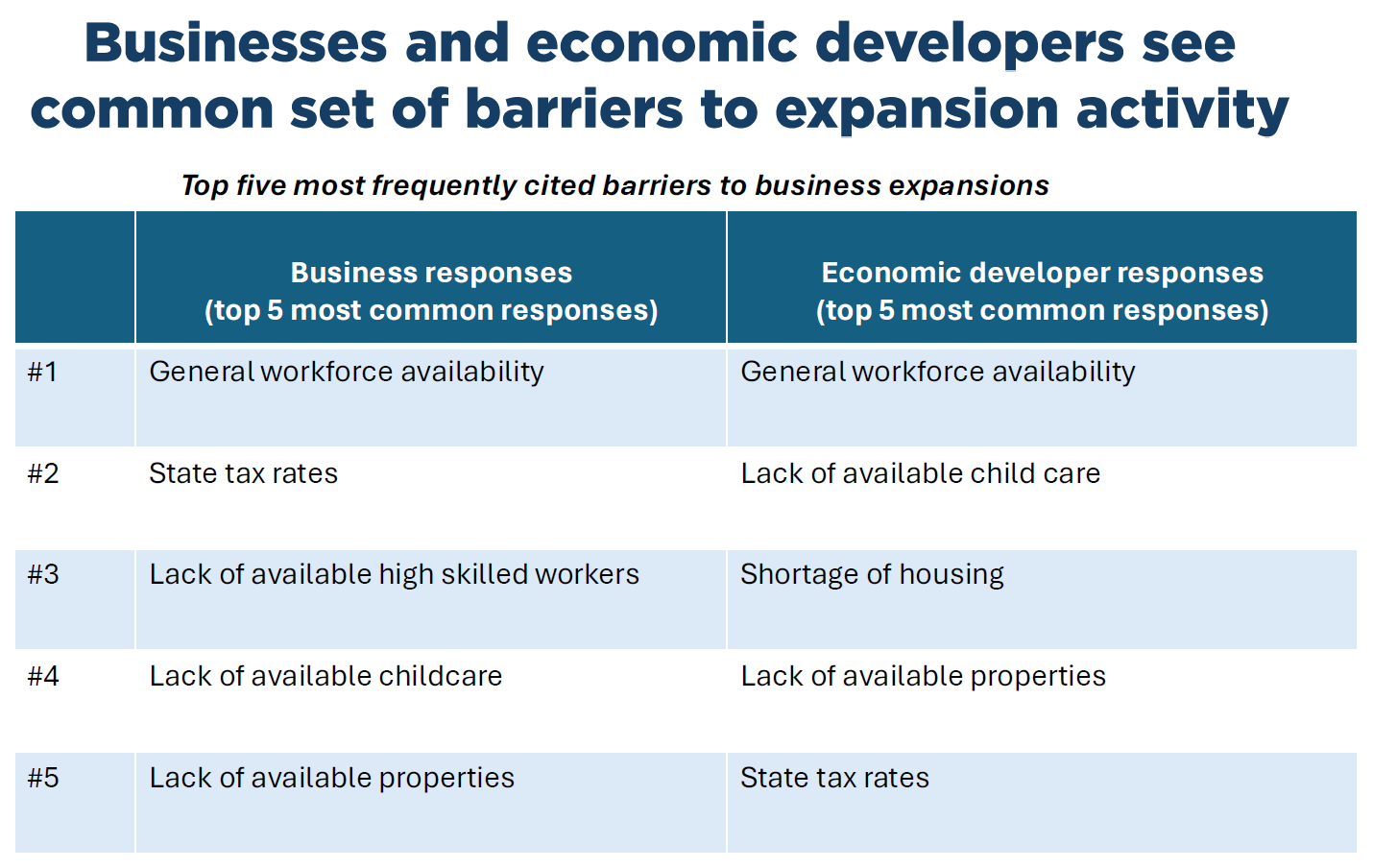

- Following trends from recent years, workforce availability topped the list of challenges for businesses to grow and expand in the state. General workforce availability was rated as the most common barrier to expansion from both businesses and economic developers surveyed.

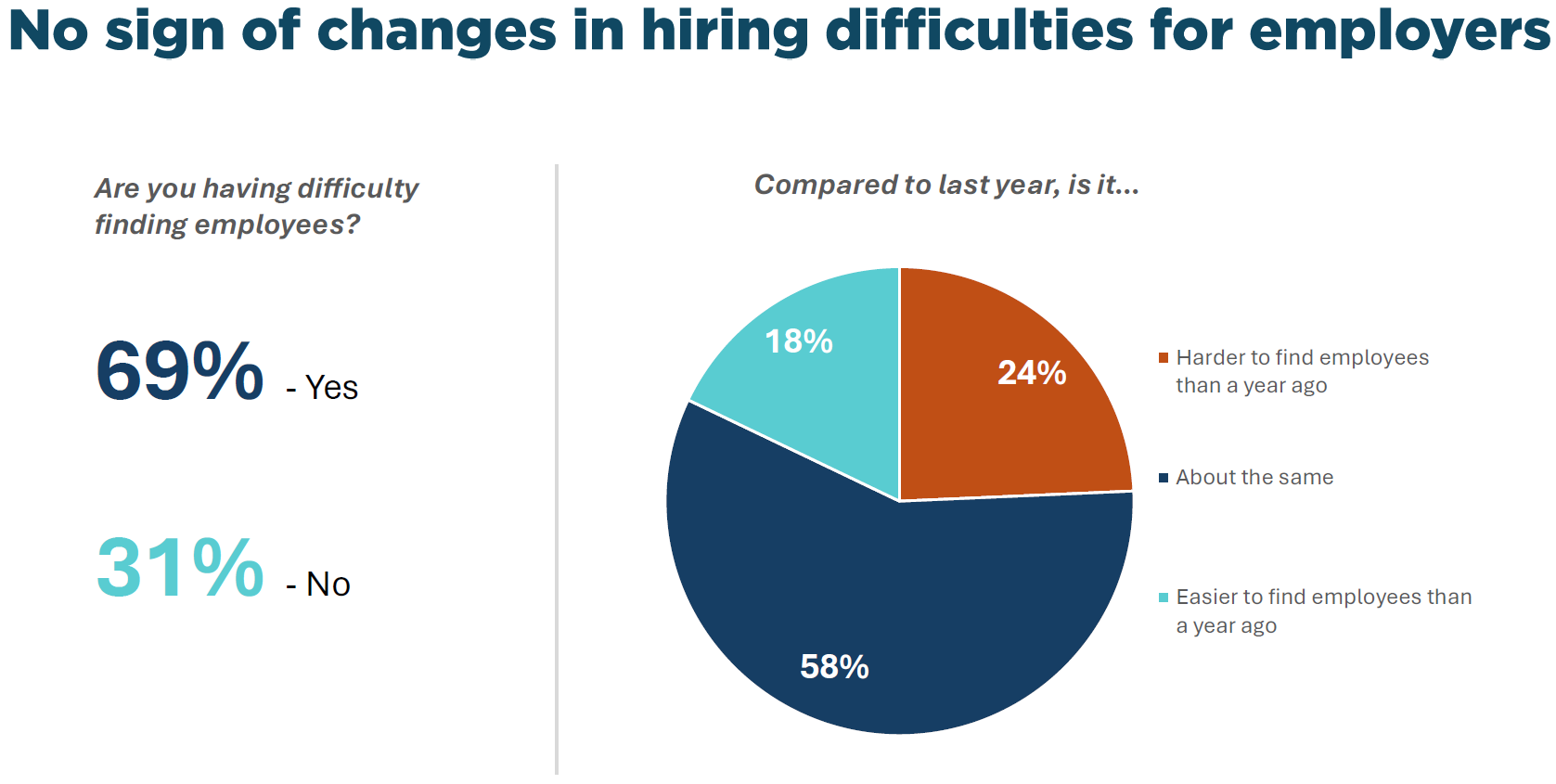

- 69% of businesses reported difficulty finding workers, with 24% saying that finding workers is harder than it was a year ago and 58% saying labor availability is about the same as last year. Only 18% said it was easier to find employees than it was a year ago.

- When asked about their greatest challenges, businesses commented on a host of issues related to hiring, including: the skillsets of candidates, finding employees who want to work full-time, housing and child care shortages, increased costs and labor mandates, competition with employers in larger metros or employers offering remote positions. Examples include: o “Difficulty finding employees with the right background and training in our area.”

- “Finding good workers in outstate Minnesota is difficult now that remote work is an option. We used to compete for employees just with other businesses in our local area. Now we compete with businesses all over the country.”

- “Finding qualified candidates continues to dampen our growth, and reconsider expansion to other communities because we don’t know how we would staff these new locations.”

- “Finding the right people that have the skillset needed to perform the job.”

- “I think it still comes down to people. Yes we have focused on automation mainly because we have more jobs than people in our community. However, it’s difficult finding people who want to do some of the work required at our manufacturing facilities. Also, it’s difficult finding maintenance, technicians, operators, which typically require an additional skillset beyond being a general laborer.”

- “It’s difficult to get young professionals to consider moving to this part of the state unless they have existing connections to the area.”

- “Our biggest barrier to growth is the inability to hire quality staff.”

- “We are constrained by the STEM skills gap. We can only go as fast as our staffing allows. So we’re turning work away.”

- “Finding good workers in outstate Minnesota is difficult now that remote work is an option. We used to compete for employees just with other businesses in our local area. Now we compete with businesses all over the country.”

Policy and regulatory environment:

State and federal policies loomed large in feedback from businesses and economic developers. Economic developers commonly cited federal policies like the Inflation Reduction Act and CHIPS Act as primary drivers of the recent surge in the number and size of new project leads. However, businesses and some economic developers also raised concerns about state policy issues, including taxes, environmental permitting and new labor mandates, among others. Indeed, state tax rates were the second most commonly cited barrier by businesses – second only to workforce availability – and the 5th most common by economic developers. Many businesses commented on the combination of policy and workforce factors that hinder their businesses’ growth. In cases where a business chose to expand outside the state, this combination of factors was often raised.

Positives

- Interviews with economic developers stressed how federal policies to increase domestic production in areas such as semiconductors, clean energy, biomanufacturing and electric vehicles have led to an influx of site selection inquiries in their regions. Notably, economic developers report that the size of prospective projects has risen to unprecedented levels, with capital expenditures for some project leads being in the billions of dollars and potential job creation in the hundreds or thousands of employees. As discussed further below, this presents emerging opportunities as well as challenges for communities and regions to consider in the years ahead.

Negatives

- Businesses surveyed by Grow Minnesota!® cited concerns about state policies that increase costs and complexity of operating in Minnesota. State tax rates were the second most cited barrier to expansion. Many businesses commented on new labor mandates, such as Earned Sick and Safe Time and Paid Family and Medical Leave Act, as additional challenges.

- Some businesses noted that these challenges have led them to expand outside of Minnesota or to contemplate expanding elsewhere in the future. When asked why their business expanded outside the state, businesses responded with comments such as:

- “Availability of people and more business-friendly (regulations).”

- “Cost of business and location to available work.”

- “Better business environment outside of Minnesota.”

- “Talent/Taxation.”

- “Availability of people and more business-friendly (regulations).”

- Respondents included additional comments when asked about their biggest challenges to growing in Minnesota. Examples include:

- “Cost of doing business in Minnesota continues to rise compared to the other states we operate in, rendering us less competitive versus others in states that actually support business and versus foreign imports.”

- “High tax rates, high cost for compensation and increasing barriers to at-will employment. This continues to make us less competitive in the market to gain and grow our business.”

- “Increasing regulations and government-mandated programs — high costs and reduced flexibility to meet the needs of our team members. High tax costs compared to the other states we operate in. Due to regulations, mandated programs and taxes, it is easier and more economical to expand in other states.”

- “Cost of doing business in Minnesota continues to rise compared to the other states we operate in, rendering us less competitive versus others in states that actually support business and versus foreign imports.”

Availability of sites and properties:

Shortages of shovel-ready sites and available properties arose as a common theme in interviews with economic development organizations. A lack of available properties was the 4th most common barrier to expansion cited by economic developers and the 5th most common among businesses surveyed. On the flip side, in situations where communities did have available sites or properties, this asset was cited as a key reason that businesses were able to expand locally.

Positives

- “We have several manufacturing businesses who are doing very well and are expanding because we have space to be able to do so within the community so that they did not have to look elsewhere.”

Negatives

- Economic developers consistently cited the lack of available sites and properties as a key barrier to attraction and expansion projects in their area. Related to this issue was the specific infrastructure needs of users with high energy and water demands, or requirements to find a site with rail, highway or airport access. This issue appeared to impact a broad range of businesses but was particularly relevant to large-scale industrial recruitment projects.

- When answering the question of what held back expansions last year, one economic developer wrote: “[For attraction projects] Lack of available buildings. Virtually zero percent industrial vacancy. [For expansion projects] Businesses had the capacity to expand but low unemployment rates meant they didn’t feel confident they could meet the labor needs to expand.”

- Others noted that site availability and infrastructure requirements have been a leading factor in cases where they lost a competitive site selection project. Economic developers wrote:

- “Inability to provide adequate water, zoning restrictions.”

- “Infrastructure, incentives.”

- “Availability of land/buildings.”

- “Many projects come in with electricity demands that need to ramp up production significantly more quickly than we can possibly do, same with wastewater and there aren’t enough funds to allow for proactive investments in either of these areas. Occasionally we are challenged with not having formal listings/city ownership for the sites that we submit.” [comment edited for length and to highlight site and infrastructure factors]

- “Lack of trained workforce, lack of land or appropriately sized buildings, the increase in costs due to transportation of goods.”

- “Land characteristics and pricing. Sometimes timing on infrastructure (e.g., water and electric) upgrades.”

- “Inability to provide adequate water, zoning restrictions.”

ISSUE SPOTLIGHT: Megaprojects in Minnesota

The United States has witnessed an increase this decade in large-scale industrial projects, commonly referred to as megaprojects. Megaprojects are characterized by high levels of capital investments, typically exceeding $1 billion, and often creating hundreds to thousands of new jobs. In 2021 alone, a record-breaking 22 megaprojects were announced, totaling $94 billion, surpassing the previous all-time high set in 2009. Real private manufacturing construction spending in the U.S. surpassed $125 billion in April 2023 and grew by a staggering 70% from 2022-2023.

There are several drivers of the recent increase in megaprojects, including geopolitical concerns, reshoring, and federal incentives via the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act. This has accelerated growth in certain industries like semiconductor facilities, electric vehicles (EVs) and battery manufacturing, clean energy, data centers, biomanufacturing, aerospace, and defense projects. Megaprojects announced this decade have been clustered around the Great Lakes, Southeast and South-Central regions of the U.S.

A survey by the Site Selectors Guild suggests that the trend of megaproject activity will persist in coming years. Factors influencing site selection decisions for these large projects include access to a skilled workforce, sufficient acreage and facilities, robust utility infrastructure, competitive state and local incentives and low overall operating costs. As projects increase in scale, these factors become more pronounced for economic developers striving to retain and attract such future investments.

Role of site certification

The complexity of site readiness means that cities and states play an important role in preparing and identifying sites. Minnesota is one of many states that has a shovel-ready certified site program. A certified site decreases risk for a business and intends to facilitate a faster development timeline. Generally, Minnesota defines a shovel-ready site as having all of the planning, zoning, surveys, title work, environmental studies, soil analysis and public infrastructure engineering completed prior to putting the site up for sale, and that the site is under legal control of a community or other third party. The Department of Employment and Economic Development (DEED) oversees the certification process, and most shovel-ready sites are owned by the local government or a regional economic development organization. As of April 2024, there were 22 available shovelready sites in Minnesota ranging from 1 to 558 developable acres with an average of 91 acres and median of 33 acres.

How does this compare to neighboring states? A direct comparison can be difficult to measure, as each state has its own metrics and guidelines for certifying sites. States typically consider land ownership, zoning, utility infrastructure, transportation access, and potential environmental concerns. For example, Illinois only certifies sites over 200 developable acres and Indiana has three tiers of certified sites with varying standards. Other Midwest states, like Ohio, Iowa and Wisconsin typically have a similar number of certified sites of around 20-30. However, Minnesota lags in the number of total acres certified and is substantially lower than states like Iowa and Illinois. This discrepancy largely stems from a difference in site size, as Minnesota only has 6 sites over 100 acres whereas Iowa has 19, Illinois has 16 and Indiana has 17.

Role of environmental permitting

The ability to provide timely and transparent approval processes can be a key competitive factor for large projects. Large industrial projects often require complex environmental review and permitting approvals that must be met before the business is authorized to start construction. Such processes offer an opportunity for collaboration between the business and regulatory agencies to ensure that plans will meet environmental standards and allow channels for community engagement on proposed projects. However, delays or uncertainty in the permitting process can severely impact the ability of a company to move forward with plans to build and expand.

This has been a growing area of concern in Minnesota, leading the Minnesota Chamber Foundation to conduct an in-depth study of the state’s environmental permitting programs. The report, issued in early 2024, showed that businesses wait over a year on average to receive a Tier 2 air or water permit to expand or modify their facility. While permitting delays are not unique to Minnesota, the study showed that Minnesota takes 1.5 to 6 times longer than other neighboring and peer states to issue similar air permits for capital investment projects. (The full report can be viewed at https://www.mnchamber.com/permitting) Creating a more streamlined and transparent process for environmental reviews and permits could improve economic development outcomes, helping it leverage its substantial strengths while providing a timely path for new investments to take place.

Back to top

Conclusions:

Minnesota faces a unique window of opportunity, as a convergence of factors has led to historic investments in economic development projects around the country. The state has many of the essential assets needed to compete for projects that will drive innovation and growth for years to come. These strengths are already resulting in notable project activity in key sectors around the state.

Yet, Minnesota is also losing investments from businesses due to a variety of supply-side challenges (e.g., workforce availability, lack of available sites and properties, infrastructure needs, housing and child care, etc.) and self-imposed actions that increase the cost and complexity of operating in the state. Addressing these concerns could help Minnesota better reach its economic potential.

Additionally, new questions have emerged regarding the role of large-scale projects in the state’s economic development efforts. While these opportunities offer the potential for transformative gains for communities and the state’s economy, they also come with steep demands that may not be easily met. Given the likelihood that these emerging trends will continue over the short and medium term, stakeholders around the state should carefully assess how their communities can position themselves to compete for high-quality projects while being realistic about the trade-offs and constraints that may be involved with certain projects. There is no simple answer to these questions, but we hope this report helps guide discussion and spur action to support businesses’ ability to grow and expand in Minnesota in the coming years.

Back to top